- Israel

- /

- Capital Markets

- /

- TASE:TASE

How Investors May Respond To Tel-Aviv Stock Exchange (TASE:TASE) Record Highs on Post-War Recovery Hopes

Reviewed by Sasha Jovanovic

- In recent days, the Tel-Aviv Stock Exchange has reached record highs as optimism builds over Israel's post-war economic recovery and possible regional normalization initiatives.

- Analysts point to anticipated expansion of the Abraham Accords and potential normalization with Saudi Arabia as potential catalysts for further market development, particularly in real estate and financial sectors.

- We will examine how optimism around economic normalization and easing monetary policy shapes the Israeli investment narrative going forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Tel-Aviv Stock Exchange's Investment Narrative?

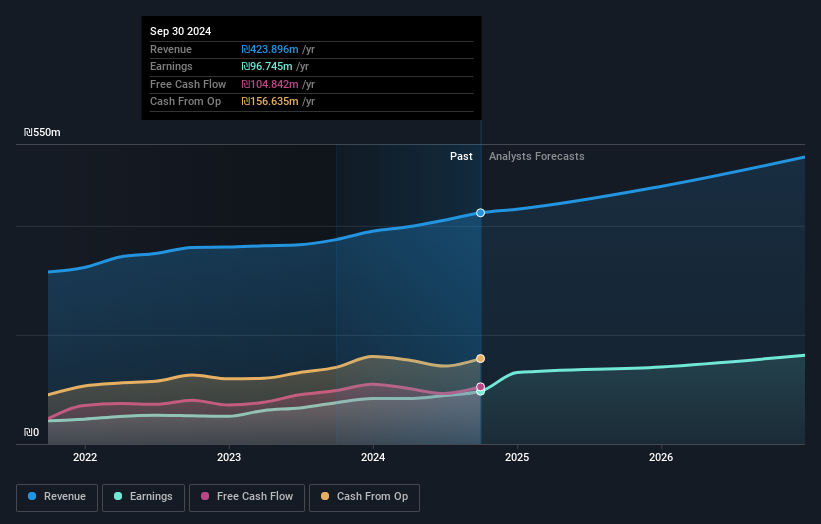

To be a shareholder in the Tel-Aviv Stock Exchange (TASE) today, you need to see the big picture: a market moving on optimism about Israel's post-war growth, regional normalization potential, and more investor-friendly monetary policies. The record market highs reached in recent days add weight to short-term catalysts, especially growing interest in Israel's financial and real estate sectors if Abraham Accords expansion and Saudi normalization progress. These developments could shift momentum and draw new capital, supporting fee income and trading volumes. On the flip side, TASE's high valuation multiples and prior underperformance relative to regional peers remain critical risks, now slightly offset by robust earnings and revenue growth shown in recent results. Any cooling of diplomatic progress or delays in policy easing, however, could take the shine off this rally, so these remain factors to watch, potentially more so than before. Yet, shifts in diplomacy can quickly alter the risk balance for investors.

Tel-Aviv Stock Exchange's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Tel-Aviv Stock Exchange - why the stock might be worth as much as ₪72.71!

Build Your Own Tel-Aviv Stock Exchange Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tel-Aviv Stock Exchange research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Tel-Aviv Stock Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tel-Aviv Stock Exchange's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives