Discovering December 2024's Undiscovered Gems with Potential

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, including record highs in major indexes and fluctuating performance in small-cap stocks like the Russell 2000 Index, investors are closely watching for opportunities amid these dynamics. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially as we explore December 2024's undiscovered gems that may thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Saudi Advanced Industries (SASE:2120)

Simply Wall St Value Rating: ★★★★★☆

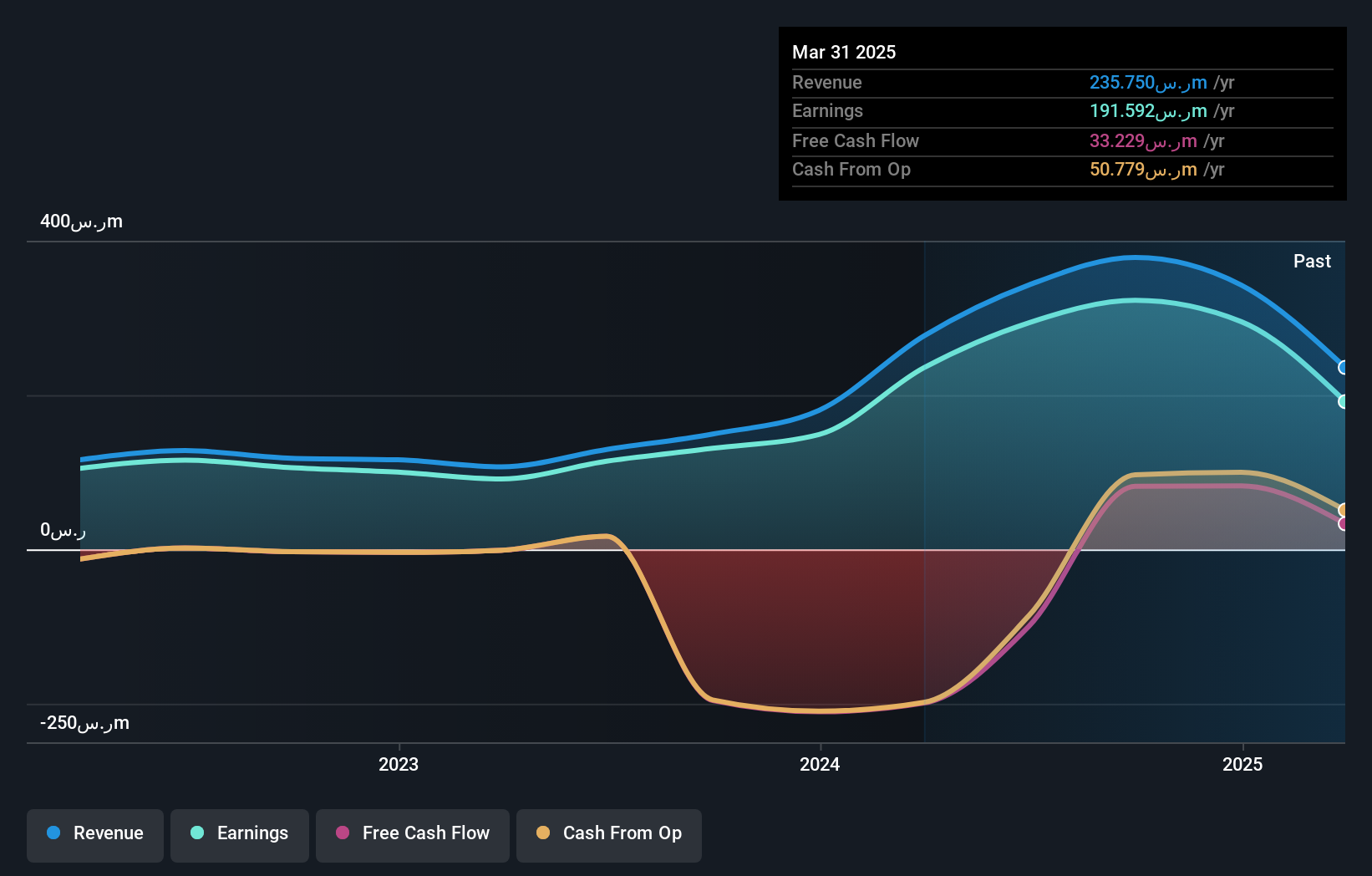

Overview: Saudi Advanced Industries Company engages in diverse industrial investments across Saudi Arabia, with a market capitalization of SAR 2.16 billion.

Operations: The company's primary revenue streams include investments in the glass industry, industrial services related to energy and utilities, and financial services, with the latter contributing SAR 239.17 million. The glass industry segment generates SAR 101.63 million in revenue, while industrial services add SAR 37.58 million.

Saudi Advanced Industries, a nimble player in its sector, has shown impressive financial strength with cash exceeding total debt and a debt-to-equity ratio climbing to 8.6% over five years. The company's earnings have surged by 146%, outpacing the broader Diversified Financial industry growth of 17%. Recent third-quarter results highlight sales reaching SAR 81.71 million and net income at SAR 67.95 million, marking significant year-over-year improvements. With a price-to-earnings ratio of just 6.7x compared to the SA market's average of 23.7x, it presents an attractive valuation while maintaining high-quality earnings and robust interest coverage at 49 times EBIT.

Isracard (TASE:ISCD)

Simply Wall St Value Rating: ★★★★★☆

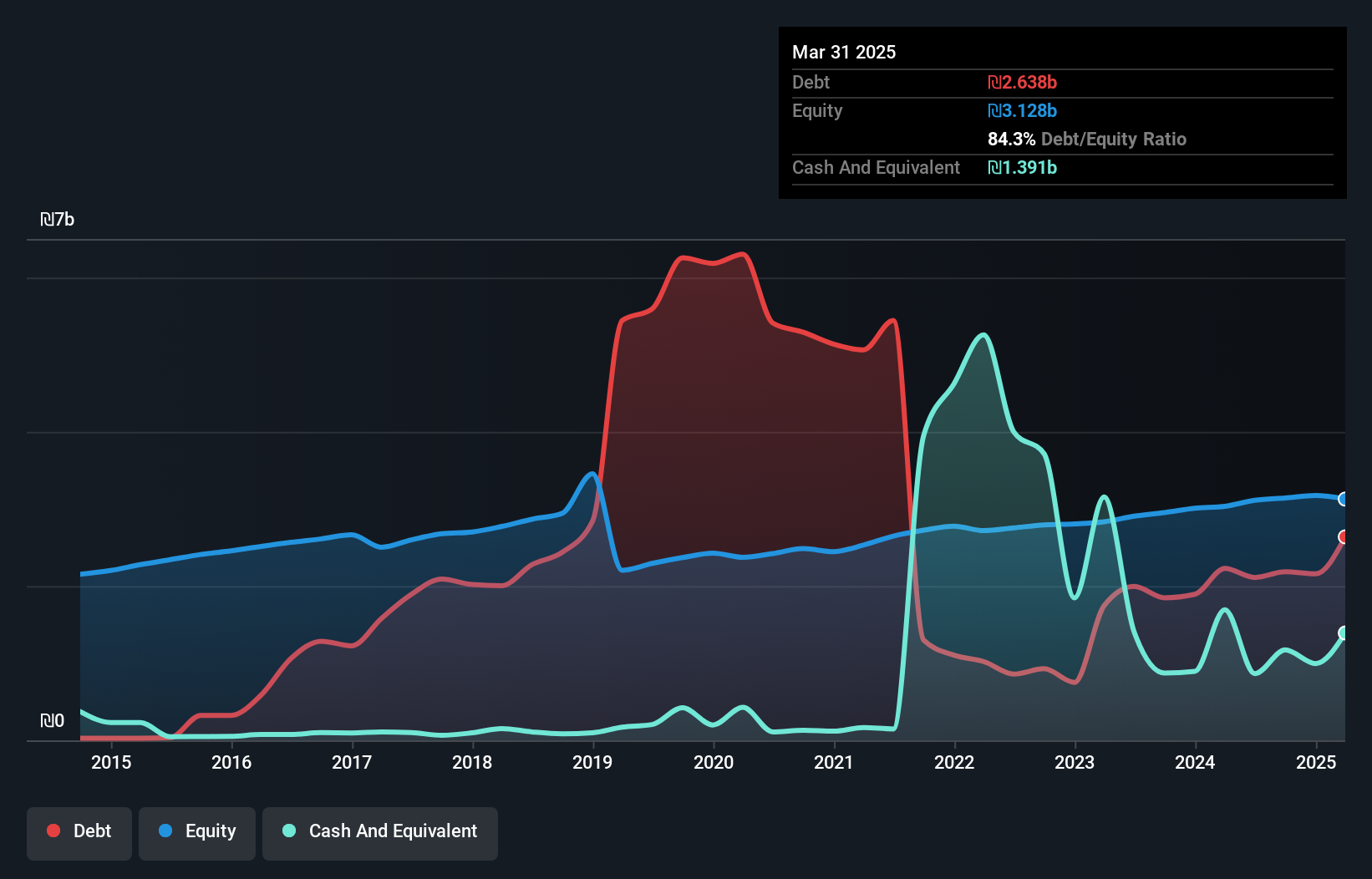

Overview: Isracard Ltd. operates as a credit card company in Israel with a market capitalization of ₪3.05 billion.

Operations: Isracard generates revenue primarily from private customers, contributing ₪2.36 billion, and business customers, adding ₪787 million.

Isracard, a notable player in the financial sector, has shown resilience with its debt to equity ratio dropping from 264% to 69.5% over five years, indicating improved financial stability. The company's price-to-earnings ratio of 11.7x suggests it offers good value compared to the IL market average of 13.6x. Recent earnings grew by 22%, outpacing the Consumer Finance industry's growth rate of 11.4%. Despite a slight dip in Q3 net income from ILS 80 million to ILS 78 million year-on-year, Isracard remains profitable and free cash flow positive, highlighting its robust operational performance amidst industry challenges.

- Take a closer look at Isracard's potential here in our health report.

Gain insights into Isracard's past trends and performance with our Past report.

Kintetsu Department Store (TSE:8244)

Simply Wall St Value Rating: ★★★★★☆

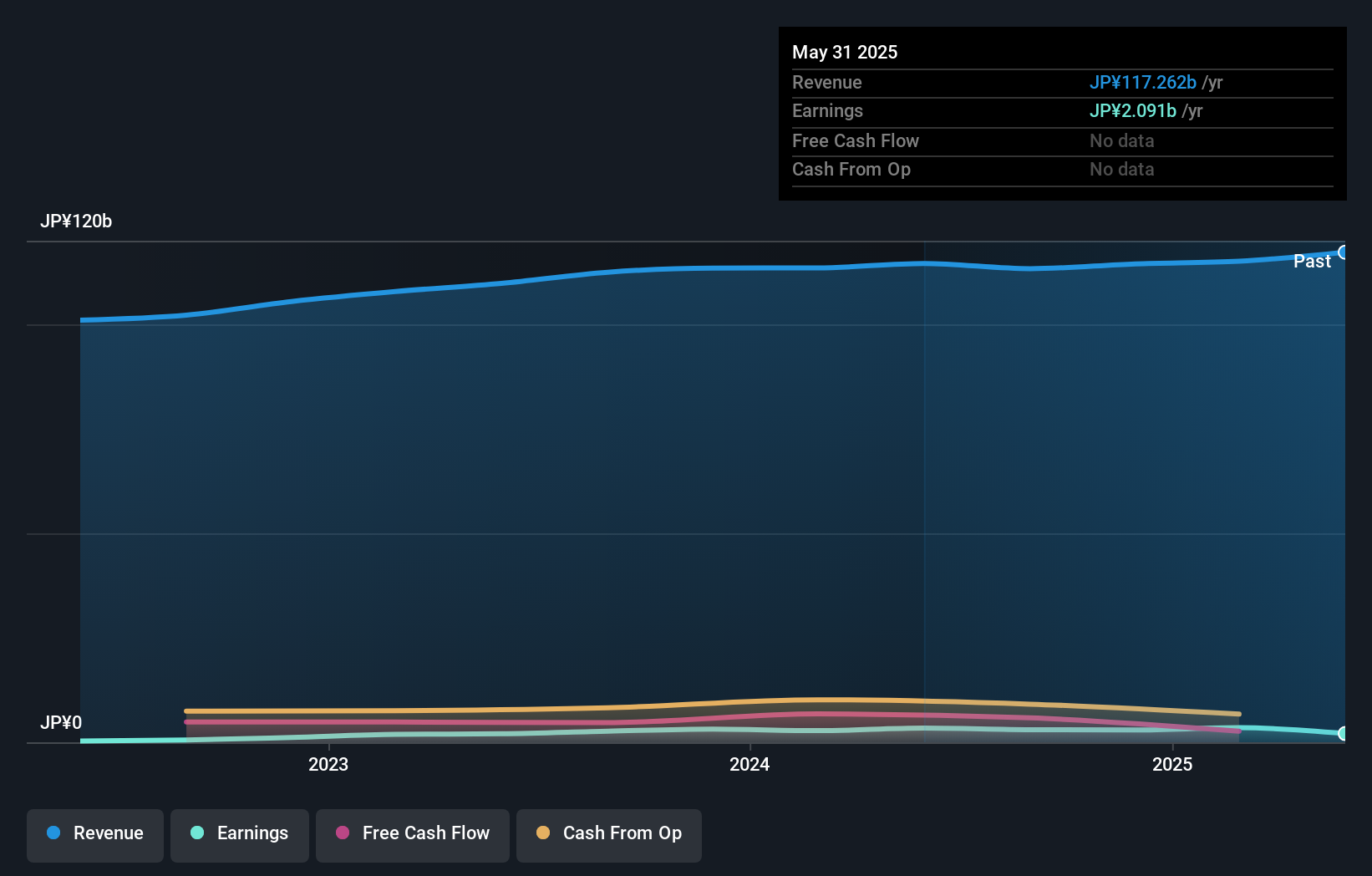

Overview: Kintetsu Department Store Co., Ltd. operates department stores in Japan and has a market cap of ¥85.92 billion.

Operations: Kintetsu Department Store generates revenue primarily through its department store operations in Japan. The company's financial performance is reflected in its market capitalization of ¥85.92 billion.

Kintetsu Department Store, a relatively small player in the retail sector, has demonstrated impressive financial resilience. Over the past five years, its earnings have grown annually by 25.8%, showcasing robust performance despite industry challenges. The company boasts high-quality earnings and has strategically reduced its debt to equity ratio from 33.1% to 10.8%, indicating prudent financial management. Trading at a significant discount of 42% below estimated fair value, it presents potential for value-seeking investors. However, recent shareholder dilution might concern some stakeholders as they anticipate its upcoming earnings release scheduled for October next year.

Key Takeaways

- Click here to access our complete index of 4645 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kintetsu Department Store might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8244

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.