- Israel

- /

- Oil and Gas

- /

- TASE:ILDR

Israel Land Development - Urban Renewal Ltd's (TLV:ILDR) Share Price Matching Investor Opinion

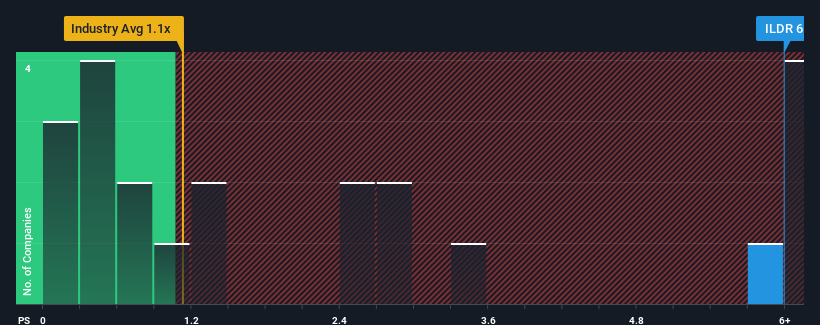

Israel Land Development - Urban Renewal Ltd's (TLV:ILDR) price-to-sales (or "P/S") ratio of 6x may look like a poor investment opportunity when you consider close to half the companies in the Oil and Gas industry in Israel have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Israel Land Development - Urban Renewal

How Israel Land Development - Urban Renewal Has Been Performing

With revenue growth that's exceedingly strong of late, Israel Land Development - Urban Renewal has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Israel Land Development - Urban Renewal will help you shine a light on its historical performance.How Is Israel Land Development - Urban Renewal's Revenue Growth Trending?

In order to justify its P/S ratio, Israel Land Development - Urban Renewal would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 86% last year. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

In contrast to the company, the rest of the industry is expected to decline by 0.8% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we can see why Israel Land Development - Urban Renewal is trading at a high P/S compared to the industry. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As detailed previously, the strength of Israel Land Development - Urban Renewal's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

It is also worth noting that we have found 4 warning signs for Israel Land Development - Urban Renewal (2 don't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Israel Land Development - Urban Renewal's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ILDR

Israel Land Development - Urban Renewal

Engages in urban renewal activities.

Flawless balance sheet very low.

Market Insights

Community Narratives