Klil Industries (TLV:KLIL) shareholders have lost 25% over 3 years, earnings decline likely the culprit

While it may not be enough for some shareholders, we think it is good to see the Klil Industries Ltd (TLV:KLIL) share price up 20% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 26% in the last three years, significantly under-performing the market.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Klil Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

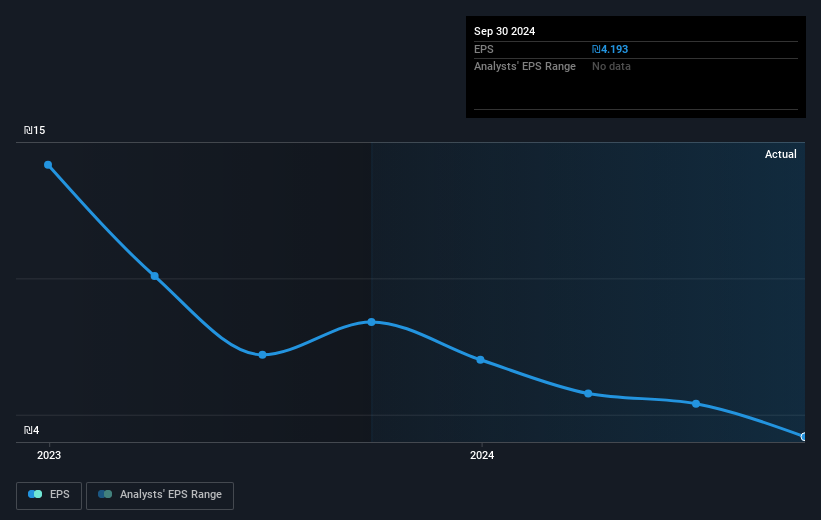

Klil Industries saw its EPS decline at a compound rate of 42% per year, over the last three years. This fall in the EPS is worse than the 10% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. This positive sentiment is also reflected in the generous P/E ratio of 55.68.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Klil Industries' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Klil Industries shareholders are up 18% for the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 2% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Klil Industries is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Klil Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:KLIL

Klil Industries

Designs, develops, manufactures, paints, and markets aluminum systems for the construction and industrial sectors in Israel and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives