- Israel

- /

- Food and Staples Retail

- /

- TASE:YHNF

Undiscovered Gems with Promising Potential In November 2024

Reviewed by Simply Wall St

In the wake of a significant rally in global markets, particularly with small-cap indices like the Russell 2000 showing strong gains, investors are keenly observing the potential impacts of recent U.S. political shifts and economic policy changes. As these developments unfold, identifying stocks with promising fundamentals and resilience amid evolving market dynamics becomes increasingly crucial for those seeking opportunities in less-explored segments of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Lion Capital | NA | 21.26% | 24.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Gränges (OM:GRNG)

Simply Wall St Value Rating: ★★★★★★

Overview: Gränges AB (publ) is a company that specializes in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications across Europe, Asia, and the Americas with a market cap of approximately SEK13.78 billion.

Operations: Gränges generates revenue primarily from its Gränges Eurasia and Gränges Americas segments, with SEK12.45 billion and SEK10.83 billion respectively.

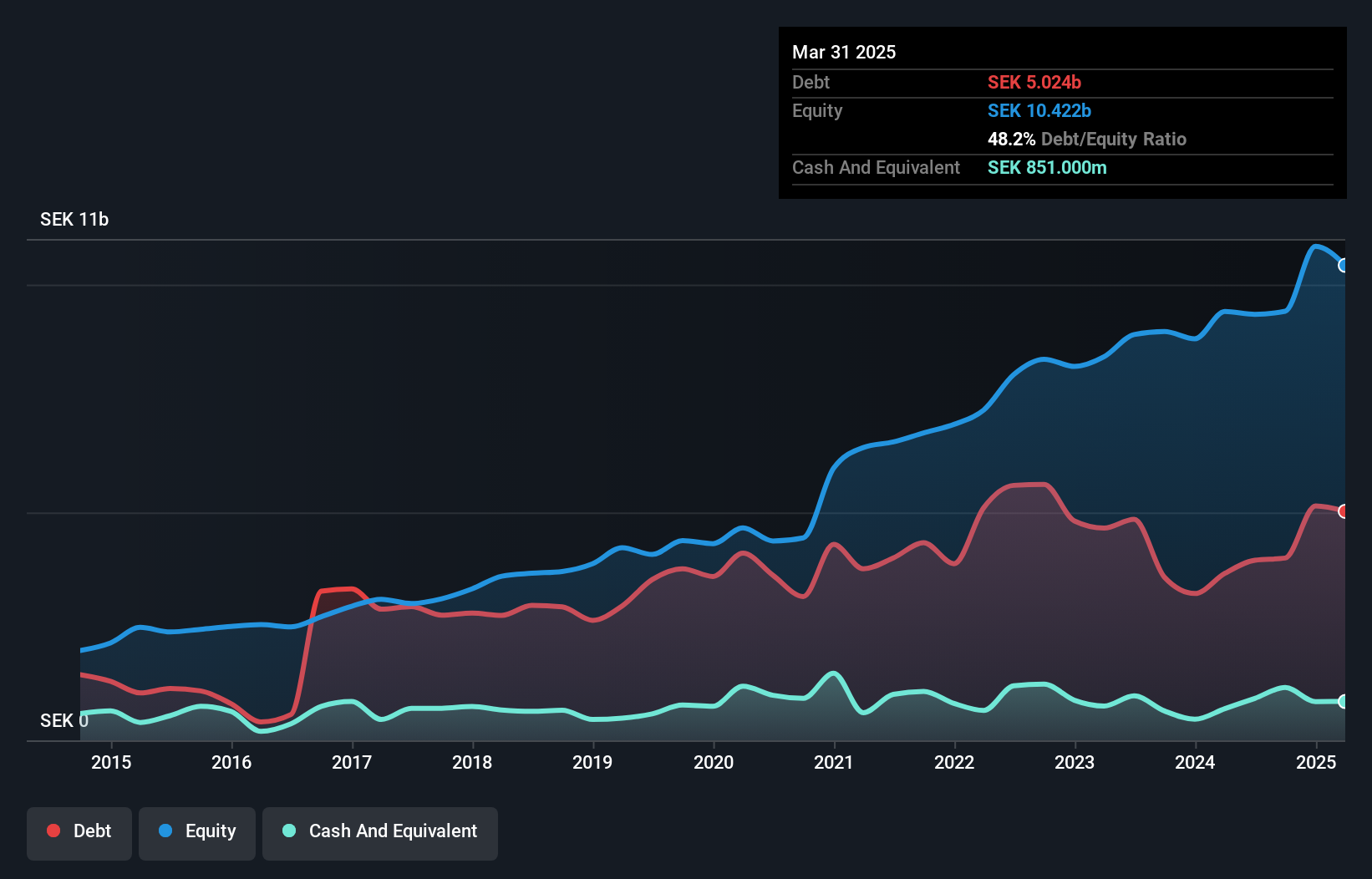

Gränges, a notable player in the metals industry, presents an intriguing profile with its net debt to equity ratio at a satisfactory 30.2%, reflecting prudent financial management. Despite recent earnings showing a slight dip with SEK 285 million compared to SEK 332 million last year for Q3, the company's high-quality earnings and forecasted annual growth of 24.17% offer promise. Trading at 72.6% below estimated fair value suggests potential undervaluation for investors seeking opportunities in this sector. Additionally, Gränges' EBIT covers interest payments by 6.7 times, indicating strong operational efficiency amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Gränges' health report.

Understand Gränges' track record by examining our Past report.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, with a market cap of CHF948.72 million, operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland.

Operations: Jungfraubahn Holding AG generates revenue primarily from the Jungfraujoch - TOP of Europe segment, contributing CHF190.99 million, followed by Experience Mountains at CHF51.27 million and Winter Sports at CHF40.47 million. The company's net profit margin reflects its financial efficiency over time.

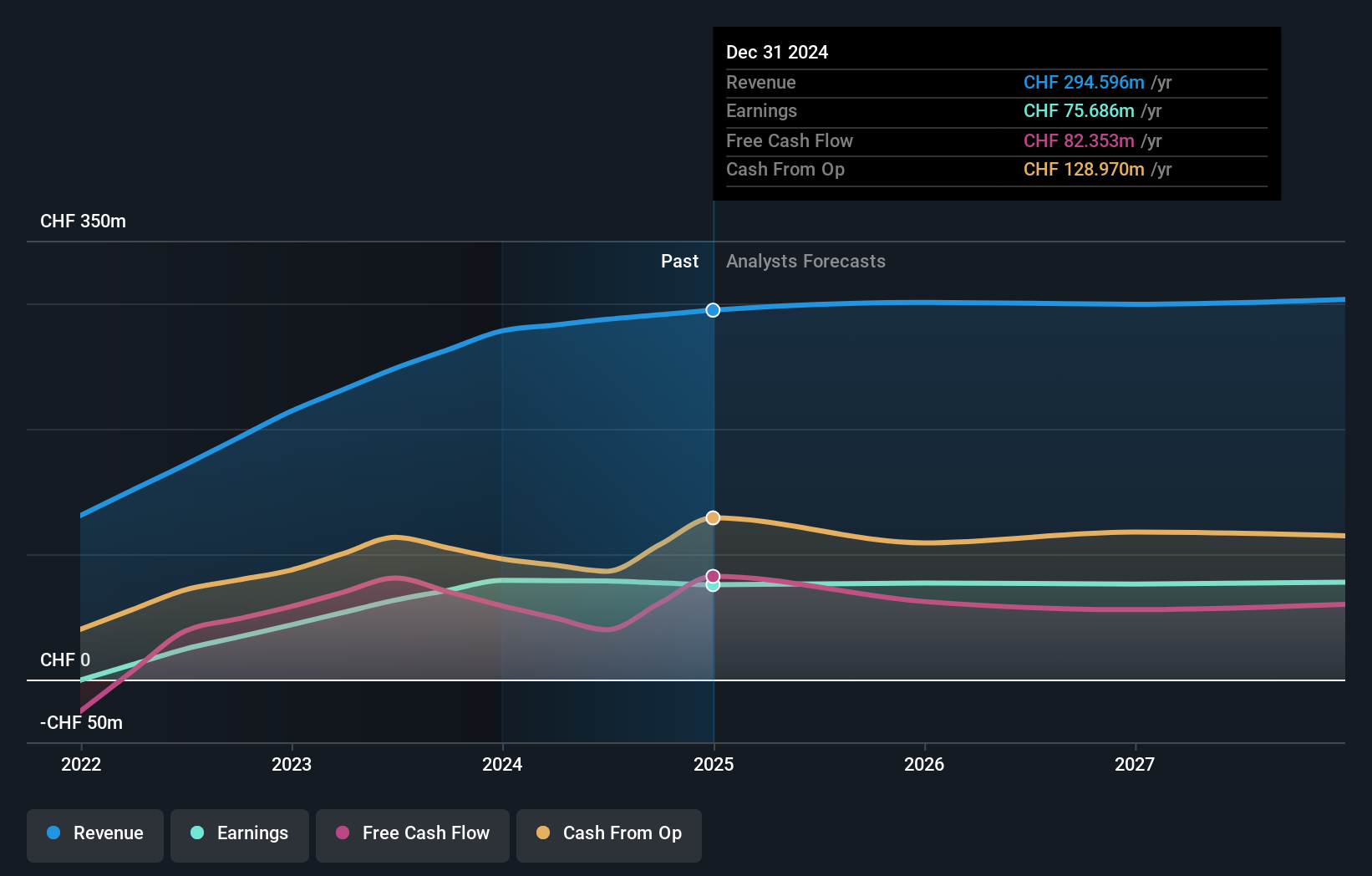

Jungfraubahn Holding, a niche player in the transportation sector, showcases promising financial health with its earnings growing by 24% over the past year, outpacing the industry average. The company trades at a compelling 46.3% below its estimated fair value and maintains high-quality earnings. Despite an increase in its debt to equity ratio from 7.2% to 17.4% over five years, it remains satisfactory at 13.6%. Recent half-year results reveal revenue of CHF141.77 million and net income of CHF34.27 million, slightly lower than last year's figure of CHF34.8 million but still demonstrating robust performance amidst industry challenges.

M.Yochananof and Sons (1988) (TASE:YHNF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: M.Yochananof and Sons (1988) Ltd operates in the marketing and retail trade of food and related products in Israel with a market capitalization of ₪3.47 billion.

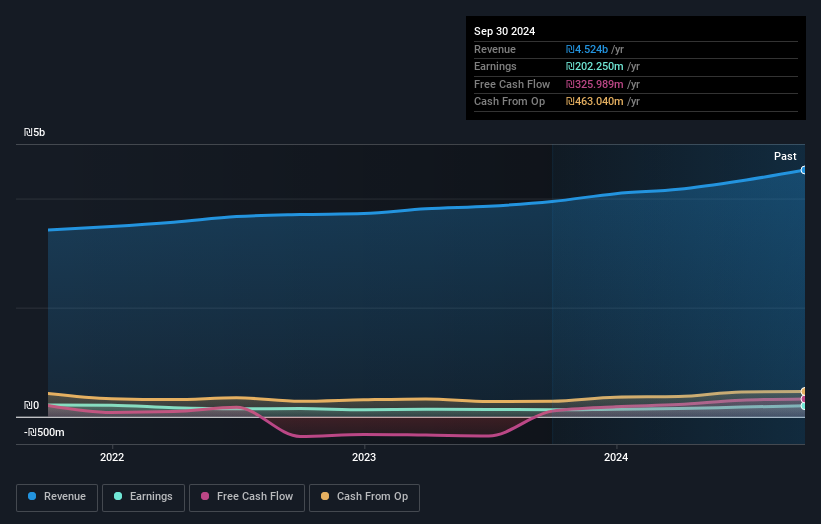

Operations: The primary revenue stream for M.Yochananof and Sons (1988) Ltd comes from the food retail sector, generating ₪4.18 billion.

With a knack for steady growth, Yochananof has seen its earnings climb 9.8% annually over the past five years, while reducing its net debt to equity ratio from 108.6% to a satisfactory 23.2%. This retail player reported impressive second-quarter sales of ILS 1.14 billion, up from ILS 985 million last year, and net income rose to ILS 61.89 million from ILS 34.62 million previously. Basic earnings per share jumped to ILS 4.27 compared to last year's ILS 2.39, showcasing strong financial health and potential for continued value in the market landscape.

- Get an in-depth perspective on M.Yochananof and Sons (1988)'s performance by reading our health report here.

Gain insights into M.Yochananof and Sons (1988)'s past trends and performance with our Past report.

Seize The Opportunity

- Click this link to deep-dive into the 4676 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:YHNF

M.Yochananof and Sons (1988)

Engages in the marketing and retail trade in the food and related products in Israel.

Solid track record with adequate balance sheet.