- China

- /

- Consumer Durables

- /

- SZSE:000521

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with the S&P 500 marking strong annual gains despite recent volatility and economic indicators like the Chicago PMI showing contraction, investors are increasingly on the lookout for opportunities in lesser-known sectors. In this environment, identifying stocks with solid fundamentals and growth potential can be key to uncovering hidden gems that may benefit from broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jantsa Jant Sanayi ve Ticaret (IBSE:JANTS)

Simply Wall St Value Rating: ★★★★★★

Overview: Jantsa Jant Sanayi ve Ticaret A.S. is a Turkish company that manufactures and sells steel wheels for commercial, industrial, and agricultural machinery, with a market capitalization of TRY18.79 billion.

Operations: Jantsa generates revenue primarily from rim production, amounting to TRY6.42 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of its operations and cost management strategies.

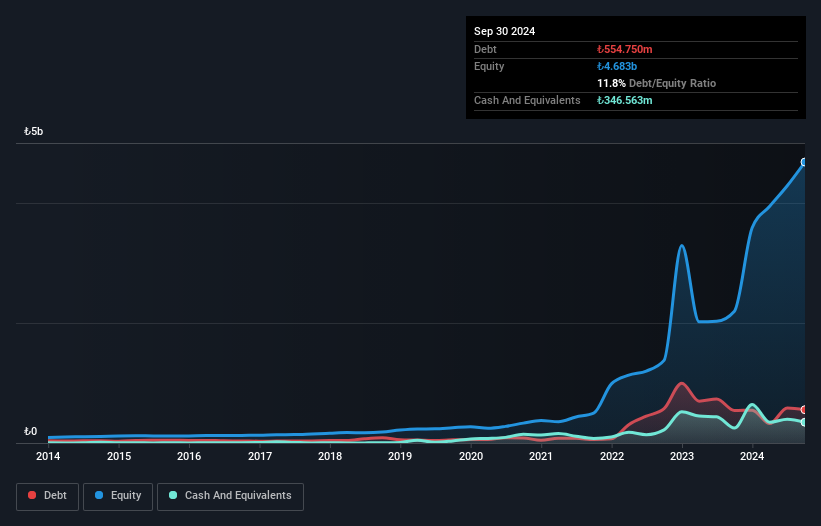

Jantsa Jant Sanayi ve Ticaret, a smaller player in the machinery sector, showcases a mixed financial landscape. Recently, it reported third-quarter sales of TRY 1.27 billion, down from TRY 1.65 billion the previous year; however, net income improved to TRY 10.51 million from a net loss of TRY 9.67 million last year. The company's debt-to-equity ratio has impressively decreased from 21% to nearly 12% over five years and maintains satisfactory interest coverage levels. Despite negative earnings growth of -27%, its free cash flow turned positive at TRY 328 million by September 2024, suggesting potential operational improvements ahead.

Lily Group (SHSE:603823)

Simply Wall St Value Rating: ★★★★★★

Overview: Lily Group Co., Ltd. is a company that manufactures and sells organic pigments in the People’s Republic of China, with a market capitalization of approximately CN¥3.97 billion.

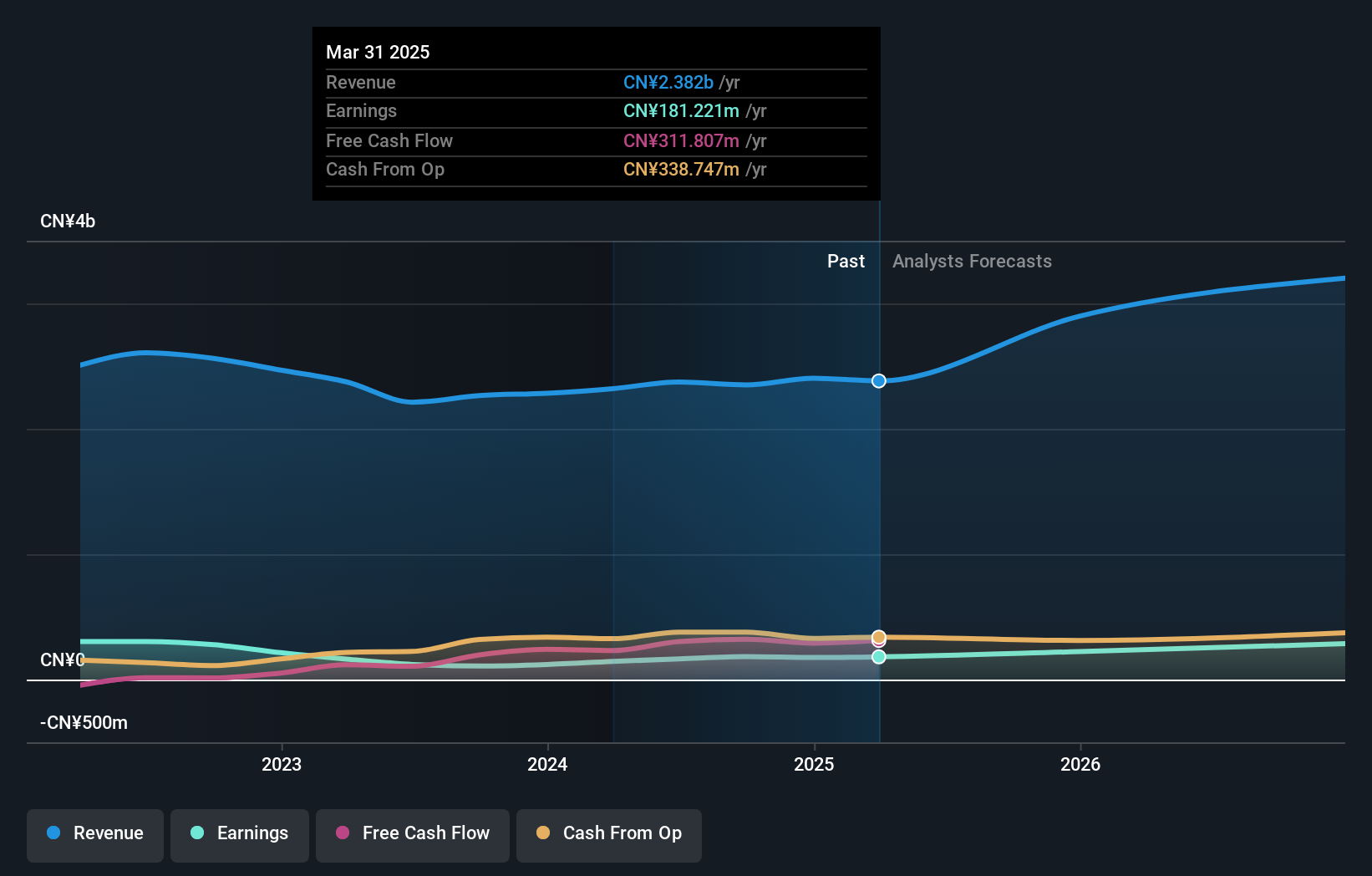

Operations: Lily Group generates revenue primarily from its chemicals segment, amounting to CN¥2.34 billion. The company's financial performance is influenced by its cost structure and market dynamics in the organic pigments industry.

Lily Group, a nimble player in the chemicals sector, has demonstrated impressive financial health with earnings growth of 69.5% over the past year, outpacing the industry average of -4.7%. The company boasts a debt-to-equity ratio that has improved from 8.3% to 6.9% over five years, indicating prudent financial management and more cash than its total debt, which is reassuring for investors concerned about leverage. Trading at an attractive value—53.6% below its estimated fair value—Lily Group's net income surged to CNY 143.83 million from CNY 81.31 million last year, reflecting strong operational performance and profitability prospects moving forward.

- Take a closer look at Lily Group's potential here in our health report.

Gain insights into Lily Group's historical performance by reviewing our past performance report.

Changhong Meiling (SZSE:000521)

Simply Wall St Value Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. operates in the electrical machinery and equipment manufacturing industry both in China and internationally, with a market cap of CN¥7.91 billion.

Operations: Changhong Meiling generates revenue primarily from its electrical machinery and equipment manufacturing operations. The company's financial performance is influenced by its cost structure, which impacts its profitability.

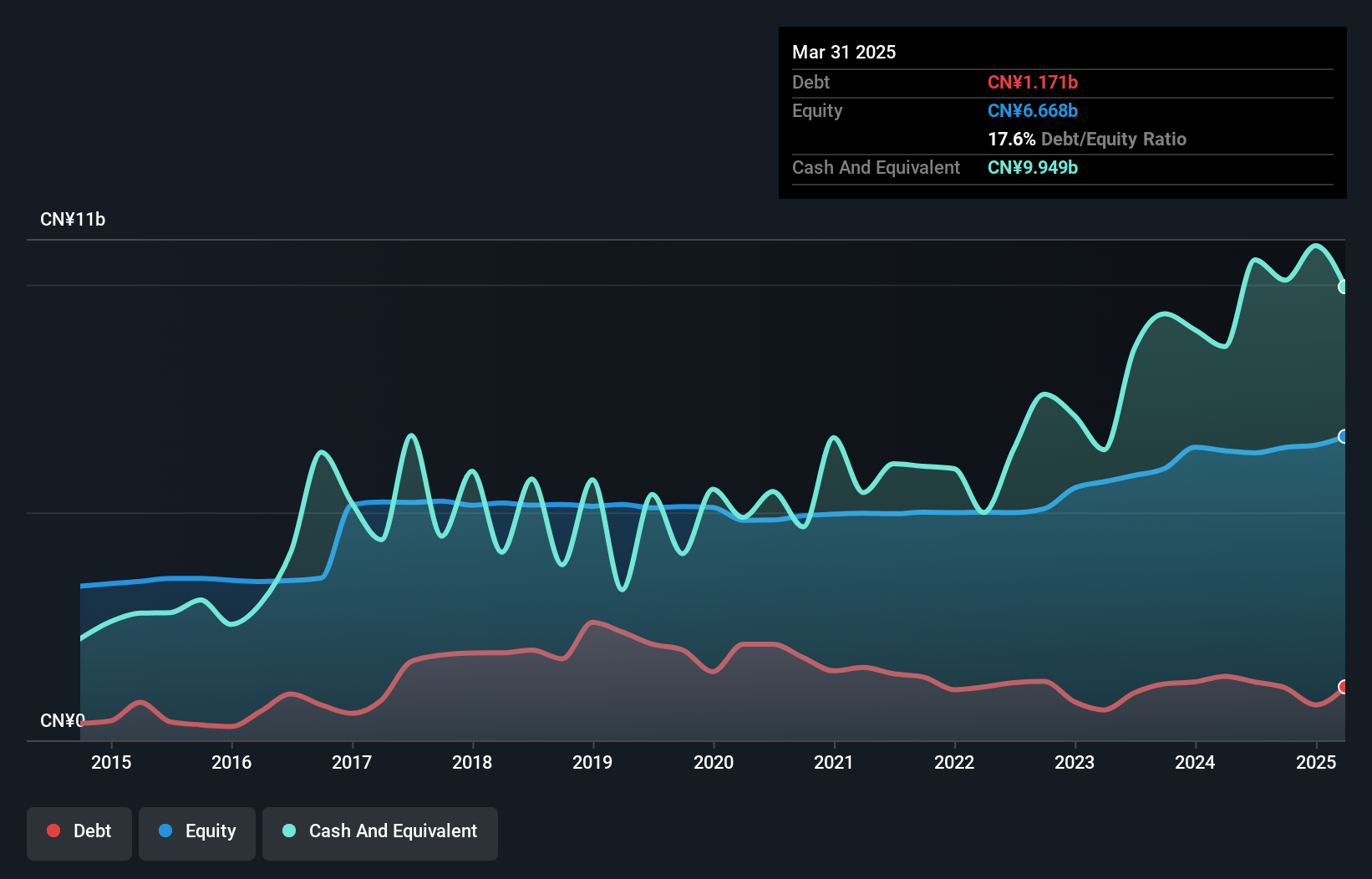

Changhong Meiling, a relatively small company in the consumer durables sector, has shown impressive earnings growth of 33% over the past year, outpacing its industry average. Its debt-to-equity ratio improved significantly from 38.7% to 17.9% over five years, indicating better financial health. The company reported a net income of CNY 530 million for nine months ending September 2024, compared to CNY 499 million the previous year. Trading at an attractive valuation—74% below estimated fair value—it seems positioned well against peers. Recent meetings focused on strategic transactions and substantial credit lines suggest active financial maneuvering for future opportunities.

- Delve into the full analysis health report here for a deeper understanding of Changhong Meiling.

Gain insights into Changhong Meiling's past trends and performance with our Past report.

Make It Happen

- Unlock our comprehensive list of 4668 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000521

Changhong Meiling

Operates in electrical machinery and equipment manufacturing industry in China and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives