- Israel

- /

- Capital Markets

- /

- TASE:IBI

Undiscovered Gems in Middle East Stocks to Watch July 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains buoyed by positive corporate earnings, with Dubai's main index reaching a 17.5-year high, the Middle East continues to present intriguing opportunities for investors. In this dynamic environment, identifying stocks with strong fundamentals and growth potential becomes essential for navigating the evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

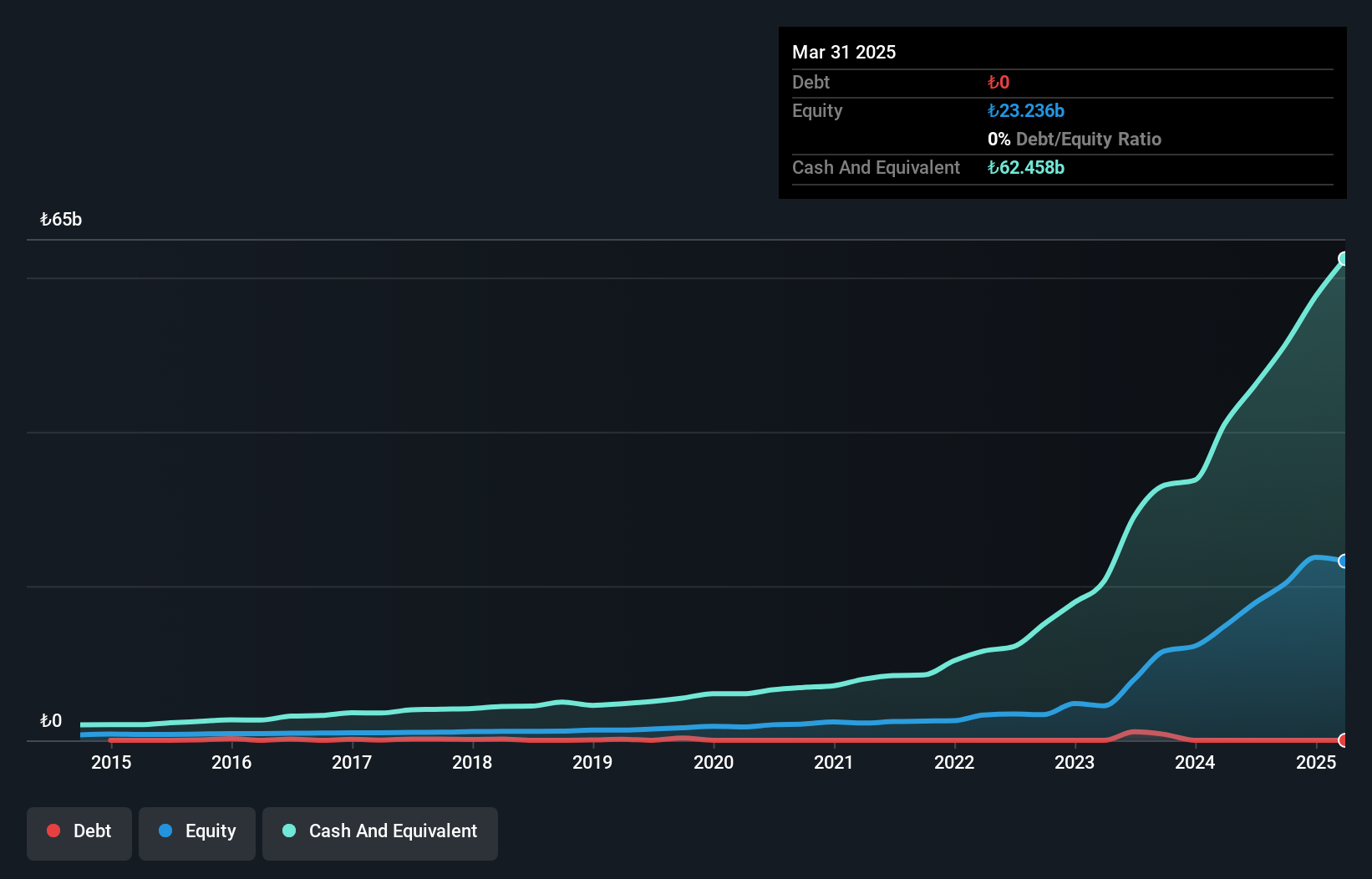

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY46 billion.

Operations: Anadolu Sigorta primarily generates revenue from its Motor Vehicles and Disease/Health insurance segments, contributing TRY14.17 billion and TRY10.38 billion, respectively. The company's financial performance is influenced by these key segments, with the Motor Vehicles Liability segment also playing a significant role at TRY9.16 billion in revenue.

Anadolu Sigorta, a prominent player in the insurance sector, has demonstrated robust earnings growth of 65% annually over the past five years. Despite trading at 8.2% below its estimated fair value, this debt-free entity showcases high-quality earnings and positive free cash flow. However, recent performance indicates net income for Q1 2025 at TRY 1,977 million, down from TRY 2,867 million last year. Basic earnings per share also saw a decrease to TRY 3.95 from TRY 5.73 previously. While not outpacing industry growth rates recently, Anadolu Sigorta remains a noteworthy contender in its field with potential for future value realization.

I.B.I. Investment House (TASE:IBI)

Simply Wall St Value Rating: ★★★★★★

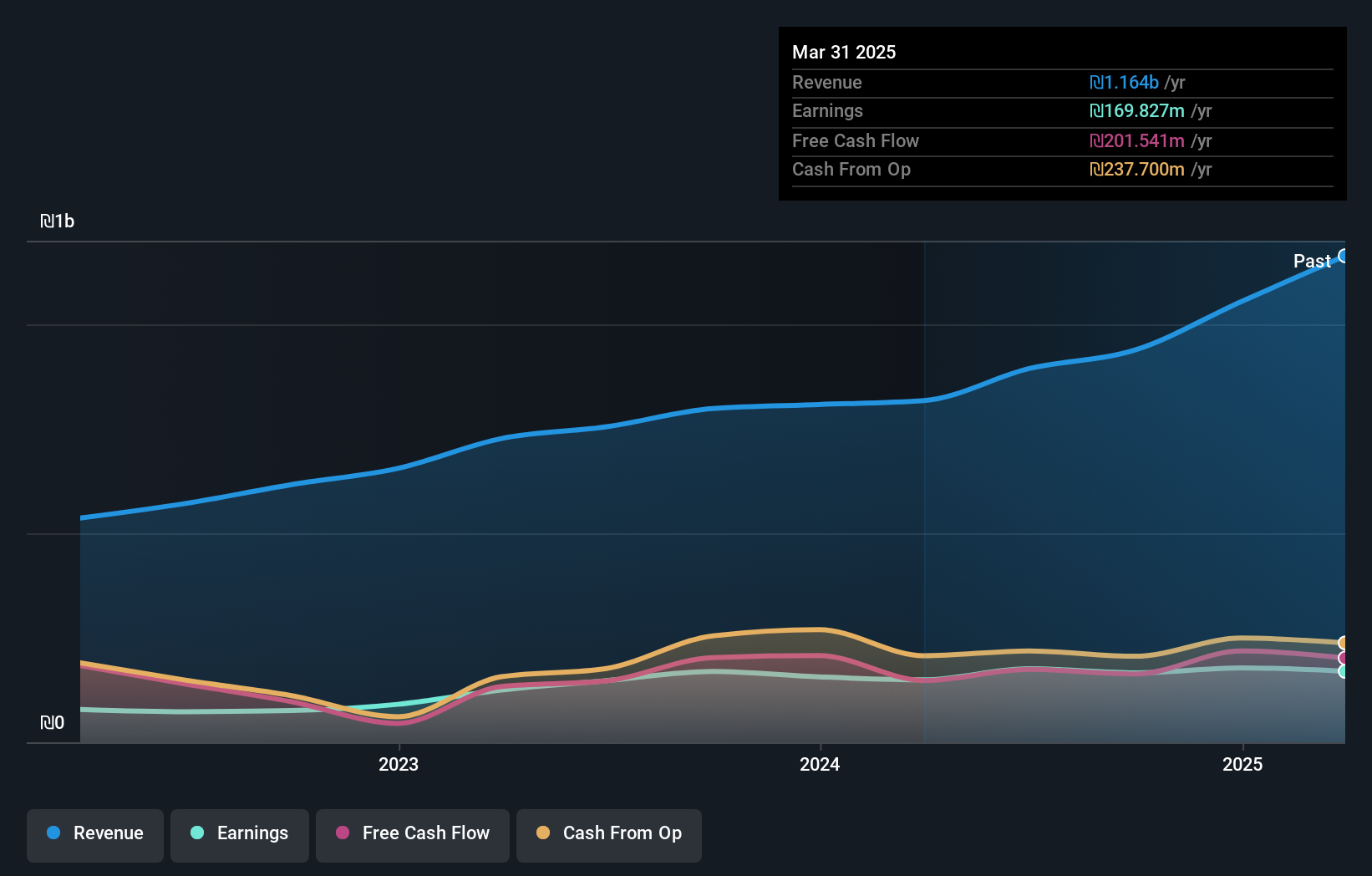

Overview: I.B.I Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management and a market capitalization of ₪3.59 billion, focusing on diverse financial services and investment activities.

Operations: I.B.I Investment House generates revenue primarily from service, trade and custody activities (₪329.32 million), followed by capital group operations (₪212.37 million) and alternative investment management (₪180.51 million). The firm also earns from pension and financial agencies (₪103.56 million) and issues and underwriting services (₪45.54 million).

I.B.I. Investment House, a relatively small player in the financial sector, has shown consistent earnings growth of 16% annually over the past five years. Although its recent 13.6% earnings growth lagged behind the broader Capital Markets industry, it remains profitable with high-quality earnings and well-covered interest payments at 22 times EBIT. The company's debt-to-equity ratio improved from 30.9% to 22.9%, indicating prudent financial management with more cash than total debt on hand. Despite a volatile share price recently, IBI's inclusion in the TA-125 Index highlights its growing recognition within the market landscape.

Turpaz Industries (TASE:TRPZ)

Simply Wall St Value Rating: ★★★★☆☆

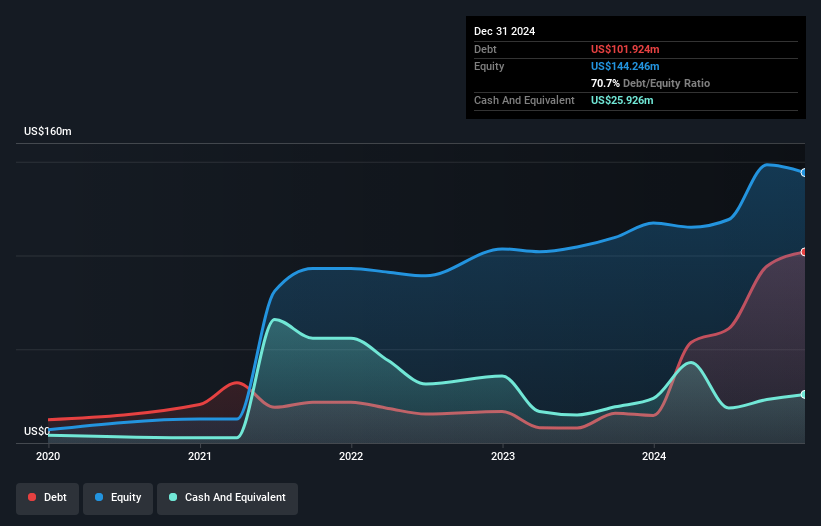

Overview: Turpaz Industries Ltd, along with its subsidiaries, is involved in the development, production, marketing, and sale of scents across various regions worldwide and has a market capitalization of approximately ₪5.10 billion.

Operations: Turpaz Industries generates revenue through three primary segments: Taste ($154.47 million), Fragrance ($35.26 million), and Specialty Fine Ingredients ($20.56 million).

Turpaz Industries, a nimble player in the chemicals sector, has been making waves with its impressive earnings growth of 20.1% over the past year, outpacing the industry average of 5.3%. Despite carrying a high net debt to equity ratio at 57.6%, Turpaz shows resilience by maintaining strong interest coverage with EBIT covering interest payments 5.4 times over. The company's recent acquisition financing for Attractive Scent through a EUR 28 million loan highlights its strategic expansion efforts. With free cash flow remaining positive and high-quality earnings reported, Turpaz seems poised for continued development in its niche market space.

Turning Ideas Into Actions

- Explore the 221 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:IBI

I.B.I. Investment House

I.B.I Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives