- Israel

- /

- Commercial Services

- /

- TASE:UTRN

Shareholders May Be Wary Of Increasing Utron Ltd's (TLV:UTRN) CEO Compensation Package

Key Insights

- Utron's Annual General Meeting to take place on 26th of August

- CEO Haim Shani's total compensation includes salary of ₪906.0k

- Total compensation is similar to the industry average

- Utron's three-year loss to shareholders was 42% while its EPS was down 48% over the past three years

The results at Utron Ltd (TLV:UTRN) have been quite disappointing recently and CEO Haim Shani bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 26th of August. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Utron

Comparing Utron Ltd's CEO Compensation With The Industry

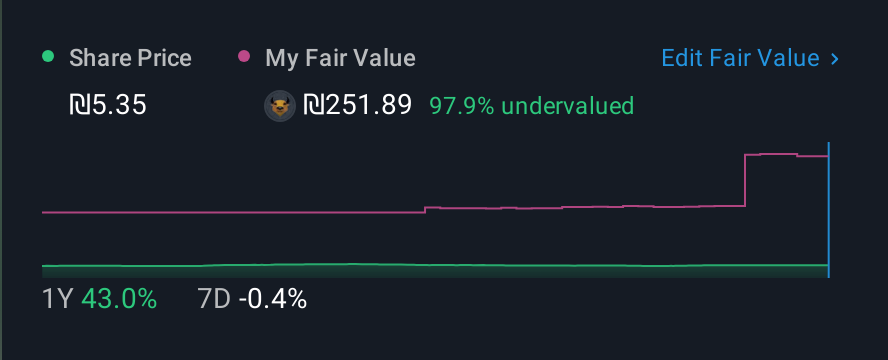

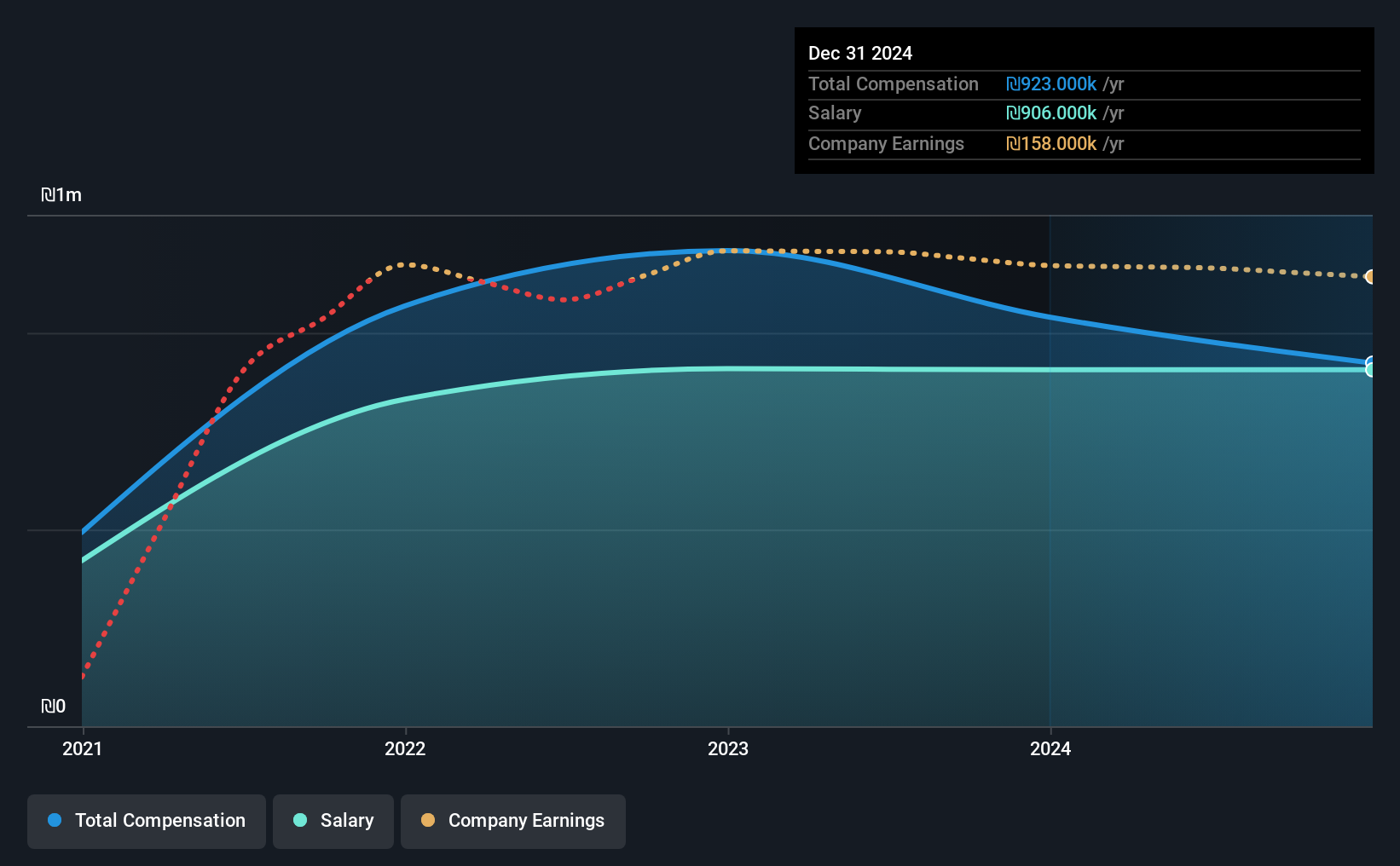

According to our data, Utron Ltd has a market capitalization of ₪103m, and paid its CEO total annual compensation worth ₪923k over the year to December 2024. That's a notable decrease of 11% on last year. We note that the salary portion, which stands at ₪906.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Israel Commercial Services industry with market capitalizations below ₪679m, reported a median total CEO compensation of ₪923k. This suggests that Utron remunerates its CEO largely in line with the industry average. Furthermore, Haim Shani directly owns ₪20m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₪906k | ₪906k | 98% |

| Other | ₪17k | ₪134k | 2% |

| Total Compensation | ₪923k | ₪1.0m | 100% |

Speaking on an industry level, nearly 84% of total compensation represents salary, while the remainder of 16% is other remuneration. Utron pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Utron Ltd's Growth

Over the last three years, Utron Ltd has shrunk its earnings per share by 48% per year. It saw its revenue drop 12% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Utron Ltd Been A Good Investment?

The return of -42% over three years would not have pleased Utron Ltd shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Utron pays its CEO a majority of compensation through a salary. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Utron that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:UTRN

Utron

Engages in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.