- Israel

- /

- Basic Materials

- /

- TASE:ACKR

Undiscovered Gems in Middle East Stocks to Explore May 2025

Reviewed by Simply Wall St

As the Middle Eastern markets navigate a volatile landscape, characterized by Saudi Arabia's stock index experiencing its worst session in six weeks and UAE indices settling lower, investors are increasingly cautious amid global fiscal uncertainties and fluctuating oil exports. In such a climate, identifying promising stocks often involves looking for companies with robust fundamentals and growth potential that can withstand external pressures and capitalize on regional opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Response Plus Holding PJSC (ADX:RPM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Response Plus Holding PJSC, along with its subsidiaries, provides healthcare services in the United Arab Emirates, Saudi Arabia, and Oman, with a market capitalization of AED930 million.

Operations: Revenue for Response Plus Holding PJSC comes primarily from its healthcare facilities and services, totaling AED456.52 million. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency within the sector.

Response Plus Holding PJSC, a promising player in the healthcare sector, has demonstrated robust earnings growth of 8.3% over the past year, outpacing the industry average of 6.5%. The company's price-to-earnings ratio stands at 17.4x, which is attractive compared to the industry average of 18.9x. With interest payments well covered by EBIT (23.5x), financial stability appears solid. Recent news highlights a dividend distribution of AED 20 million for fiscal year-end 2024, reflecting confidence in its financial health and rewarding shareholders with AED 0.10 per share—10% of its share capital—indicating strong shareholder value commitment.

Ackerstein Group (TASE:ACKR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ackerstein Group Ltd operates in the production, infrastructure, construction, and development sectors across Israel and the United States, with a market capitalization of ₪2.13 billion.

Operations: Ackerstein Group Ltd generates revenue primarily from its Engineering Segment (₪546.20 million) and Industry Sector (₪266.31 million), with additional contributions from the Real Estate Sector (₪47.48 million) and Industry Sector Abroad (₪58.74 million).

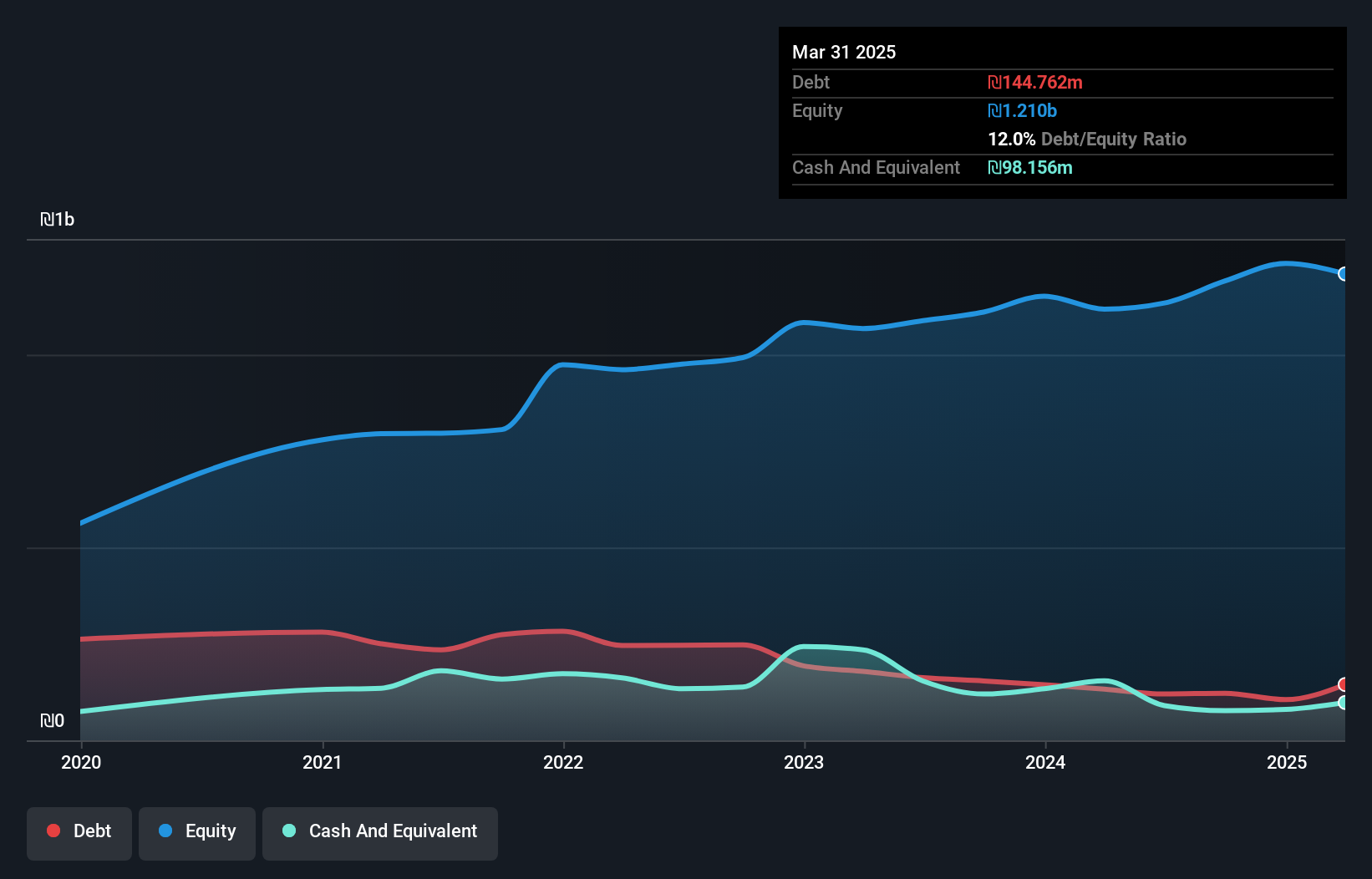

In the Middle East's dynamic market, Ackerstein Group stands out with its impressive financial performance. Over the past year, earnings surged by 32%, notably surpassing the Basic Materials industry's modest 1.3% growth. The company's debt management is commendable, with a significant reduction in its debt-to-equity ratio from 46.6% to just 8.5% over five years, and a net debt-to-equity ratio at a satisfactory 2.1%. Recent results show sales climbing to ₪230 million for Q1 2025 from ₪194 million last year, while net income increased to ₪21 million compared to ₪15 million previously, reflecting strong operational efficiency despite recent volatility in share price and one-off gains impacting past earnings.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Y.D. More Investments Ltd is a privately owned investment manager with a market capitalization of ₪1.40 billion.

Operations: Y.D. More generates revenue primarily from the management of provident and pension funds, contributing ₪515.23 million, followed by mutual fund management at ₪214.96 million. The investment portfolio management segment adds another ₪32.47 million to its revenue streams.

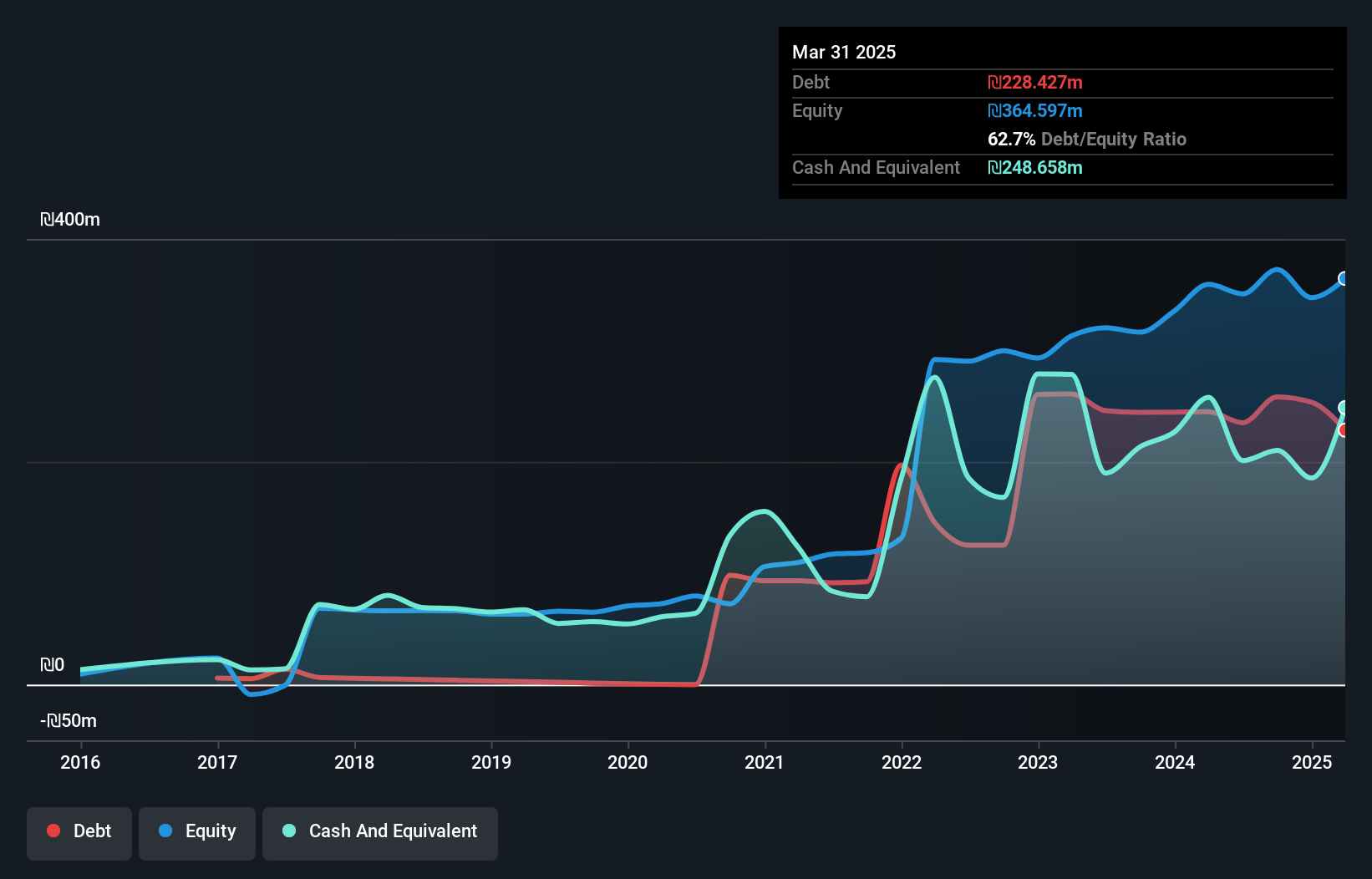

Y.D. More Investments, a noteworthy player in the Middle East, has demonstrated robust financial performance with earnings growing 29.5% annually over the past five years. The net debt to equity ratio stands at a satisfactory 19.6%, indicating prudent financial management, while interest payments are well-covered by EBIT at 47 times coverage. Recent results show revenue climbing to ILS 785 million from ILS 650 million year-on-year, and net income reaching ILS 78 million compared to ILS 66 million previously. Basic earnings per share rose to ILS 1.1 from ILS 0.93, reflecting solid operational efficiency and growth potential in its market segment.

- Get an in-depth perspective on Y.D. More Investments' performance by reading our health report here.

Where To Now?

- Dive into all 236 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ACKR

Ackerstein Group

Engages in the production, infrastructure, construction, and development activities in Israel and the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives