- Turkey

- /

- Residential REITs

- /

- IBSE:SNGYO

Middle Eastern Penny Stocks: 3 Picks With Market Caps Under US$500M

Reviewed by Simply Wall St

Most Gulf bourses have recently seen an upswing, buoyed by favorable U.S. economic data and ongoing trade discussions, which has injected a dose of optimism into the Middle Eastern markets. Despite being associated with earlier market periods, penny stocks continue to offer intriguing opportunities for investors willing to explore smaller or emerging companies. These stocks can present a compelling mix of affordability and growth potential when backed by strong financials, making them an interesting area for those seeking value in the Middle East's dynamic market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.399 | ₪14.85M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.13 | SAR1.65B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.09 | AED2.69B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.113 | ₪289.27M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.15 | AED2.32B | ✅ 4 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.95 | TRY2.1B | ✅ 2 ⚠️ 1 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.19 | AED366.13M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.80 | AED11.82B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.80 | AED486.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.636 | ₪195.97M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gulf Pharmaceutical Industries P.S.C., also known as Julphar, manufactures and sells a range of pharmaceutical, cosmetic, and medical products in the UAE, other GCC countries, and internationally with a market cap of AED1.72 billion.

Operations: Julphar's revenue is primarily derived from its Manufacturing segment, which generated AED864.9 million, while the Planet segment contributed AED732.9 million.

Market Cap: AED1.72B

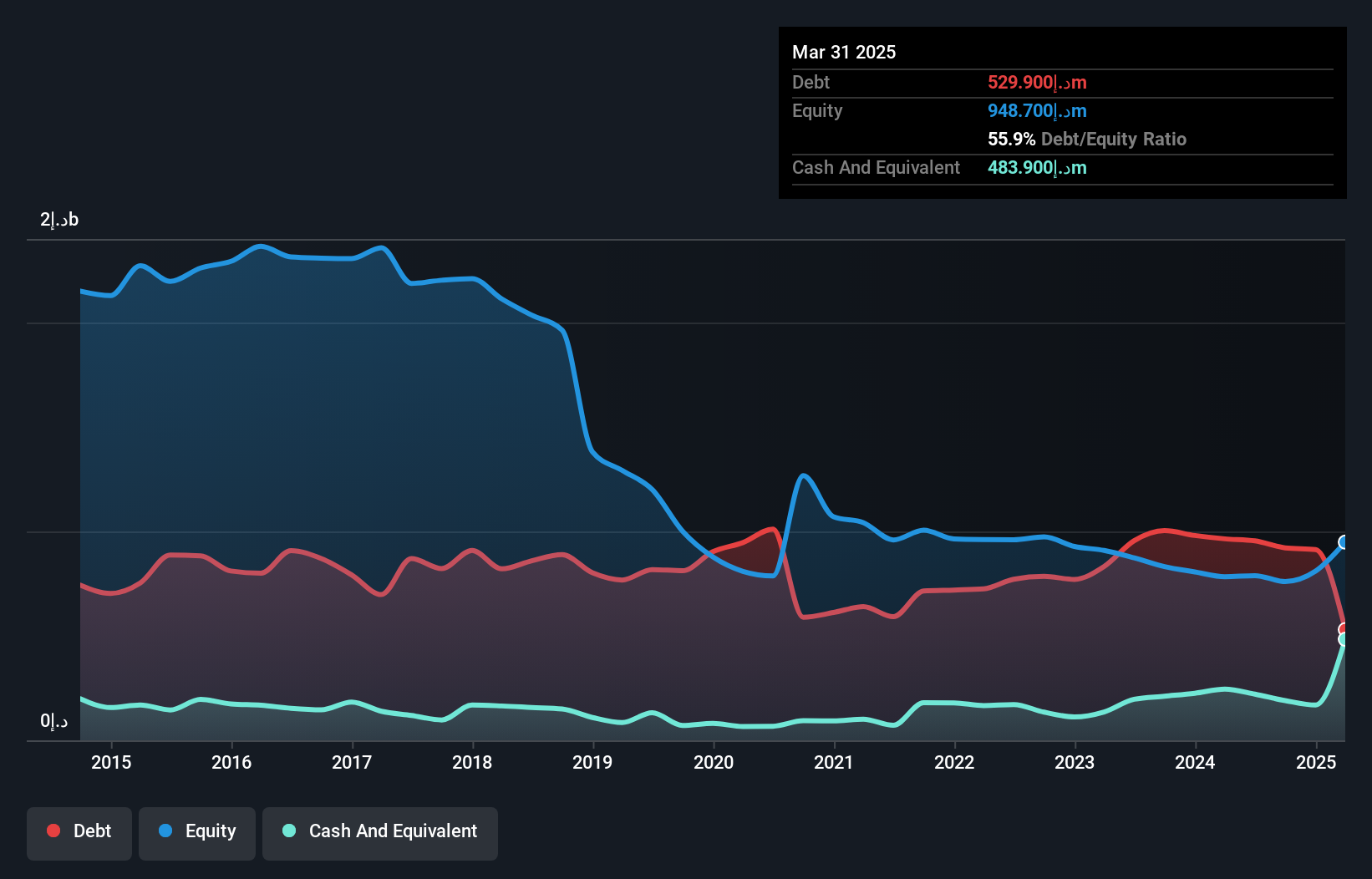

Gulf Pharmaceutical Industries P.S.C., known as Julphar, has shown significant financial improvement, reporting AED 359.2 million in sales for the first quarter of 2025 and a net income surge to AED 140.9 million from AED 1.9 million a year ago. Despite its low Return on Equity of 2.4%, Julphar's debt is well managed with a satisfactory net debt to equity ratio of 4.8%. The company's earnings growth is notable, although its share price remains highly volatile compared to other stocks in the region. Recent management changes include appointing KPMG as external auditors for the year ahead.

- Get an in-depth perspective on Gulf Pharmaceutical Industries P.S.C's performance by reading our balance sheet health report here.

- Evaluate Gulf Pharmaceutical Industries P.S.C's prospects by accessing our earnings growth report.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi, originally established as Sinpas Insaat in 2006 and transformed into a Real Estate Investment Trust (REIT) in 2007, operates in the real estate sector with a market capitalization of TRY17.64 billion.

Operations: The company generates revenue primarily from residential real estate developments, amounting to TRY12.64 billion.

Market Cap: TRY17.64B

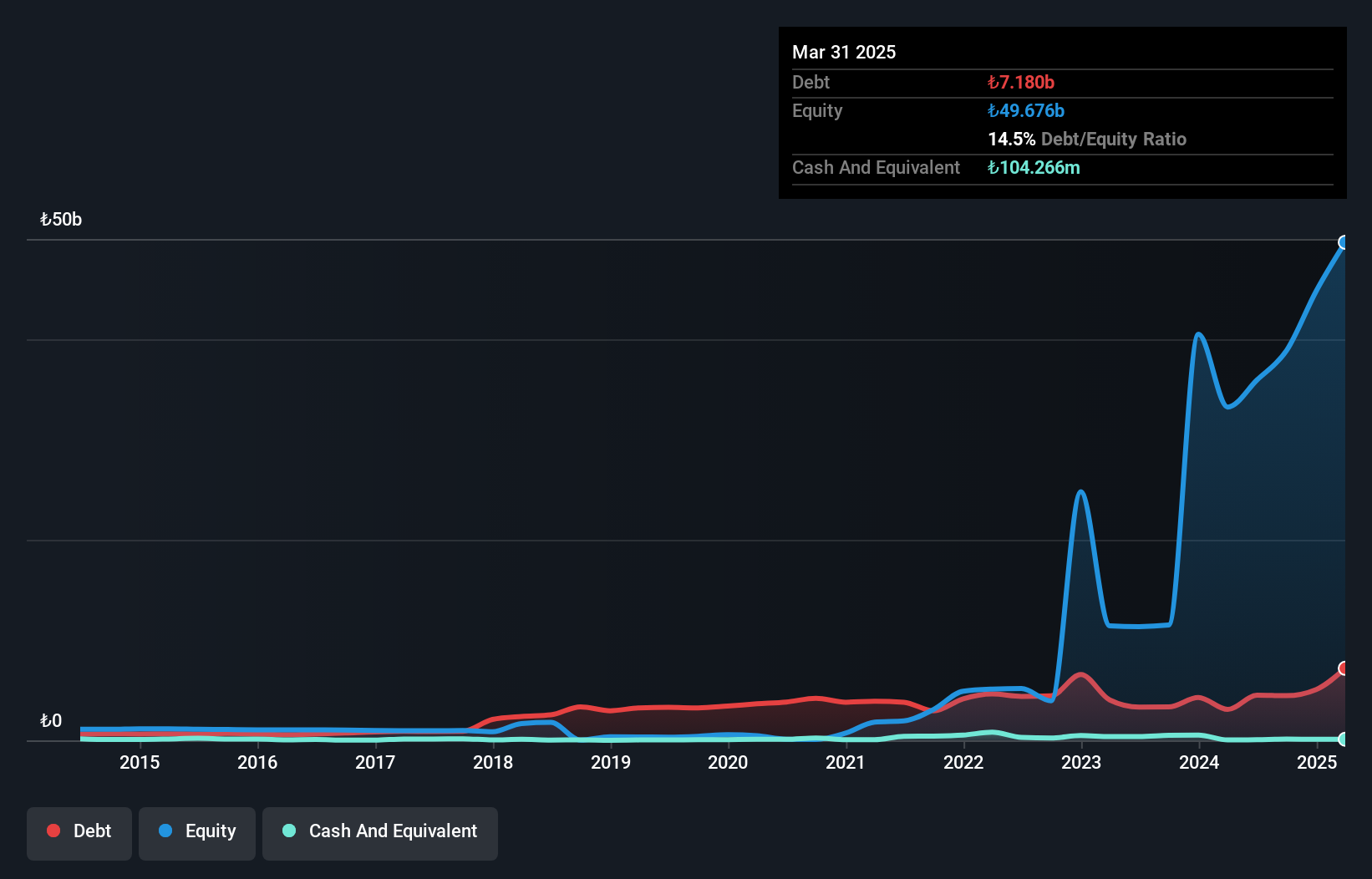

Sinpas Gayrimenkul Yatirim Ortakligi, a real estate-focused REIT, reported TRY1.08 billion in sales for Q1 2025, down from TRY1.87 billion the previous year, with net income also decreasing to TRY312.06 million. Despite this decline, the company has seen significant earnings growth over the past year at 86.4%, aided by a large one-off gain of TRY5.3 billion. The debt-to-equity ratio has impressively reduced from very high levels to 14.5% over five years, and its short-term assets comfortably cover both short-term and long-term liabilities, indicating strong financial management amidst volatility concerns.

- Dive into the specifics of Sinpas Gayrimenkul Yatirim Ortakligi here with our thorough balance sheet health report.

- Evaluate Sinpas Gayrimenkul Yatirim Ortakligi's historical performance by accessing our past performance report.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions and has a market cap of ₪78.54 million.

Operations: The company generates revenue from its Heavy Construction segment, amounting to ₪89.61 million.

Market Cap: ₪78.54M

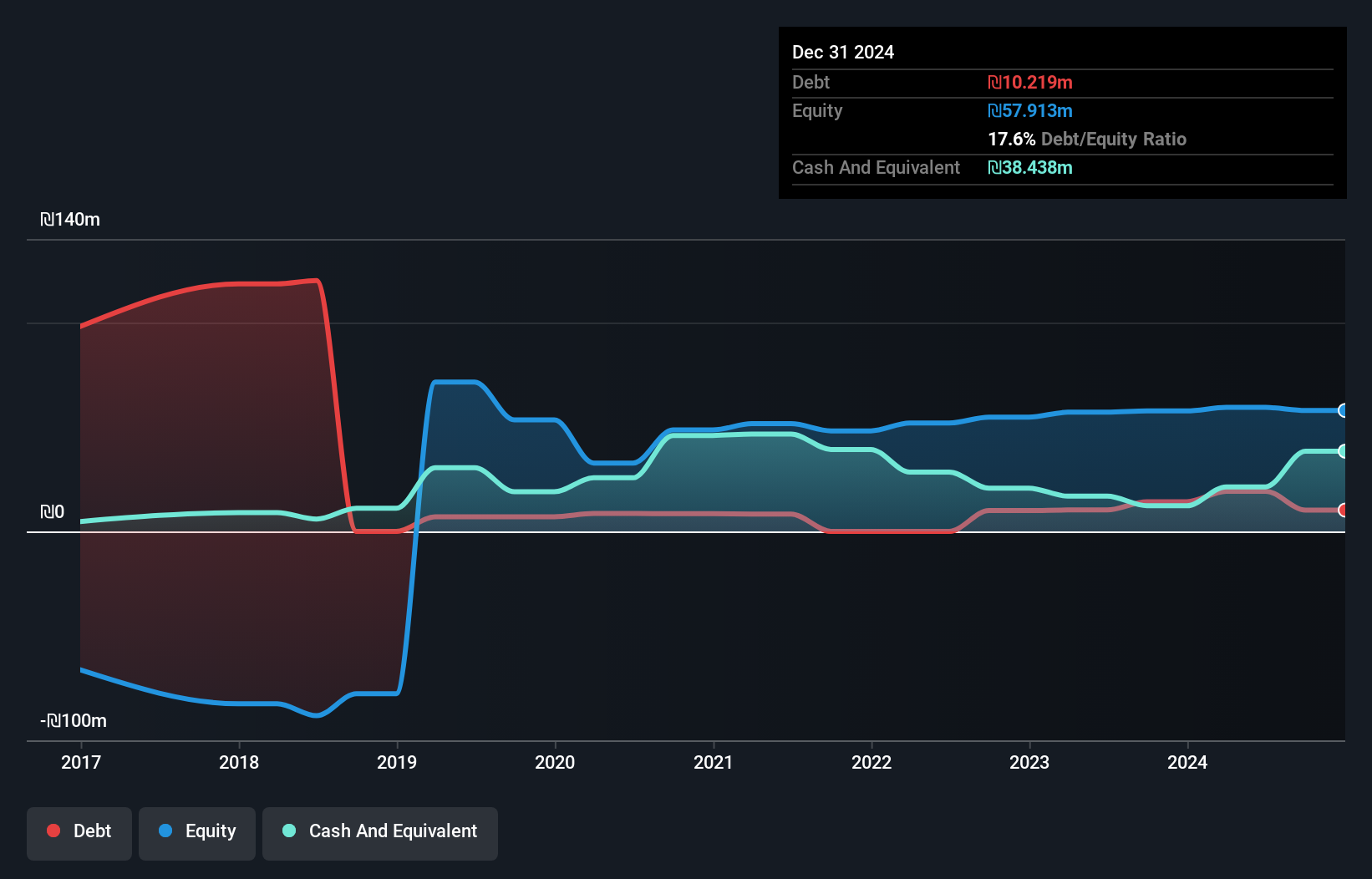

Utron Ltd, with a market cap of ₪78.54 million, shows a mixed financial picture. While its short-term assets significantly exceed both short and long-term liabilities, indicating solid liquidity management, the company's earnings have declined sharply by 84.7% over the past year compared to industry averages. Despite having more cash than total debt and operating cash flow covering debt well, interest payments are not adequately covered by EBIT. The company has achieved profitability over five years with high-quality earnings but currently struggles with low return on equity at 0.3%. The management and board are experienced, adding stability amidst these challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Utron.

- Gain insights into Utron's historical outcomes by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 75 Middle Eastern Penny Stocks.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SNGYO

Sinpas Gayrimenkul Yatirim Ortakligi

Sinpas Insaat Anonim Sirketi (Sinpas Insaat), which was established on 22 December 2006 with the aim of transforming into a Real Estate Investment Partnership (REIT), applied to the Capital Markets Board (CMB) with the request to transform into a REIT and following the approval of the relevant request, it was transformed into a REIT by being registered in the trade registry on 3 May 2007 and its title was changed to Sinpas Gayrimenkul Yatirim Ortakligi A.S.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives