- China

- /

- Electrical

- /

- SZSE:300835

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed signals, with major indices showing both resilience and volatility, small-cap stocks have captured attention due to their potential for growth amid economic fluctuations. In this dynamic environment, identifying promising opportunities often involves looking at companies that demonstrate strong fundamentals and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sichuan Kexin Mechanical and Electrical EquipmentLtd (SZSE:300092)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Kexin Mechanical and Electrical Equipment Co., Ltd. is involved in the design, development, and manufacture of heavy-duty process equipment and system integration both in China and internationally, with a market cap of CN¥3.24 billion.

Operations: Sichuan Kexin generates revenue primarily through the sale of heavy-duty process equipment and system integration services. The company has a market cap of CN¥3.24 billion.

Sichuan Kexin, a small player in the machinery sector, showcases some promising aspects. Despite a dip in sales to CNY 1.05 billion from CNY 1.17 billion, net income rose to CNY 143 million from CNY 136 million. Earnings per share also edged up slightly to CNY 0.523 from CNY 0.515, indicating resilience amidst challenges. With no debt and trading at an estimated value of 57% below fair value, the company seems well-positioned for future growth with forecasted earnings expected to grow by about 21% annually, outpacing industry averages and highlighting its potential as an investment opportunity.

Sinomag Technology (SZSE:300835)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sinomag Technology Co., Ltd. is involved in the research, development, production, and sale of permanent ferrite magnets and soft magnetic cores and components globally, with a market cap of CN¥3.71 billion.

Operations: Sinomag Technology generates revenue primarily from the sale of permanent ferrite magnets and soft magnetic cores and components. The company's cost structure includes expenses related to research, development, production, and sales activities. It has a market capitalization of CN¥3.71 billion.

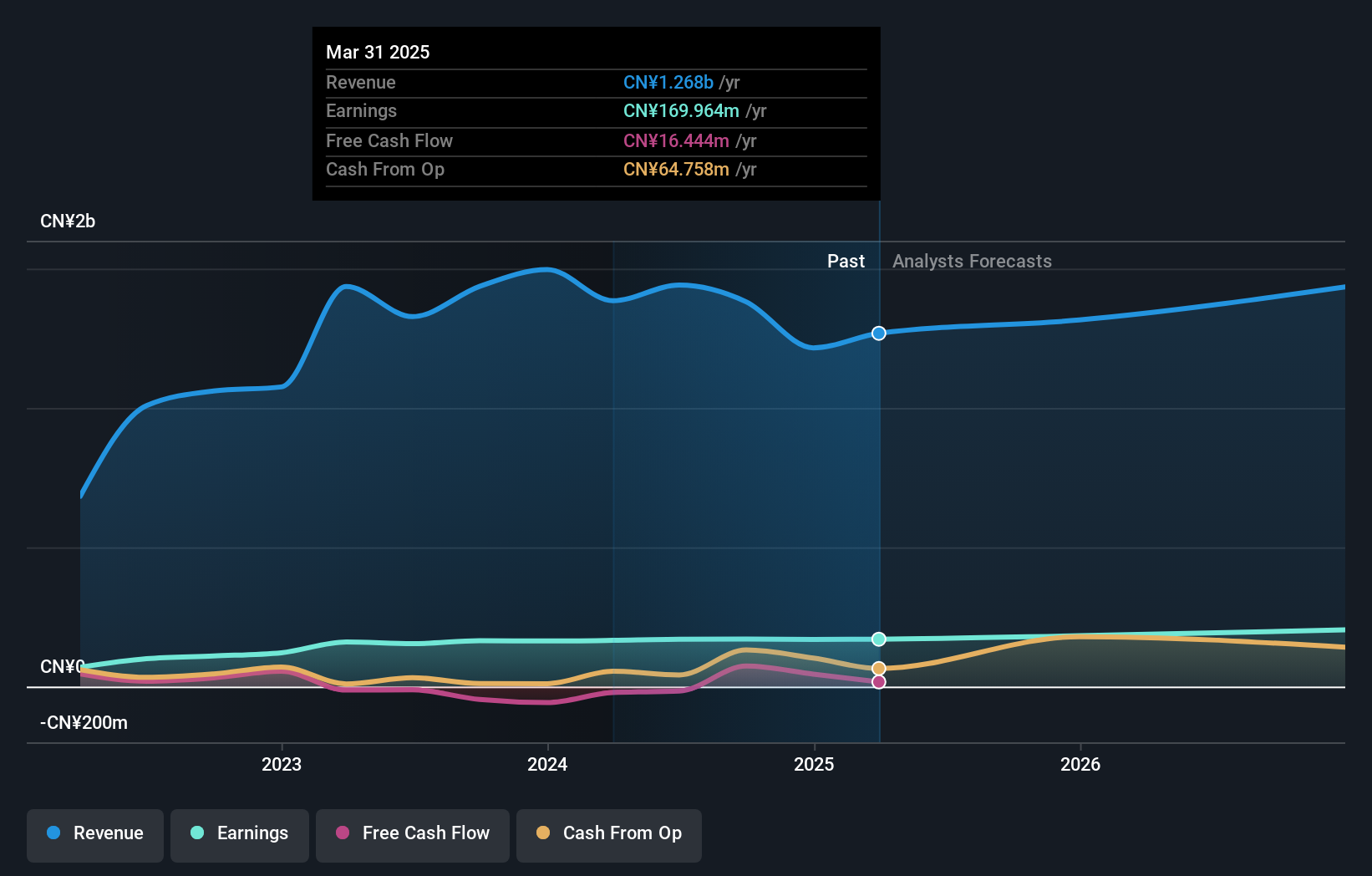

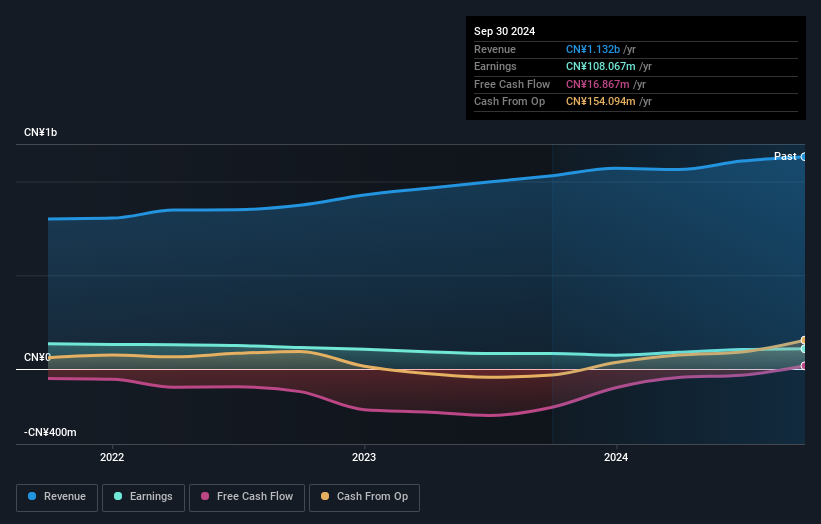

Sinomag Technology, a smaller player in the electrical industry, has shown impressive earnings growth of 30.1% over the past year, outpacing the industry's 1.1%. The company's net income for the first nine months of 2024 reached CNY 99.42 million, up from CNY 65.23 million a year ago, reflecting its high-quality earnings profile. Despite an increase in debt to equity ratio from 27.9% to 46.2% over five years, its net debt to equity remains satisfactory at 30.7%. Sinomag also completed a share buyback of approximately CNY 39.87 million last quarter without impacting profitability or cash runway concerns significantly.

- Click here to discover the nuances of Sinomag Technology with our detailed analytical health report.

Evaluate Sinomag Technology's historical performance by accessing our past performance report.

Naphtha Israel Petroleum (TASE:NFTA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Naphtha Israel Petroleum Corp. Ltd. focuses on the exploration, development, production, and sale of oil and gas in Israel and the United States, with a market cap of ₪2.20 billion.

Operations: Naphtha Israel Petroleum derives its revenue primarily from oil and gas operations, generating ₪1.61 billion in Israel and ₪540.58 million in the United States.

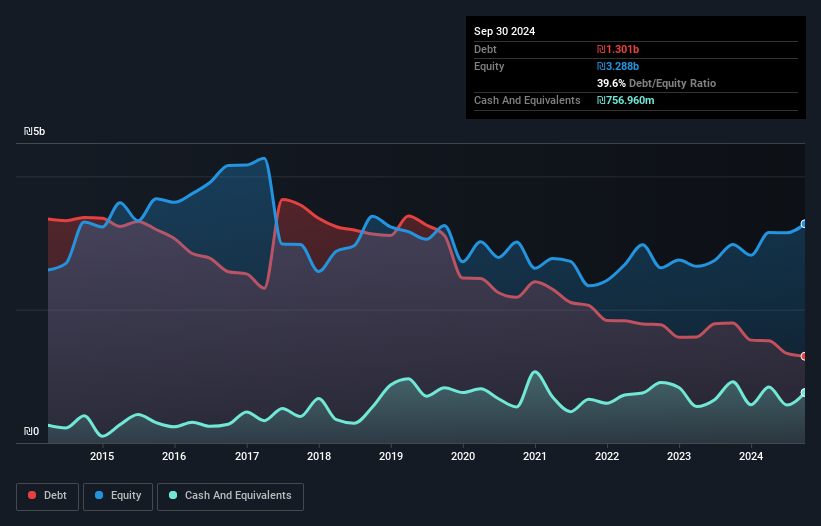

Naphtha Israel Petroleum is showcasing strong financial health, with a net debt to equity ratio of 16.6%, which has impressively decreased from 95.5% over the past five years. The company’s earnings have surged by 49.6% in the last year, outpacing the broader oil and gas industry growth of 12.8%. Despite being removed from the TA-100 Index recently, Naphtha's profitability is evident with its interest payments well-covered at 47.6 times by EBIT and a positive free cash flow position. Trading significantly below its estimated fair value, it presents an intriguing opportunity for investors seeking potential value plays in this sector.

Make It Happen

- Investigate our full lineup of 4668 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300835

Sinomag Technology

Engages in the research and development, production, and sale of permanent ferrite magnets and soft magnetic cores and components worldwide.

Solid track record with excellent balance sheet.