As global markets navigate mixed signals with U.S. stocks closing a strong year despite recent slumps and economic indicators like the Chicago PMI pointing to challenges, investors are keenly observing small-cap stocks for potential opportunities. In this environment, discovering undervalued companies with solid fundamentals and growth prospects can be key to capitalizing on market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi (IBSE:BANVT)

Simply Wall St Value Rating: ★★★★★★

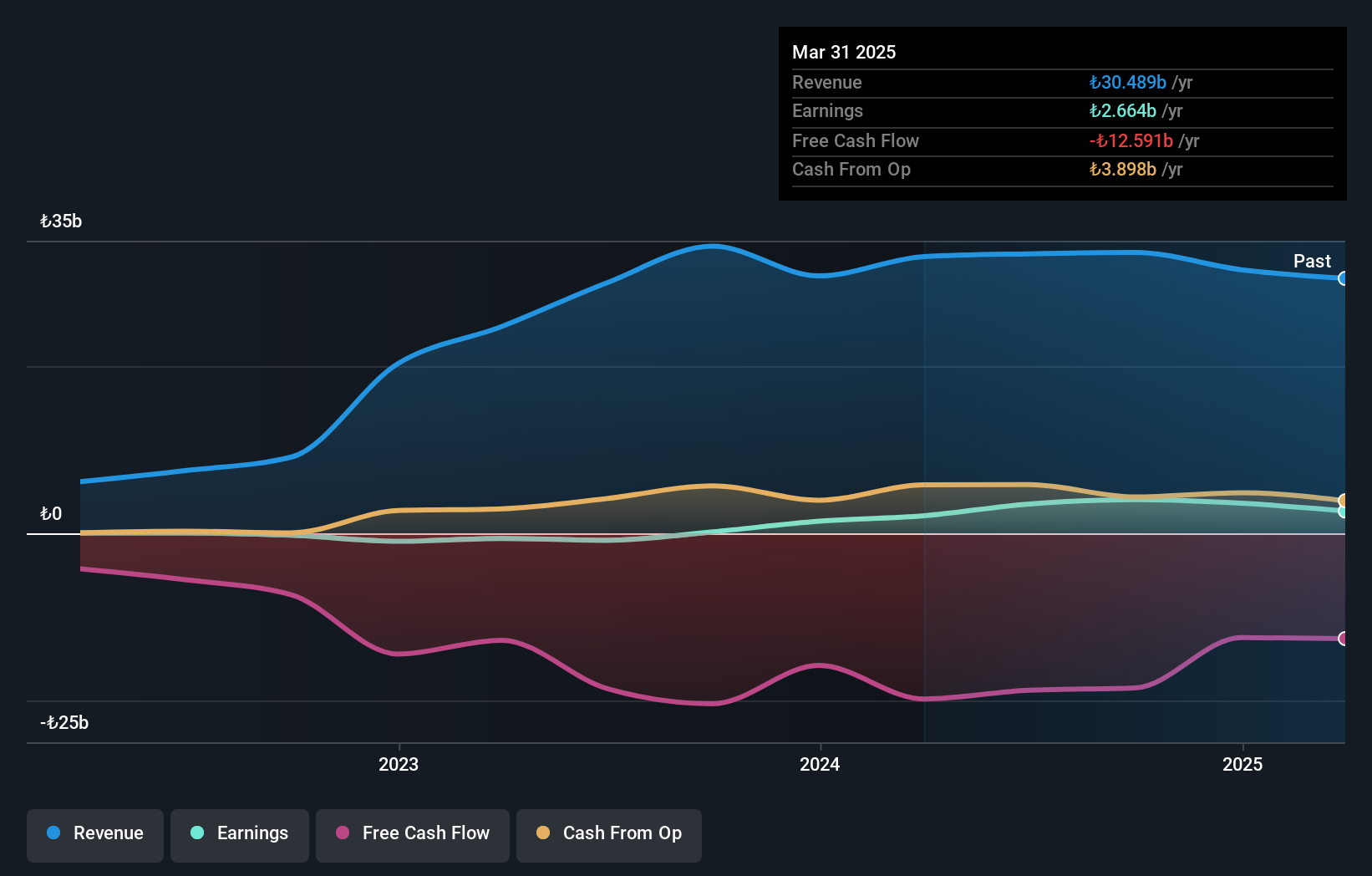

Overview: Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi is a Turkish food company with a market capitalization of TRY30.46 billion.

Operations: Banvit's primary revenue stream comes from its food processing segment, generating TRY22.26 billion. The company's financial performance is reflected in its market capitalization of TRY30.46 billion.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi, a player in the food industry, showcases impressive growth with earnings surging by 1776% over the past year. This remarkable performance outpaces the broader food sector's -9.8% earnings trend. The company has effectively reduced its debt-to-equity ratio from 31.8% to 18.1% over five years, indicating prudent financial management while maintaining more cash than total debt. Recent quarterly results reflect robust sales of TRY 7,421 million and net income of TRY 1,258 million compared to last year's figures, highlighting its potential as a value investment with a price-to-earnings ratio of 9x against the market's 16x.

Guangdong Tengen Industrial GroupLtd (SZSE:003003)

Simply Wall St Value Rating: ★★★★★☆

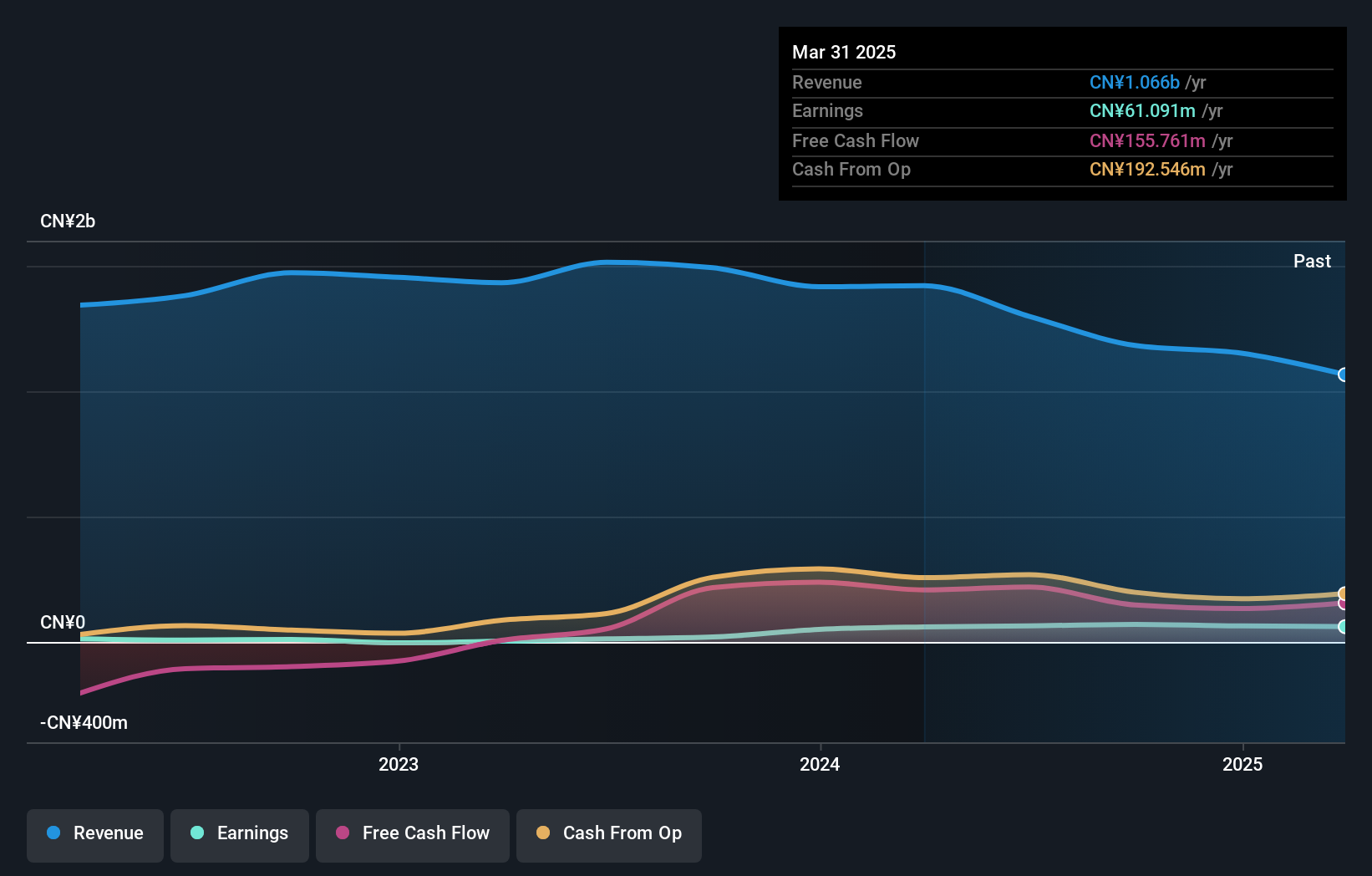

Overview: Guangdong Tengen Industrial Group Co., Ltd. operates in the industrial sector with a market capitalization of CN¥1.99 billion.

Operations: Guangdong Tengen Industrial Group Co., Ltd. generates revenue primarily from its industrial operations. The company's financial performance is highlighted by a market capitalization of CN¥1.99 billion, though specific revenue segments and cost breakdowns are not detailed in the provided information.

Guangdong Tengen, a smaller player in the industrial sector, shows intriguing potential despite recent sales dipping to CNY 885.09 million from CNY 1,119.34 million year-over-year. Impressively, net income rose to CNY 50.46 million from CNY 30.42 million, reflecting strong operational improvements with basic earnings per share climbing to CNY 0.2869 from CNY 0.1719 previously. The company recently completed a significant share buyback program repurchasing about 2.35 million shares for approximately CNY 19.18 million since April 2024, which could indicate confidence in its valuation and future prospects amidst industry challenges and opportunities for growth.

- Take a closer look at Guangdong Tengen Industrial GroupLtd's potential here in our health report.

Understand Guangdong Tengen Industrial GroupLtd's track record by examining our Past report.

TWOWAY Communications (TWSE:8045)

Simply Wall St Value Rating: ★★★★★★

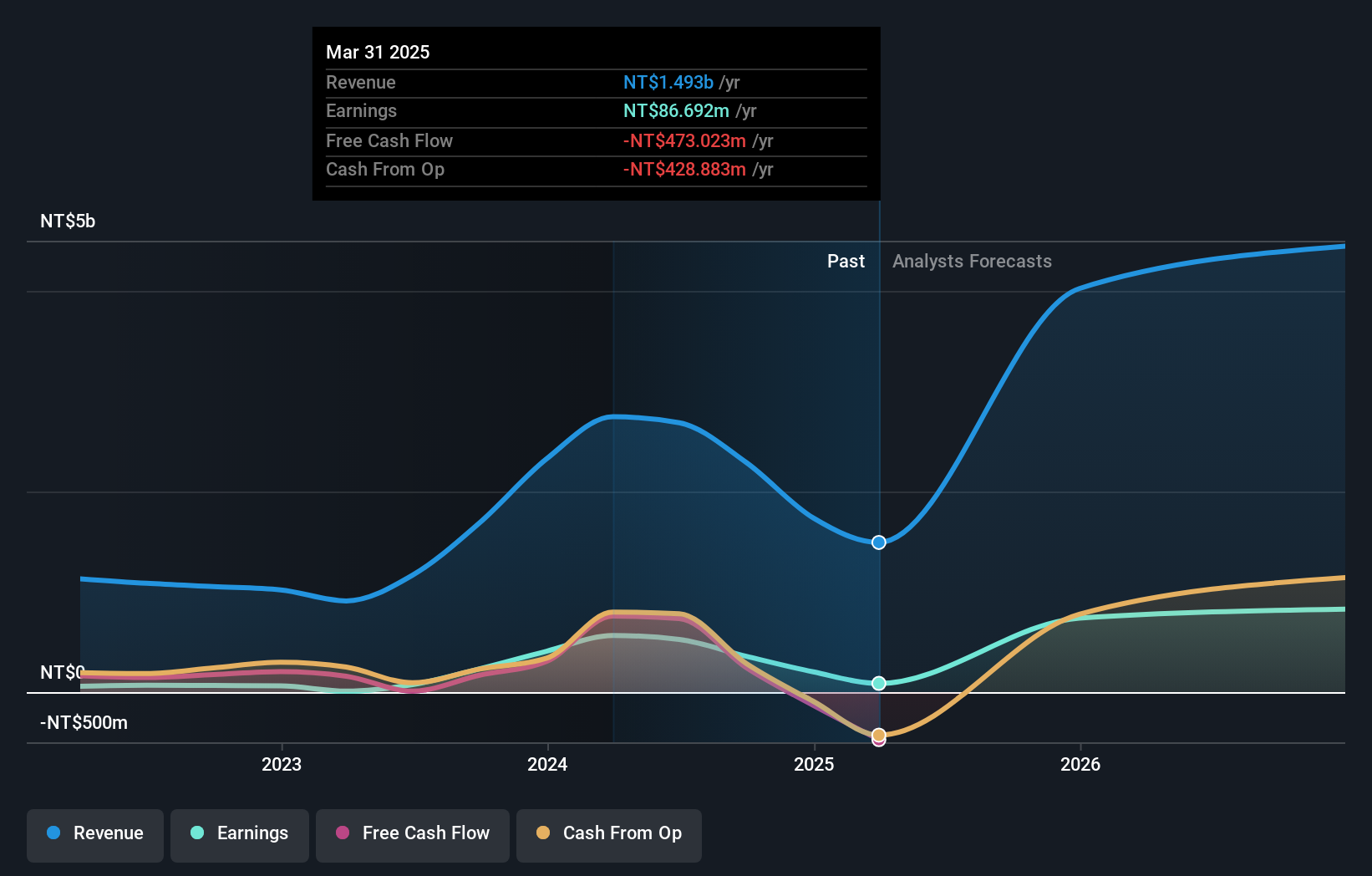

Overview: TWOWAY Communications, Inc. focuses on the research and development, manufacturing, and sale of RF and optical transmission equipment across various global markets with a market cap of approximately NT$8.32 billion.

Operations: TWOWAY Communications generates revenue primarily from its Broadband Network Equipment Division, contributing NT$3.21 billion, followed by the IOT Division with NT$377.92 million and the Labor and Other Business Division at NT$226.55 million. The company faces adjustments and write-offs amounting to -NT$1.53 billion, impacting its overall financial performance.

TWOWAY Communications, a nimble player in the communications sector, showcases potential despite recent challenges. The company's price-to-earnings ratio of 23.3x is attractive compared to the industry average of 32.5x, hinting at undervaluation. Over the past year, earnings surged by 53.5%, outpacing an industry decline of 9.2%. However, third-quarter sales dipped to TWD 390 million from TWD 787 million last year, with net income dropping to TWD 5.91 million from TWD 173 million a year ago. Despite this volatility and reduced debt levels over five years (65% down to 24%), TWOWAY remains free cash flow positive and maintains high-quality earnings standards.

- Get an in-depth perspective on TWOWAY Communications' performance by reading our health report here.

Explore historical data to track TWOWAY Communications' performance over time in our Past section.

Make It Happen

- Get an in-depth perspective on all 4668 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003003

Guangdong Tengen Industrial GroupLtd

Guangdong Tengen Industrial Group Co.,Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives