- Israel

- /

- Capital Markets

- /

- TASE:MTRD

Emerging Middle East Stocks With Promising Potential

Reviewed by Simply Wall St

As Middle Eastern markets navigate the complexities of U.S. tariff concerns and fluctuating oil prices, investors are witnessing a mixed performance across Gulf bourses, with some indices retreating while others show resilience amid strong corporate earnings. In this evolving landscape, identifying promising stocks requires a keen eye for companies that demonstrate robust financial health and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Palms Sports PJSC (ADX:PALMS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Palms Sports PJSC offers sports training programs, primarily focusing on Jiu-Jitsu and other sports in the United Arab Emirates, with a market capitalization of AED1.15 billion.

Operations: Palms Sports PJSC generates revenue primarily from its Coaching and Training segment, contributing AED405.16 million, and the Guarding and Cleaning segment, contributing AED575.45 million.

Palms Sports PJSC, a notable player in the Middle East's entertainment sector, showcases a blend of strengths and challenges. The company reported sales of AED 280.86 million for Q2 2025, up from AED 253.65 million the previous year, with net income rising to AED 27.81 million from AED 22.65 million. It maintains high-quality earnings and strong interest coverage at 17 times EBIT versus interest payments, indicating robust financial health despite a volatile share price recently. However, profit margins have slipped to 10% from last year's 15%, and earnings growth lagged behind industry averages over the past year at -0.8%.

- Take a closer look at Palms Sports PJSC's potential here in our health report.

Examine Palms Sports PJSC's past performance report to understand how it has performed in the past.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market capitalization of ₪1.33 billion.

Operations: Cohen Development Gas & Oil generates revenue from the production and management of oil and gas exploration, amounting to $29.63 million.

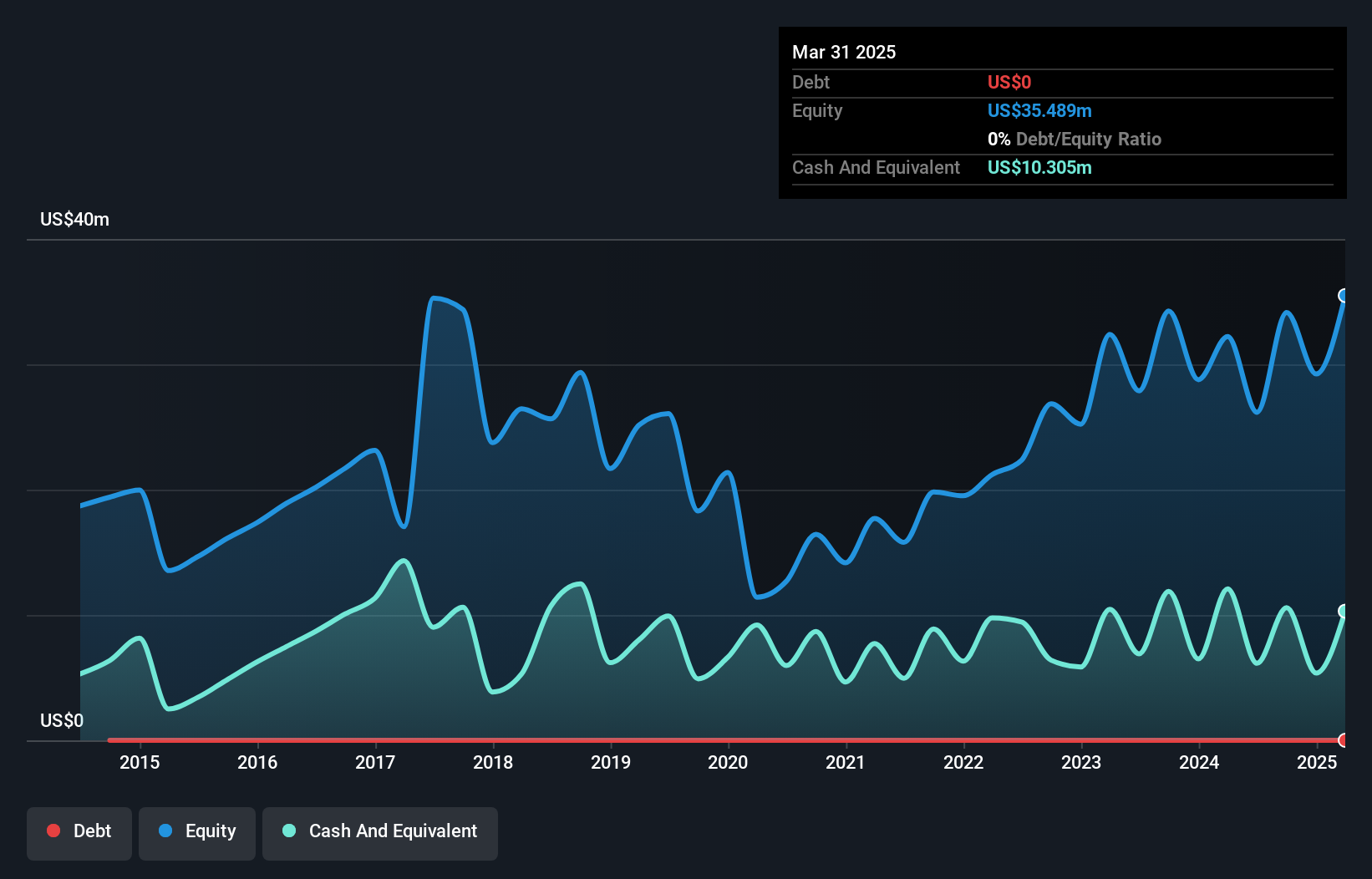

Cohen Development Gas & Oil, a relatively small player in the Middle East energy sector, has been making waves with its robust financial performance. Over the past year, earnings surged by 34.8%, outpacing the broader oil and gas industry growth of 6.3%. The company boasts a debt-free balance sheet for five years, eliminating concerns about interest payments. Its price-to-earnings ratio stands at 16x, slightly below the IL market average of 16.4x, suggesting potential value for investors. Recent earnings reveal net income climbed to US$6.26 million from US$3.44 million last year, with basic EPS rising to US$0.97 from US$0.53.

- Click here to discover the nuances of Cohen Development Gas & Oil with our detailed analytical health report.

Understand Cohen Development Gas & Oil's track record by examining our Past report.

Meitav Trade Investments (TASE:MTRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Meitav Trade Investments Ltd offers financial investment services and has a market cap of ₪1.10 billion.

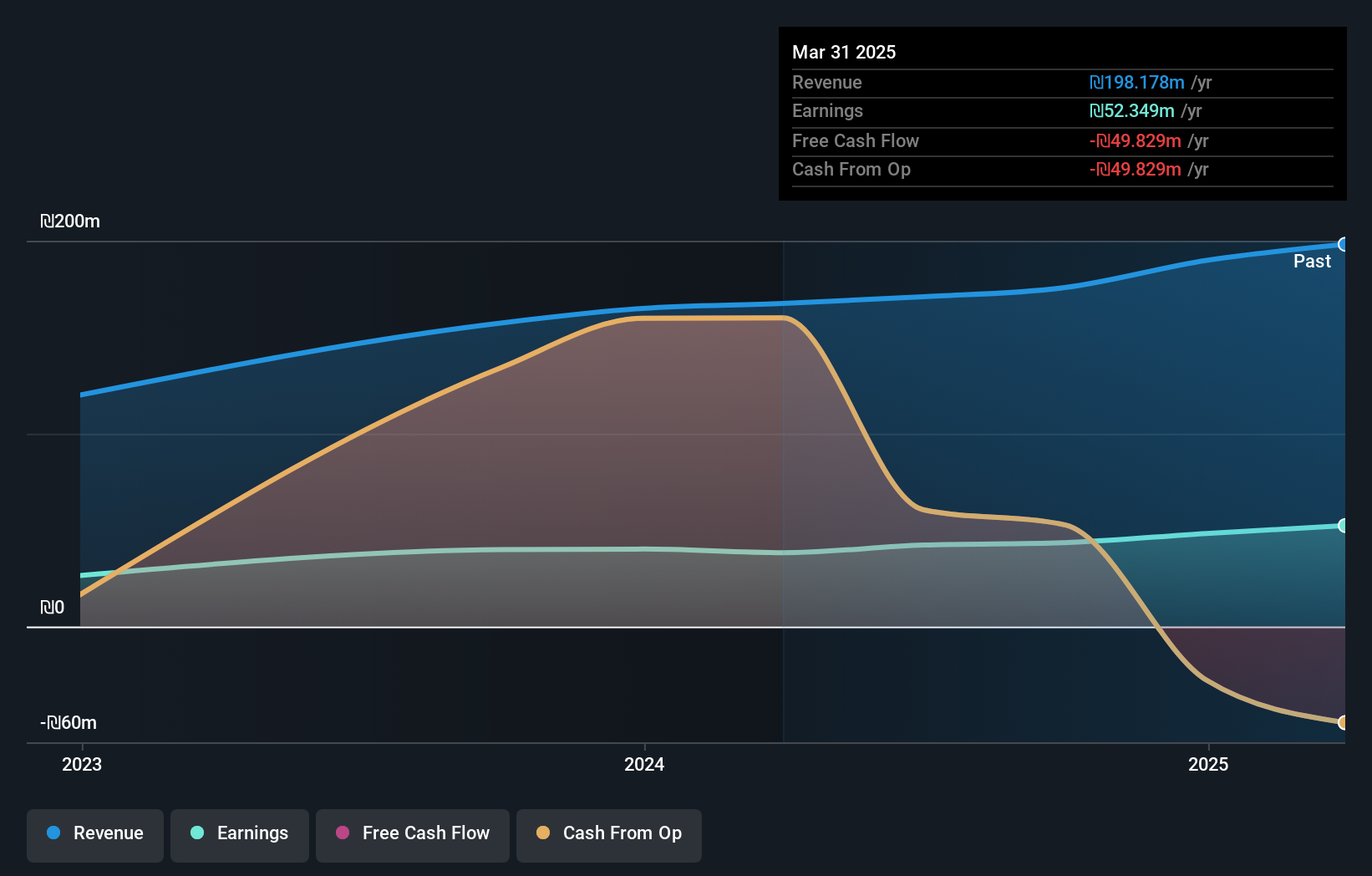

Operations: Meitav Trade Investments generates revenue primarily from its asset management segment, which amounts to ₪198.18 million.

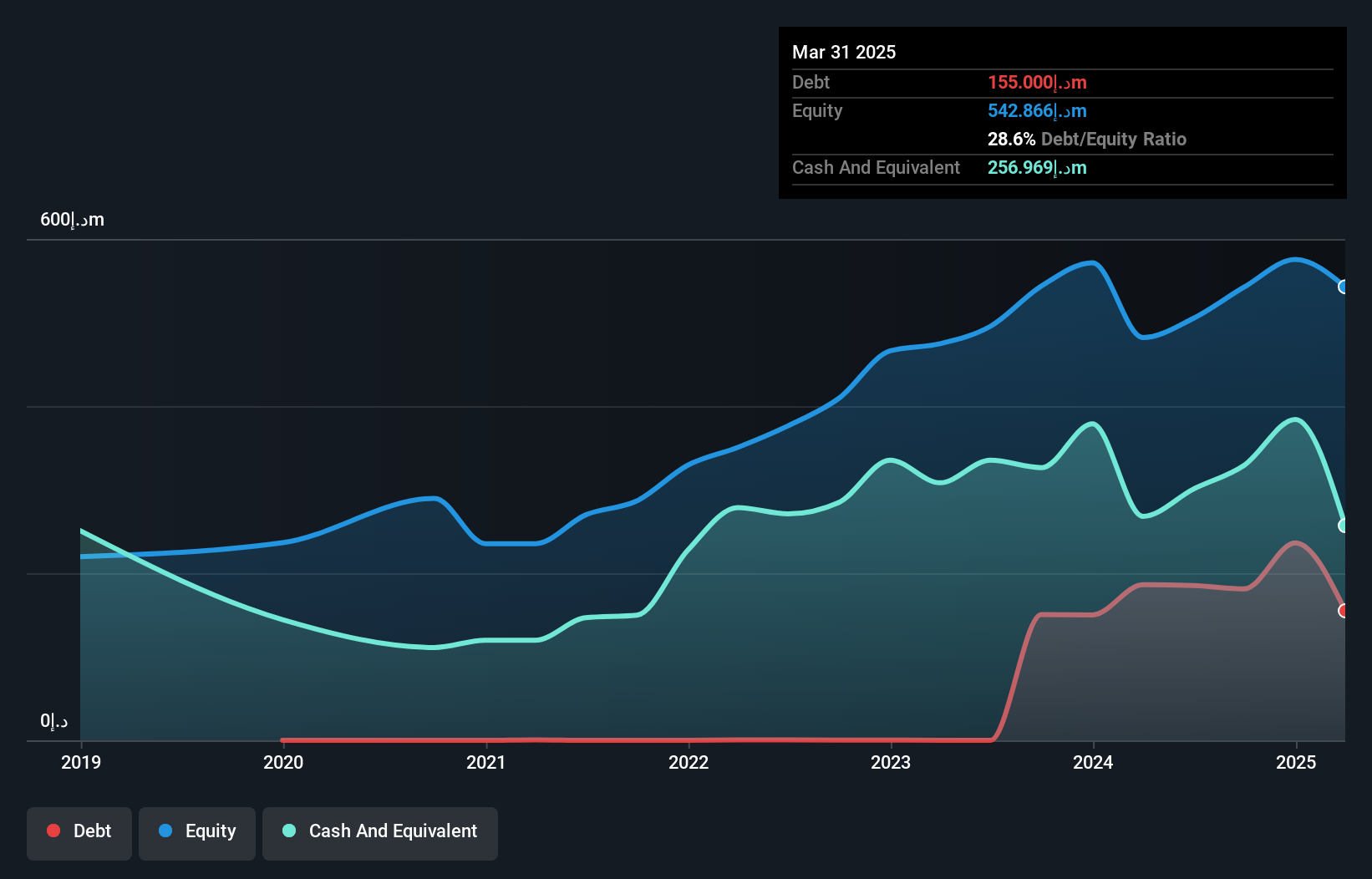

Meitav Trade Investments showcases a compelling profile with no debt over the past five years, highlighting financial prudence. Its earnings surged by 36.7% last year, outpacing the Capital Markets industry at 28.5%, indicating robust growth potential. Recent results reveal a revenue increase to ILS 51.63 million from ILS 43.27 million and net income rising to ILS 14.12 million from ILS 10.01 million year-over-year, reflecting strong operational performance despite negative levered free cash flow of -ILS 49.83 million as of March 2025, which may suggest some challenges in cash management amidst its high-quality earnings status.

- Navigate through the intricacies of Meitav Trade Investments with our comprehensive health report here.

Gain insights into Meitav Trade Investments' past trends and performance with our Past report.

Summing It All Up

- Click here to access our complete index of 221 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTRD

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives