- Turkey

- /

- Commercial Services

- /

- IBSE:GIPTA

Undiscovered Gems in Middle East Stocks for December 2025

Reviewed by Simply Wall St

As the Middle East stock markets navigate a challenging landscape marked by declining oil prices and fluctuating indices, investors are keenly observing how these dynamics impact small-cap stocks. With Gulf equities experiencing downward pressure and broader market sentiment being influenced by global economic indicators, identifying resilient stocks becomes crucial. In such an environment, a good stock is often characterized by its ability to withstand external pressures while maintaining growth potential amidst volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:ADGYO)

Simply Wall St Value Rating: ★★★★★★

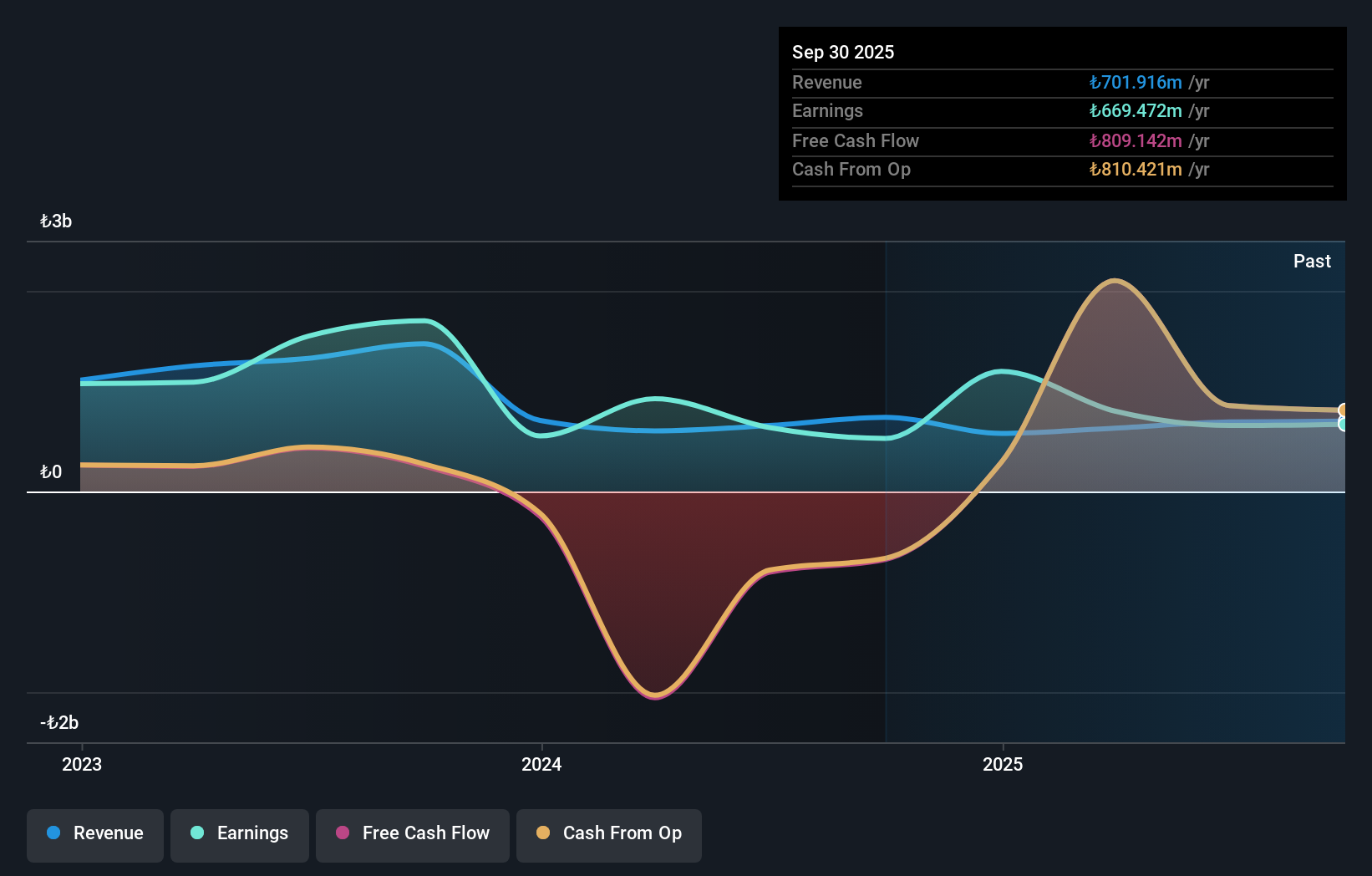

Overview: Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates as a real estate investment trust in Turkey, with a market capitalization of TRY13.77 billion.

Operations: Adra generates revenue primarily from the real estate sector, amounting to TRY701.92 million. The company's financial performance reflects its focus on this segment as a key driver of income.

Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi, a nimble player in the Middle Eastern market, has captured attention with its robust financial health. The company stands out by being debt-free for five years and posting a remarkable 26.5% earnings growth over the past year, surpassing the Residential REITs industry average of 15%. Despite this growth, recent results show mixed signals; while third-quarter sales marginally increased to TRY208.25 million from TRY207.63 million last year, net income saw a significant turnaround to TRY42.98 million from a loss of TRY9.36 million previously due to one-off gains impacting overall performance by TRY251.9M as of September 2025.

Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi (IBSE:GIPTA)

Simply Wall St Value Rating: ★★★★★☆

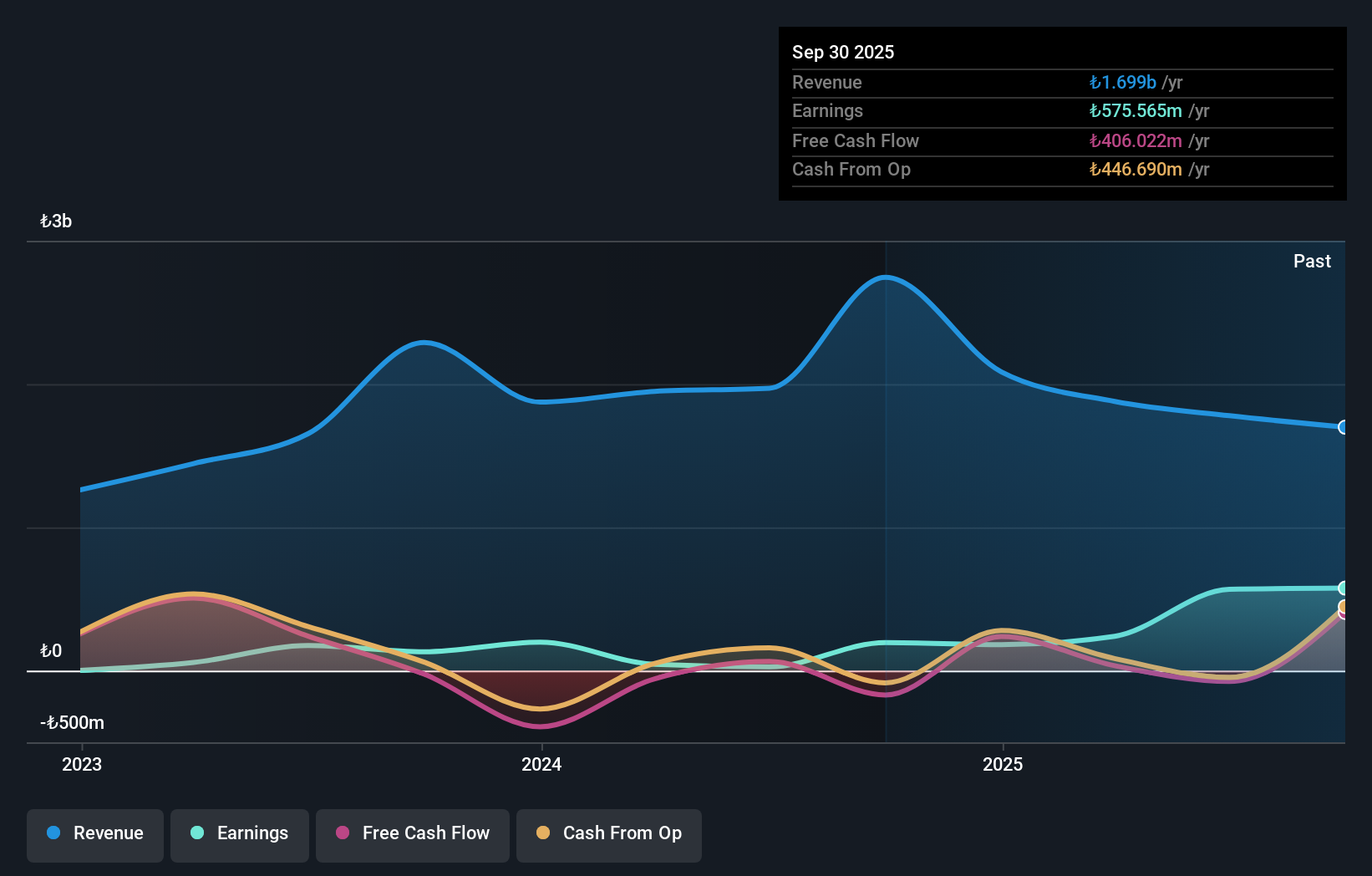

Overview: Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi operates in the manufacturing sector, focusing on office stationery and promotional products, with a market capitalization of TRY10.72 billion.

Operations: Gipta generates revenue primarily from its Paper & Paper Products segment, amounting to TRY1.70 billion.

Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi, a small player in the commercial services sector, has shown impressive earnings growth of 194.1% over the past year, outpacing the industry average of 7.1%. Despite a volatile share price recently, its financial health appears robust with more cash than total debt and strong interest coverage. Trading at 44.1% below estimated fair value suggests potential for appreciation. Recent earnings reports highlight net income rising to TRY 202.98 million in Q3 from TRY 194.78 million last year, indicating solid profitability despite sales dipping slightly to TRY 1,665.82 million from TRY 1,745.73 million previously.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★★

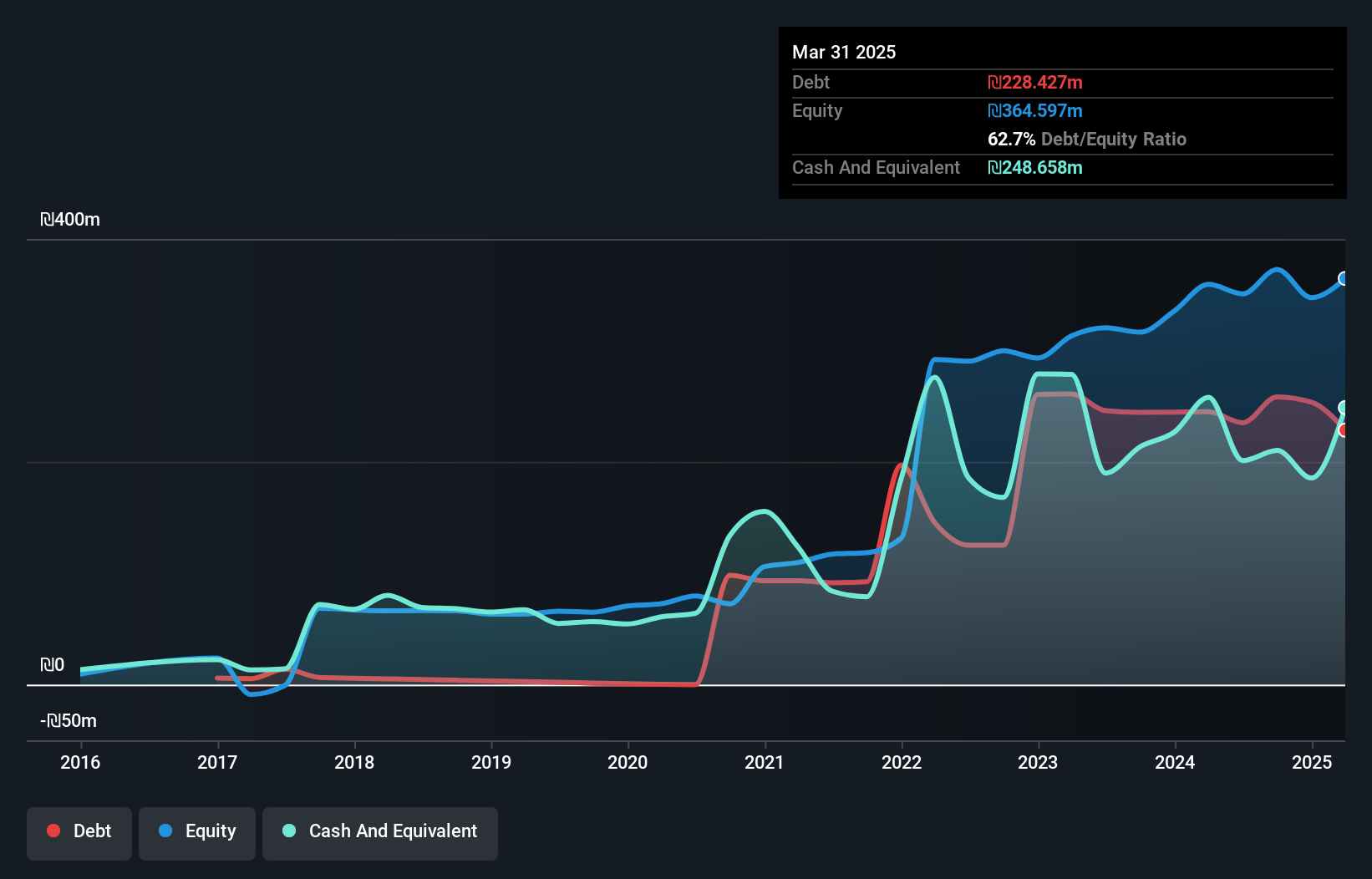

Overview: Y.D. More Investments Ltd is a privately owned investment manager with a market cap of ₪4.07 billion, focusing on various financial services and asset management activities.

Operations: Y.D. More Investments generates revenue primarily from the management of provident and pension funds, contributing ₪602.93 million, and mutual fund management, adding ₪285.30 million. Investment portfolio management also plays a role with revenues of ₪40.04 million.

Y.D. More Investments, a promising player in the Middle East market, has recently been added to both the TA-125 and S&P Global BMI Indexes, reflecting its growing recognition. The company reported third-quarter revenue of ILS 252 million, up from ILS 212 million last year, although net income fell to ILS 23.87 million from ILS 28.04 million. For nine months ending September 2025, revenue reached ILS 733 million compared to last year's ILS 577 million with net income rising significantly to ILS 93.46 million from ILS 60.23 million previously—showcasing robust performance despite quarterly fluctuations in earnings per share.

Turning Ideas Into Actions

- Dive into all 185 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GIPTA

Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi

Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi A.S.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)