- Japan

- /

- Auto Components

- /

- TSE:5949

Top Dividend Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape with rate cuts from the ECB and SNB, and expectations for another Fed cut, investors are witnessing mixed performances across major indices. While the Nasdaq Composite reached a new milestone, broader market sentiment remains cautious amid stalled inflation progress and a cooling labor market in the U.S. In such an environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1849 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and related tools in Italy, Europe, and internationally with a market cap of €694.57 million.

Operations: Cembre S.p.A.'s revenue from electric connectors and related tools amounts to €224.89 million.

Dividend Yield: 4.4%

Cembre S.p.A.'s dividends have been reliable and stable over the past decade, though its 4.35% yield is below the top tier in Italy. Despite growing dividend payments, the current payout ratio of 80% indicates coverage by earnings, but not by free cash flows—evidenced by a high cash payout ratio of 148%. Recent earnings show slight revenue growth to €172.64 million for nine months ending September 2024, though net income declined to €29.13 million.

- Click to explore a detailed breakdown of our findings in Cembre's dividend report.

- Our valuation report here indicates Cembre may be overvalued.

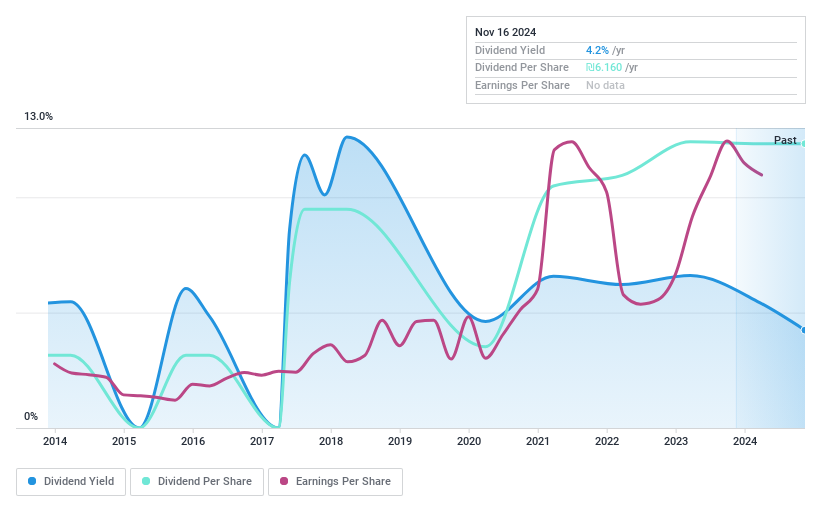

I.B.I. Investment House (TASE:IBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: I.B.I. Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management and a market cap of ₪1.91 billion.

Operations: I.B.I. Investment House Ltd.'s revenue is derived from several segments including Trading, Depository, and Execution Services (₪307.77 million), Alternative Investment Management (₪152.92 million), Equity Management and Operation Services (₪142.95 million), Pension and Financial Agencies (₪89.46 million), Investments for Own Account (₪16.16 million), and Issues and Underwriting (₪6.68 million).

Dividend Yield: 4.1%

I.B.I. Investment House's dividend yield of 4.1% is lower than Israel's top quartile, reflecting a volatile and unreliable track record over the past decade despite growth in payments. However, dividends are well-covered by earnings and cash flows with payout ratios around 48%. Recent results show revenue growth to ILS 742.98 million for nine months ending September 2024, though quarterly net income fell to ILS 31.99 million from ILS 41.89 million year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of I.B.I. Investment House.

- The valuation report we've compiled suggests that I.B.I. Investment House's current price could be quite moderate.

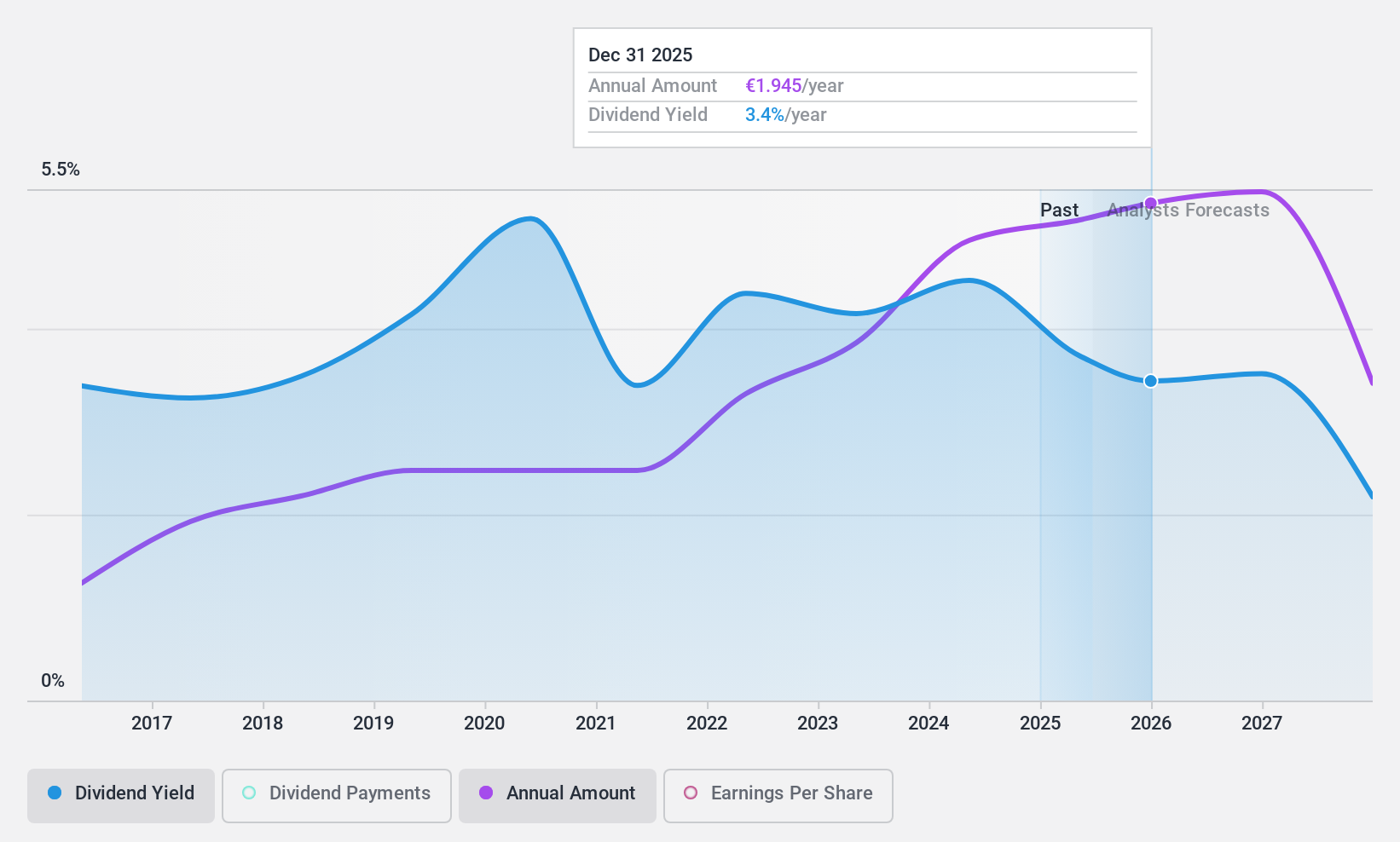

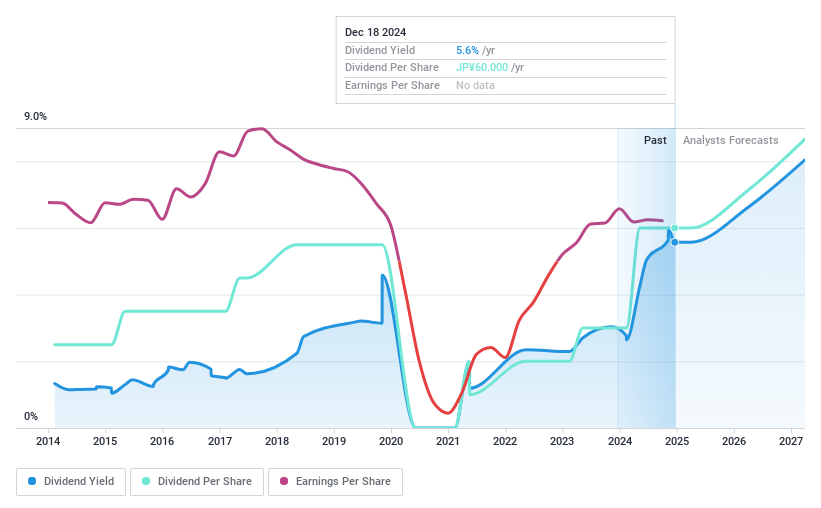

Unipres (TSE:5949)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Unipres Corporation manufactures and sells automotive parts in Japan, with a market cap of ¥46.34 billion.

Operations: Unipres Corporation generates revenue through its automotive parts business across various regions, with ¥54.80 billion from Asia, ¥118.99 billion from Japan, ¥48.04 billion from Europe, and ¥123.26 billion from the Americas.

Dividend Yield: 5.8%

Unipres Corporation's dividend has been volatile over the past decade, though recent increases suggest improvement. The company declared a JPY 30.00 per share dividend for Q2 2024, doubling from last year. Despite lowered earnings guidance due to declining sales and rising costs, dividends remain well-covered by earnings (41.1% payout ratio) and cash flows (15.6% cash payout ratio). A recent share buyback program aims to support stock value amidst these challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Unipres.

- Our valuation report unveils the possibility Unipres' shares may be trading at a discount.

Key Takeaways

- Dive into all 1849 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5949

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives