- Israel

- /

- Construction

- /

- TASE:LUDN

Declining Stock and Solid Fundamentals: Is The Market Wrong About Ludan Engineering Co. Ltd (TLV:LUDN)?

Ludan Engineering (TLV:LUDN) has had a rough week with its share price down 15%. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Particularly, we will be paying attention to Ludan Engineering's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ludan Engineering is:

31% = ₪25m ÷ ₪80m (Based on the trailing twelve months to September 2025).

The 'return' is the income the business earned over the last year. So, this means that for every ₪1 of its shareholder's investments, the company generates a profit of ₪0.31.

See our latest analysis for Ludan Engineering

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Ludan Engineering's Earnings Growth And 31% ROE

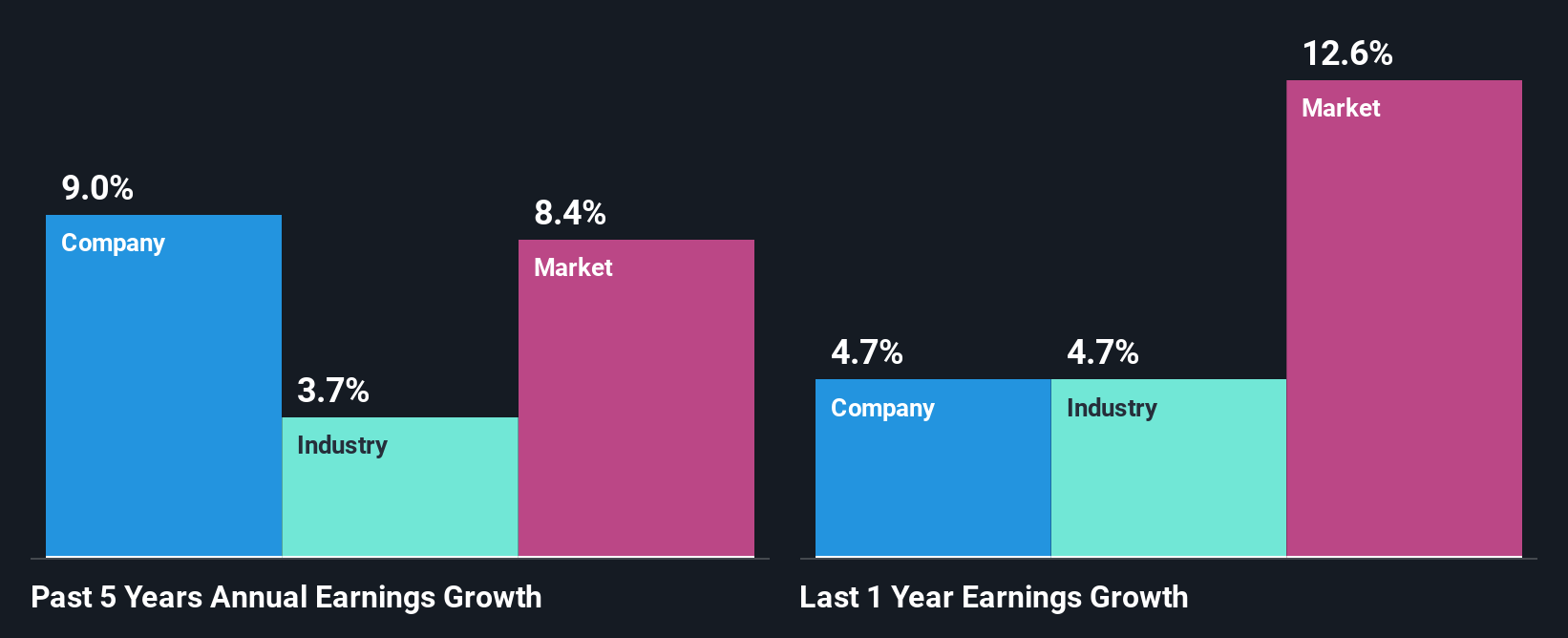

First thing first, we like that Ludan Engineering has an impressive ROE. Second, a comparison with the average ROE reported by the industry of 7.2% also doesn't go unnoticed by us. This probably laid the groundwork for Ludan Engineering's moderate 9.0% net income growth seen over the past five years.

Next, on comparing with the industry net income growth, we found that Ludan Engineering's growth is quite high when compared to the industry average growth of 3.7% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is LUDN fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Ludan Engineering Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 50% (or a retention ratio of 50%) for Ludan Engineering suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Additionally, Ludan Engineering has paid dividends over a period of five years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

On the whole, we feel that Ludan Engineering's performance has been quite good. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. Up till now, we've only made a short study of the company's growth data. You can do your own research on Ludan Engineering and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:LUDN

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026