- Israel

- /

- Commercial Services

- /

- TASE:ARAN

Does Aran Research & Development (1982) (TLV:ARAN) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Aran Research & Development (1982) Ltd. (TLV:ARAN) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Aran Research & Development (1982)

What Is Aran Research & Development (1982)'s Debt?

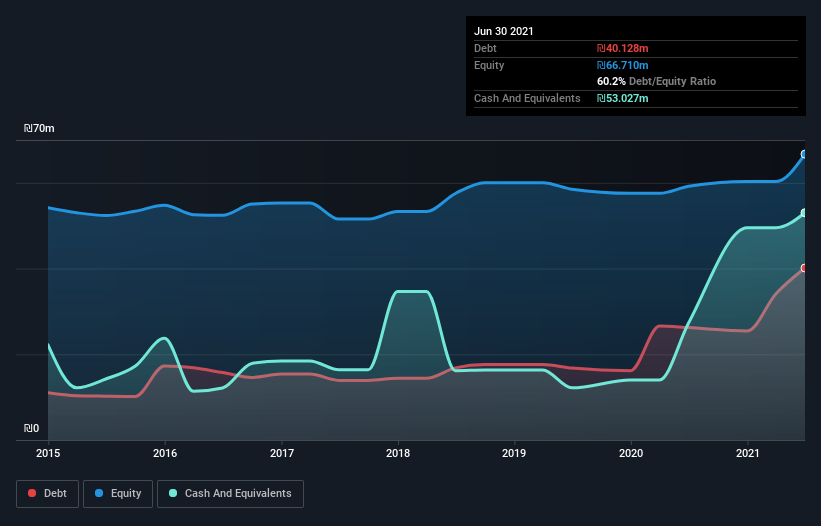

The image below, which you can click on for greater detail, shows that at June 2021 Aran Research & Development (1982) had debt of ₪40.1m, up from ₪26.2m in one year. But on the other hand it also has ₪53.0m in cash, leading to a ₪12.9m net cash position.

How Healthy Is Aran Research & Development (1982)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Aran Research & Development (1982) had liabilities of ₪74.8m due within 12 months and liabilities of ₪31.0m due beyond that. On the other hand, it had cash of ₪53.0m and ₪55.5m worth of receivables due within a year. So it can boast ₪2.81m more liquid assets than total liabilities.

This surplus suggests that Aran Research & Development (1982) has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Aran Research & Development (1982) boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Aran Research & Development (1982) grew its EBIT by 5,543% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Aran Research & Development (1982) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Aran Research & Development (1982) may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Aran Research & Development (1982) actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Aran Research & Development (1982) has net cash of ₪12.9m, as well as more liquid assets than liabilities. The cherry on top was that in converted 106% of that EBIT to free cash flow, bringing in ₪10m. So is Aran Research & Development (1982)'s debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Aran Research & Development (1982) (1 is significant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ARAN

Aran Research & Development (1982)

Engages in the product design and development, and equipment manufacturing businesses for plastics industry in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives