- Israel

- /

- Capital Markets

- /

- TASE:TASE

Tel Aviv Stock Exchange (TASE:TASE): Examining Valuation as Market Optimism Lifts Shares to New Highs

Reviewed by Kshitija Bhandaru

Tel-Aviv Stock Exchange (TASE:TASE) has surged to record levels as optimism grows around Israel’s economic recovery. Investors are encouraged by peace prospects, potential deals with Saudi Arabia, and expectations for more accommodative monetary policy.

See our latest analysis for Tel-Aviv Stock Exchange.

This rally caps an extraordinary run for Tel-Aviv Stock Exchange, with the share price up 80.8% year-to-date and a massive 107.5% one-year total shareholder return. Recent optimism surrounding regional diplomacy and a friendlier monetary outlook appears to be building real momentum. Investors are clearly recalibrating growth prospects and risk perceptions in light of these shifts.

If you want to spot more fast-moving opportunities as sentiment shifts, this is a perfect moment to discover fast growing stocks with high insider ownership

But after such an explosive run and high expectations, is Tel-Aviv Stock Exchange truly trading below its intrinsic value, or are investors already factoring in years of future growth, leaving little room for fresh upside?

Price-to-Earnings of 54.7x: Is it justified?

Tel-Aviv Stock Exchange’s current share price of ₪77.3 values the company at a hefty 54.7 times its trailing earnings, putting it well above both industry and peer averages.

The price-to-earnings (P/E) ratio tells investors how much they are paying for each shekel of profit. In the case of TASE, this is a crucial yardstick, considering its recent surge in profitability and high expectations for continued earnings growth.

At 54.7x, the P/E is dramatically higher than the Asian Capital Markets industry average of 22.4x and the peer group average of 20.7x. This could indicate the market is pricing in exceptionally strong growth ahead or perhaps overlooking relative value alternatives elsewhere in the sector. Without a fair ratio benchmark, it is difficult to gauge if this is a justified premium or an early warning sign that expectations may be overheating.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 54.7x (OVERVALUED)

However, slowing revenue growth or unexpected regional tensions could quickly dampen the mood and force investors to reassess the Tel-Aviv Stock Exchange’s lofty valuation.

Find out about the key risks to this Tel-Aviv Stock Exchange narrative.

Another View: Our DCF Model Paints a Different Picture

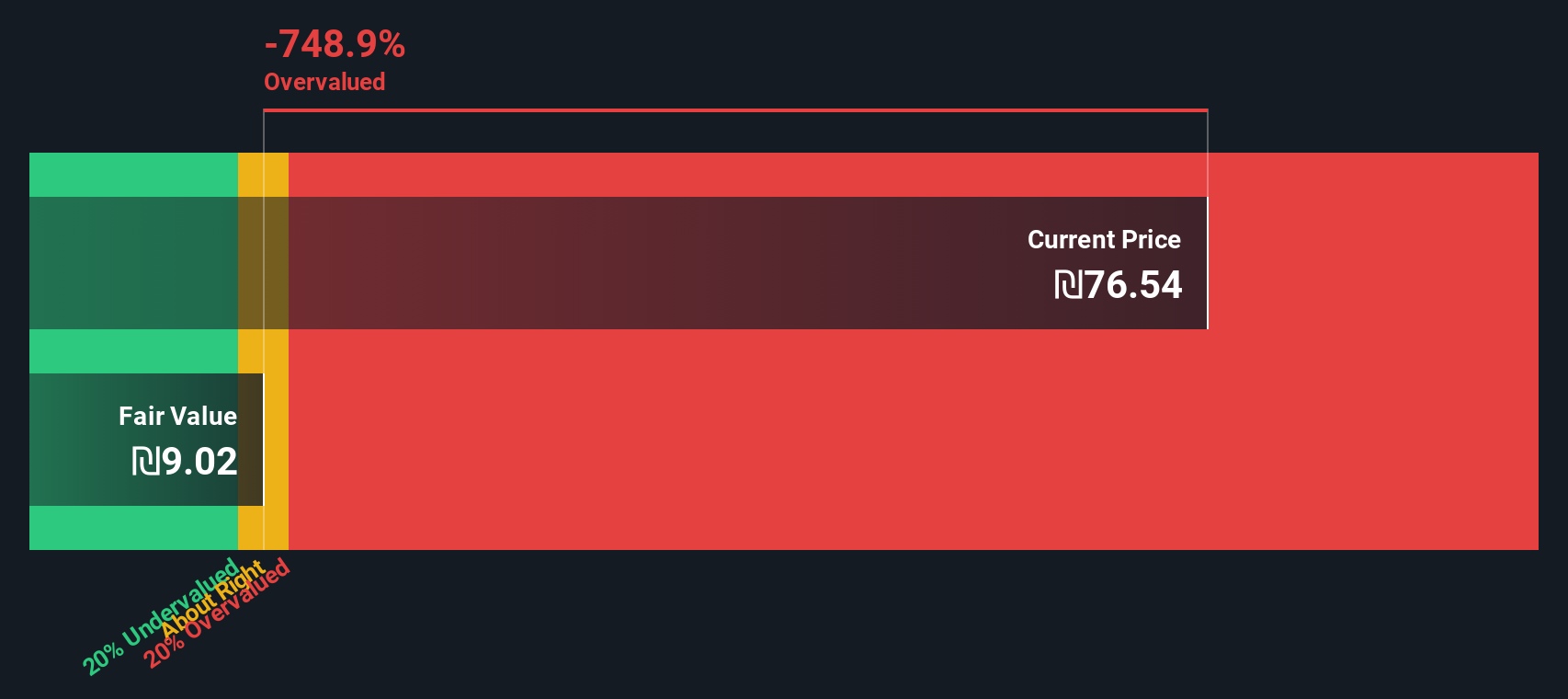

Looking beyond profit multiples, our SWS DCF model suggests Tel-Aviv Stock Exchange is trading significantly above what its future cash flows might justify. The model estimates fair value at just ₪9.02, which is a substantial gap from today's market price. Does this mean the market is ignoring underlying fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tel-Aviv Stock Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tel-Aviv Stock Exchange Narrative

If you see things differently or want to uncover the story for yourself, you can dive into the numbers and build a view in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tel-Aviv Stock Exchange.

Looking for More Investment Ideas?

Smart investors do not settle for one opportunity when the market is full of potential. Now is the time to get ahead and target fresh winners poised for growth.

- Uncover stocks offering strong yields and reliable payouts with these 18 dividend stocks with yields > 3%, designed for income-focused portfolios.

- Turbocharge your portfolio with future tech breakthroughs by tapping into these 25 AI penny stocks, which are driving advancements in artificial intelligence and next-generation automation.

- Position yourself for the next bull run by seeking out hidden bargains among these 893 undervalued stocks based on cash flows, identified for their upside potential based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives