- Israel

- /

- Energy Services

- /

- TASE:LAPD

Exploring Three Undiscovered Gems in Middle East Markets

Reviewed by Simply Wall St

As Middle East markets experience a lift, buoyed by investor optimism over potential U.S. interest rate cuts and steady oil prices, regional indices have shown positive momentum with most Gulf bourses closing higher. In this dynamic environment, uncovering stocks that can capitalize on these favorable conditions requires looking for companies with strong fundamentals and the ability to navigate both local and global economic shifts effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hat-San Gemi Insaa Bakim Onarim Deniz Nakliyat Sanayi ve Ticaret Anonim Sirketi (IBSE:HATSN)

Simply Wall St Value Rating: ★★★★★☆

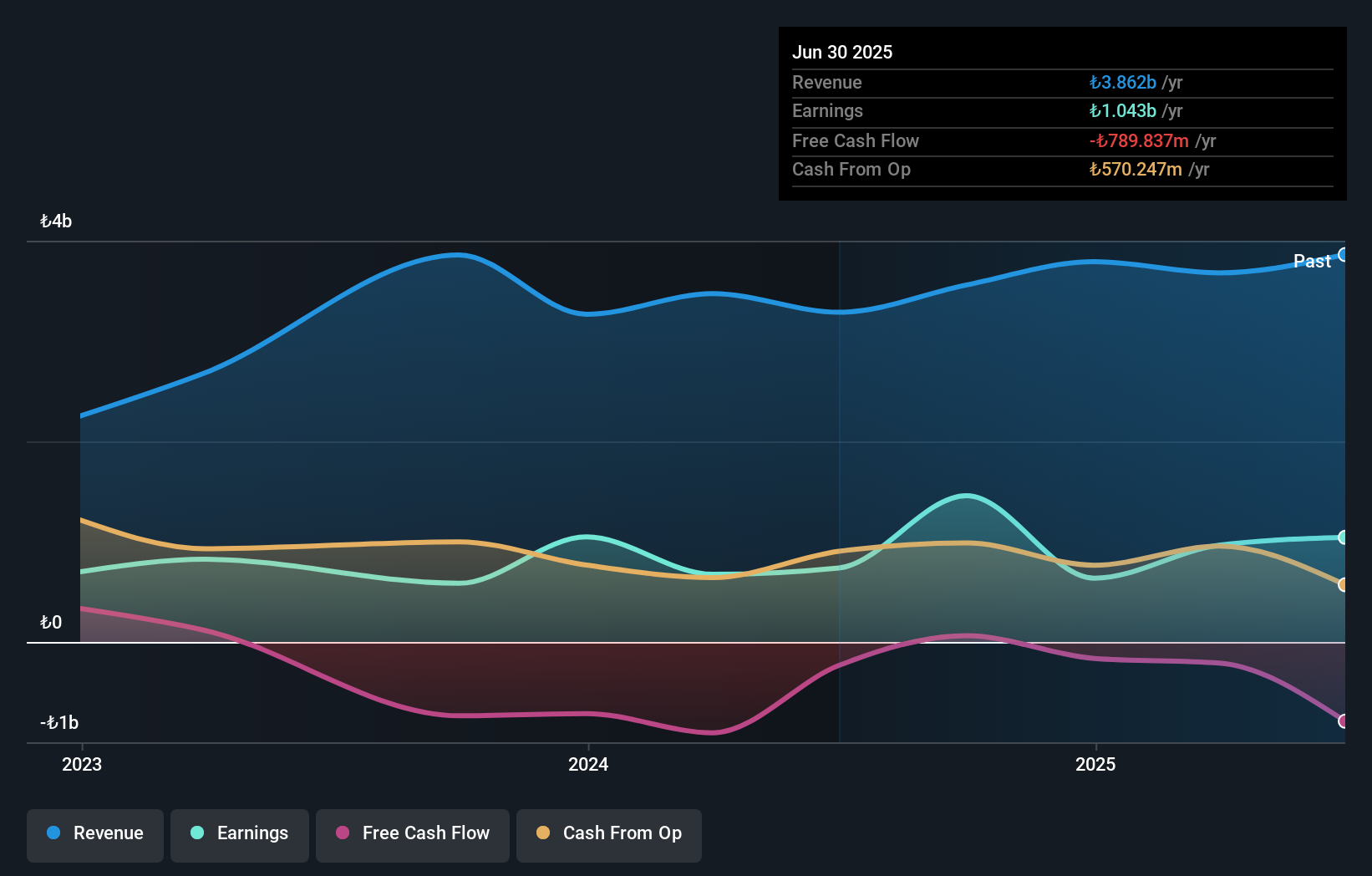

Overview: Hat-San Gemi Insaa Bakim Onarim Deniz Nakliyat Sanayi ve Ticaret Anonim Sirketi specializes in the construction of vessels and steel structures for marine and land applications, with a market capitalization of TRY10.80 billion.

Operations: Hat-San generates revenue primarily from its shipbuilding segment, totaling TRY3.86 billion. The company's financial performance is reflected in its market capitalization of TRY10.80 billion.

Hat-San Gemi Insaa Bakim Onarim Deniz Nakliyat Sanayi ve Ticaret Anonim Sirketi, a small cap player in the industry, has shown impressive earnings growth of 41.4% over the past year, outpacing the Machinery industry's 8.6%. With a net debt to equity ratio at a satisfactory 2.7%, its financial health appears robust. The company reported second-quarter sales of TRY 987 million and net income of TRY 127 million, up from TRY 48 million last year. Despite being dropped from the S&P Global BMI Index recently, its price-to-earnings ratio remains attractive at 10.3x against the market's 21.7x.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

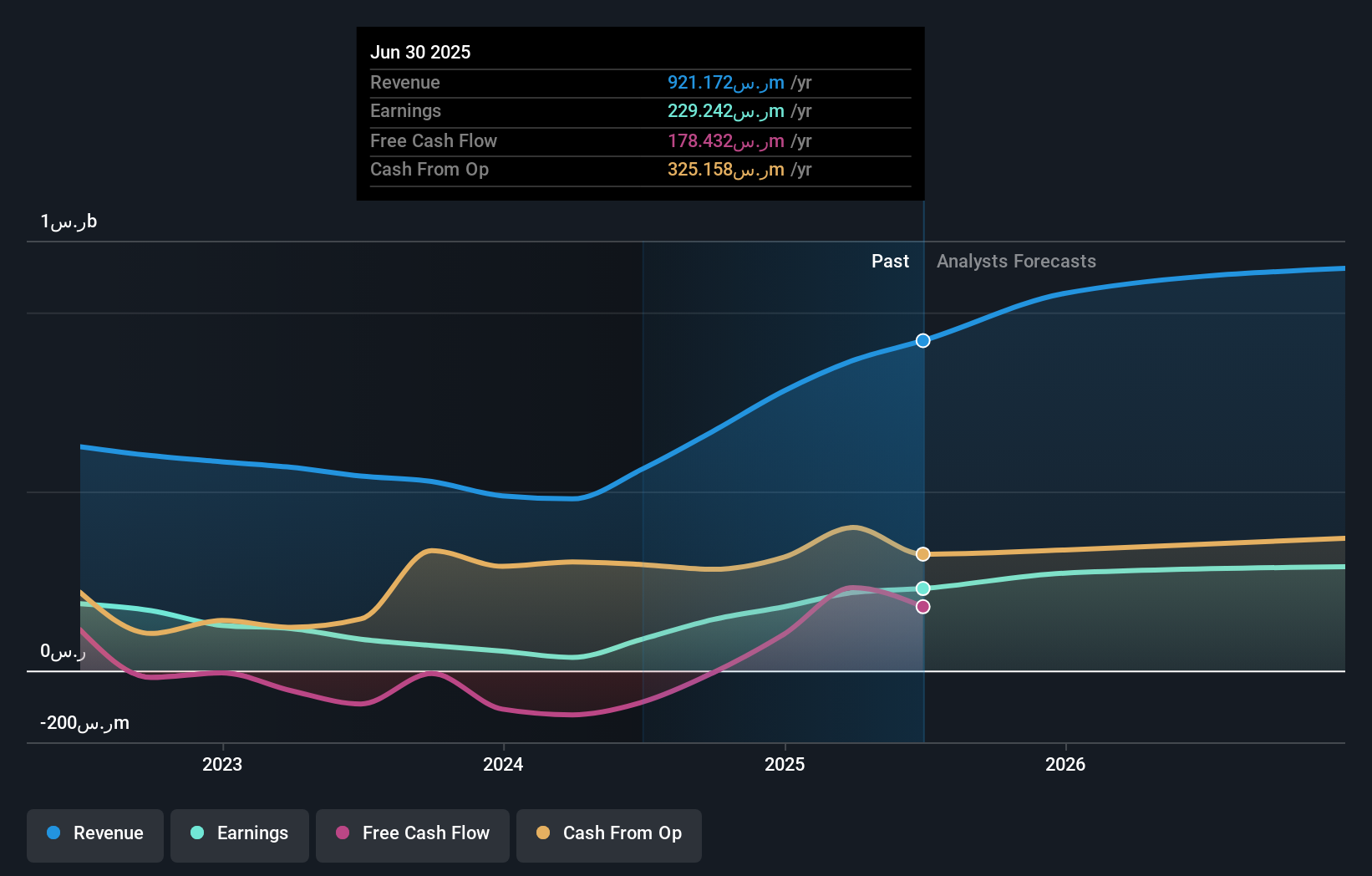

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market capitalization of SAR6.88 billion.

Operations: Revenue streams for Al Masane Al Kobra Mining primarily include contributions from the Moyeath Mine (SAR279.10 million), Al Masane Mine (SAR330.70 million), and Mount Guyan Mine (SAR311.37 million).

The mining firm Al Masane Al Kobra is making waves with its impressive financial performance. Over the past year, earnings surged by 160%, outpacing the industry average of 9%. Its debt to equity ratio has improved significantly from 65% to a mere 9% over five years, highlighting prudent financial management. The company's price-to-earnings ratio stands at 30x, offering good value compared to the industry average of 32x. Recent earnings reports show net income for Q2 at SAR 73 million, up from SAR 62 million last year. Additionally, it announced a cash dividend distribution totaling SAR 110.7 million for H1 2025.

Lapidoth Capital (TASE:LAPD)

Simply Wall St Value Rating: ★★★★★☆

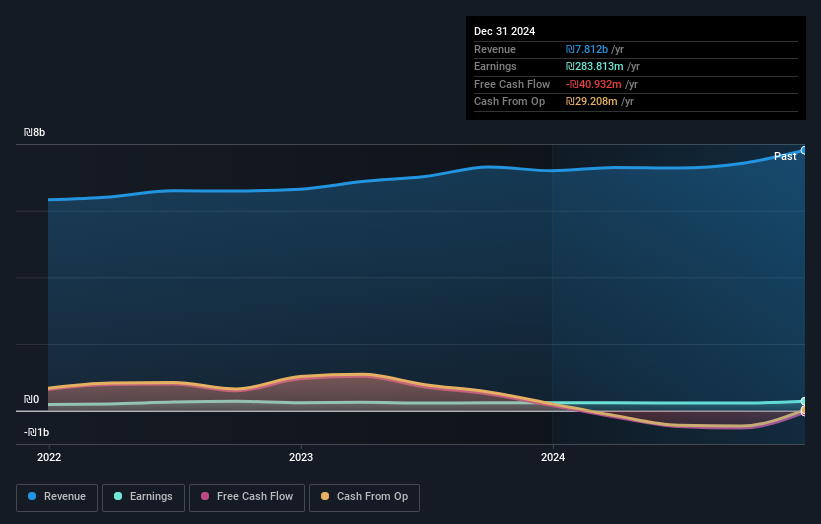

Overview: Lapidoth Capital Ltd, with a market cap of ₪4.87 billion, operates in Israel offering drilling and related services through its subsidiaries.

Operations: Lapidoth Capital generates revenue primarily from its Dania segment, contributing ₪6.58 billion, and Sunny Communications, adding ₪994.25 million. The AFI Residences segment also plays a significant role with revenues of ₪976.67 million.

Lapidoth Capital, a smaller player in the Energy Services sector, has shown impressive earnings growth of 21.6% over the past year, outpacing the industry average of 11.8%. The company's price-to-earnings ratio stands at 16.7x, slightly below the industry norm of 16.9x, indicating potential value for investors. Despite a significant one-off gain of ₪120 million affecting recent results, Lapidoth's financial health appears robust with its debt to equity ratio dropping from 192% to a more manageable 47% over five years and maintaining positive free cash flow throughout this period.

- Click to explore a detailed breakdown of our findings in Lapidoth Capital's health report.

Understand Lapidoth Capital's track record by examining our Past report.

Where To Now?

- Gain an insight into the universe of 204 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:LAPD

Excellent balance sheet with proven track record.

Market Insights

Community Narratives