- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

The three-year shareholder returns and company earnings persist lower as Hypoport (ETR:HYQ) stock falls a further 5.9% in past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Hypoport SE (ETR:HYQ) have had an unfortunate run in the last three years. So they might be feeling emotional about the 66% share price collapse, in that time. Furthermore, it's down 39% in about a quarter. That's not much fun for holders.

After losing 5.9% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Hypoport

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Hypoport moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We think that the revenue decline over three years, at a rate of 7.4% per year, probably had some shareholders looking to sell. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

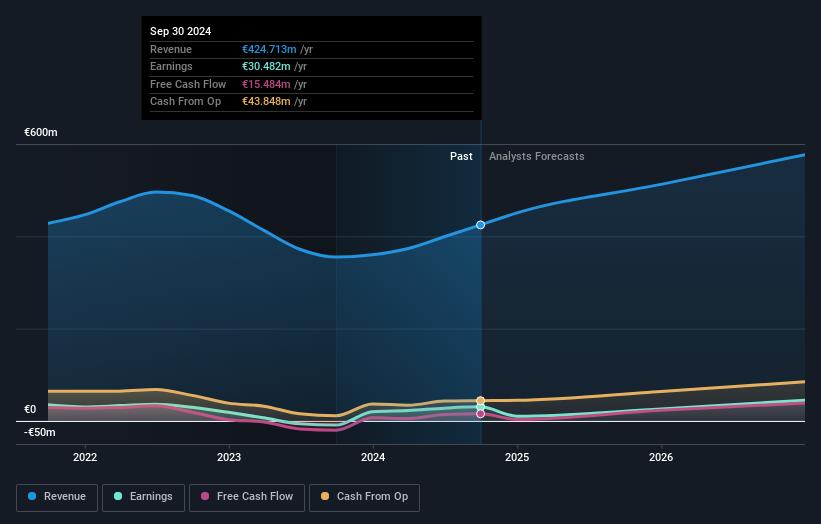

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Hypoport has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Hypoport

A Different Perspective

Hypoport shareholders are down 4.1% for the year, but the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Hypoport better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hypoport you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HYQ

Hypoport

Develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives