- Israel

- /

- Food and Staples Retail

- /

- TASE:RMLI

Rami Levi (TASE:RMLI) Valuation After Q3 Sales Growth But Lower Net Income

Reviewed by Simply Wall St

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI) just posted its Q3 and year to date numbers, with sales climbing but profits slipping, a mix that naturally sharpened investor focus on margins.

See our latest analysis for Rami Levi Chain Stores Hashikma Marketing 2006.

The latest earnings drop landed against a strong backdrop, with the share price up roughly 13 percent over three months and a robust 1 year total shareholder return near 48 percent, suggesting momentum is still building rather than fading.

If Rami Levi’s move has you thinking about what else is working in retail and beyond, it could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas.

With valuation indicators still hinting at a modest discount even as earnings soften, the real question now is whether Rami Levi is a value opportunity in disguise, or if the market is already pricing in its next leg of growth?

Price-to-Earnings of 21.9x: Is it justified?

Rami Levi’s current price of ₪345.2 implies a price-to-earnings ratio of 21.9x, putting the stock at a clear premium to peers.

The price-to-earnings multiple compares today’s share price with the company’s annual earnings per share, making it a direct shorthand for how much investors are willing to pay for each shekel of profit.

For a mature, discount focused grocery chain with high quality earnings and a 40.1 percent return on equity, a richer multiple can signal confidence that profitability will remain resilient even as near term earnings growth has turned negative.

However, the valuation gap is hard to ignore, with Rami Levi trading on 21.9x earnings versus 16.7x for the wider Asian consumer retailing space and 19.8x for its closest peers. This suggests the market is pricing in a superior long term earnings profile that still needs to be proven after this latest margin squeeze.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 21.9x (OVERVALUED)

However, sustained margin pressure or a reversal in recent share price momentum could quickly challenge the case for paying a premium valuation.

Find out about the key risks to this Rami Levi Chain Stores Hashikma Marketing 2006 narrative.

Another Take on Value

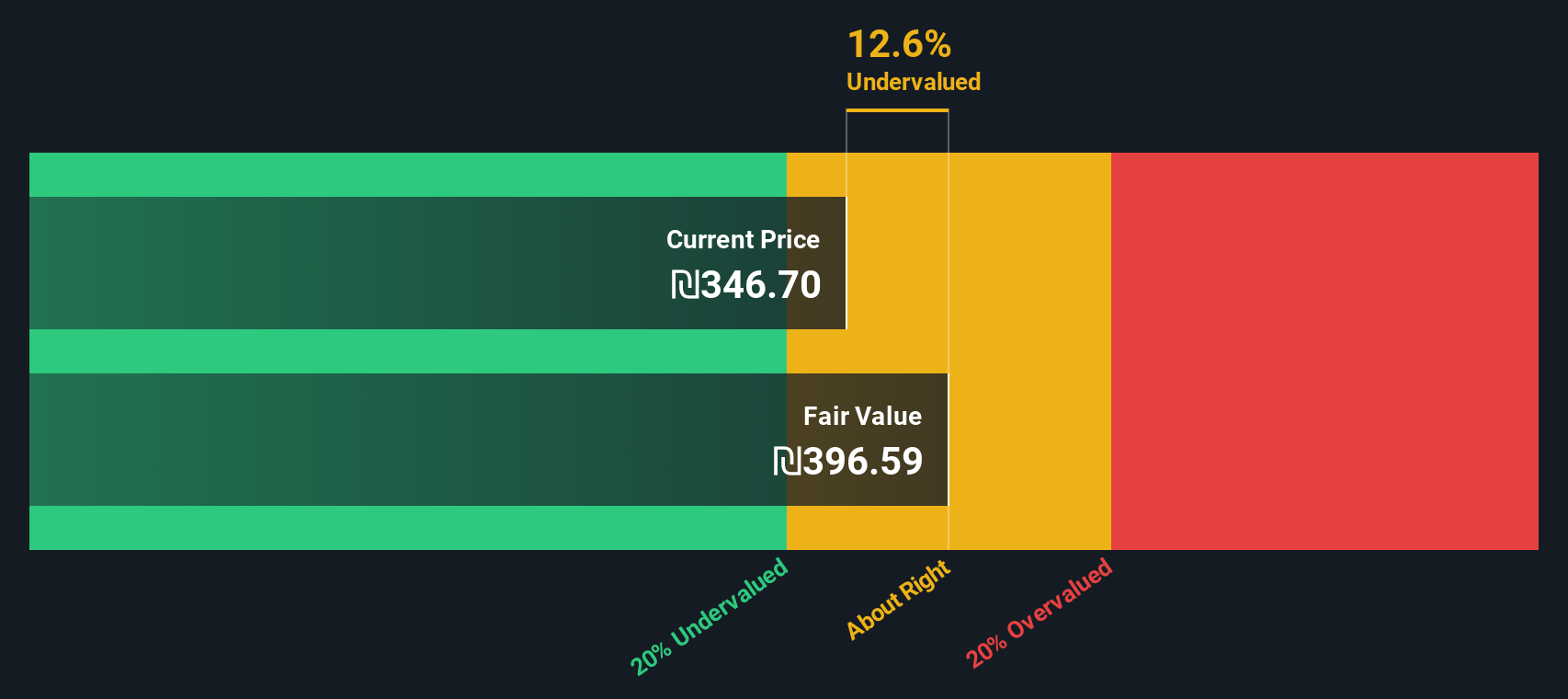

Our DCF model paints a different picture, suggesting Rami Levi is trading about 13 percent below its estimated fair value of ₪396.69, despite the rich 21.9x earnings multiple. If cash flow math points to upside while margins soften, which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rami Levi Chain Stores Hashikma Marketing 2006 for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rami Levi Chain Stores Hashikma Marketing 2006 Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in minutes: Do it your way.

A great starting point for your Rami Levi Chain Stores Hashikma Marketing 2006 research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to keep your edge and spot the next winners early, let Simply Wall St’s powerful screener surface high conviction opportunities before others notice.

- Capitalize on market mispricing by targeting quality companies trading below their intrinsic worth through these 920 undervalued stocks based on cash flows and sharpen your value focused strategy.

- Ride structural growth in cutting edge technology by filtering for companies advancing algorithms, infrastructure, and real world applications using these 25 AI penny stocks.

- Strengthen your portfolio’s income stream by selecting businesses with sustainable payouts and yields above 3 percent via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RMLI

Rami Levi Chain Stores Hashikma Marketing 2006

Operates a chain of discount format retail stores in Israel.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026