Undiscovered Gems None Features 3 Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across global markets, smaller-cap stocks faced challenges as the Russell 2000 Index underperformed relative to its larger counterparts. With economic indicators hinting at a cooling labor market and potential interest rate cuts on the horizon, small-cap companies may find themselves navigating both opportunities and uncertainties. In such an environment, identifying promising small-cap stocks with strong fundamentals can be key to uncovering hidden potential in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hunan Investment GroupLtd | 7.09% | 33.04% | 20.37% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Abu Dhabi Ship Building PJSC (ADX:ADSB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi Ship Building PJSC operates in the United Arab Emirates, focusing on the construction, maintenance, repair, and overhaul of commercial and military ships and vessels, with a market capitalization of AED1.03 billion.

Operations: ADSB generates revenue primarily from its New Build and Engineering segment, which accounts for AED1.29 billion, followed by Military Repairs and Maintenance at AED166.90 million. The company also derives income from Small Boats, Mission Systems, and Commercial Repairs and Maintenance segments.

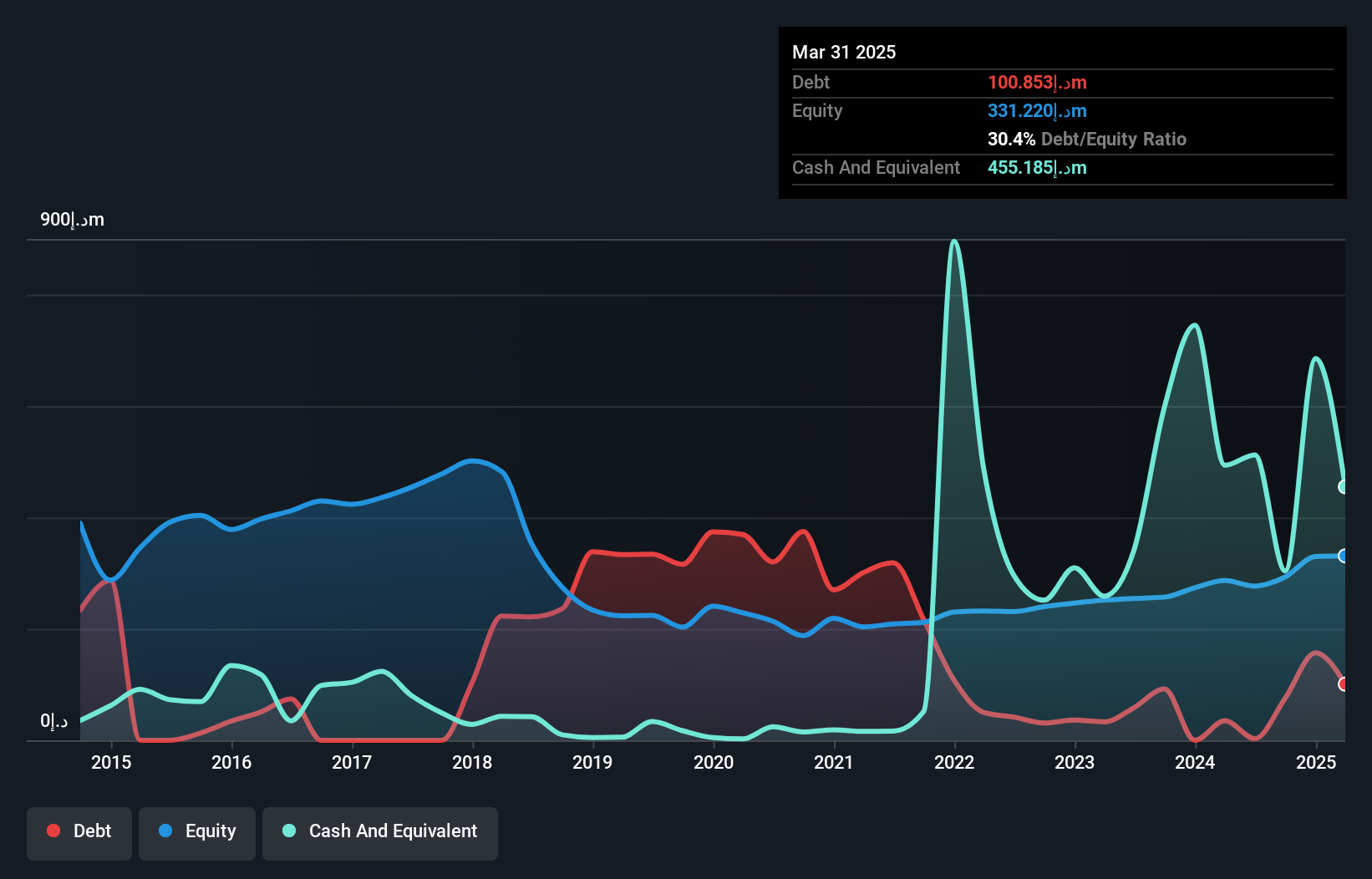

Abu Dhabi Ship Building (ADSB) has shown impressive growth, with earnings surging by 92.9% in the past year, outpacing the Aerospace & Defense industry's 3.8%. The company's debt-to-equity ratio has significantly improved from 155.6% to 25.8% over five years, indicating a stronger financial position. Despite a volatile share price recently, ADSB's price-to-earnings ratio of 19.2x remains attractive compared to the industry average of 50.4x. Recent strategic moves include partnering with SIATT for missile integration on their RABDAN FA-400 vessel, enhancing its capabilities without additional costs and showcasing it at NAVDEX in February 2025.

- Get an in-depth perspective on Abu Dhabi Ship Building PJSC's performance by reading our health report here.

Understand Abu Dhabi Ship Building PJSC's track record by examining our Past report.

Pryce (PSE:PPC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pryce Corporation, with a market cap of ₱19.56 billion, operates in the Philippines where it imports and distributes liquefied petroleum gas (LPG) under the PryceGas brand name.

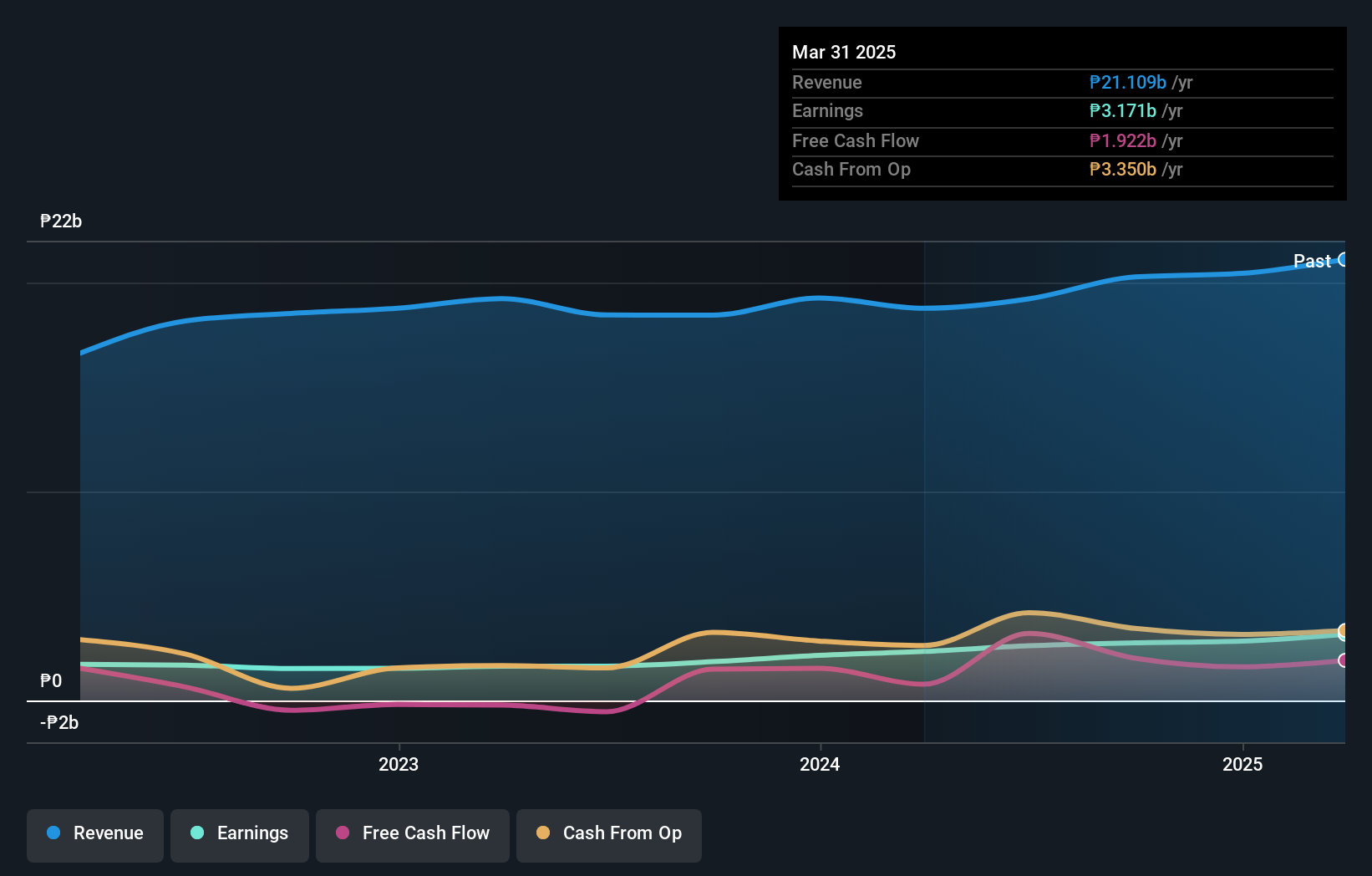

Operations: Pryce Corporation generates its revenue primarily from the liquefied petroleum and industrial gases segment, contributing ₱19.88 billion, followed by real estate at ₱342.85 million, and pharmaceutical products at ₱46.57 million.

Pryce Corporation, a player in the oil and gas sector, has shown impressive growth with earnings rising 48.3% over the past year, outpacing the industry's -10.2%. The company reported third-quarter sales of PHP 5.46 billion, up from PHP 4.41 billion previously, while net income reached PHP 831.73 million compared to last year's PHP 692.28 million. Trading at roughly 24% below its estimated fair value suggests potential undervaluation for investors considering this small entity's prospects. Pryce's debt is well-managed with interest payments covered by EBIT at a robust 28x ratio and more cash than total debt on hand enhances financial stability.

- Dive into the specifics of Pryce here with our thorough health report.

Gain insights into Pryce's historical performance by reviewing our past performance report.

Inrom Construction Industries (TASE:INRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Inrom Construction Industries Ltd, along with its subsidiaries, engages in the production, marketing, and sale of a range of products and solutions for the construction, renovation, and infrastructure sectors in Israel with a market cap of ₪2.65 billion.

Operations: Inrom generates revenue primarily from its Construction Solutions and Finishing Products for Construction segments, contributing ₪359.03 million and ₪296.27 million respectively. Paint Products add another significant portion with sales of ₪229 million, while Plumbing Systems contribute ₪76.07 million to the total revenue stream.

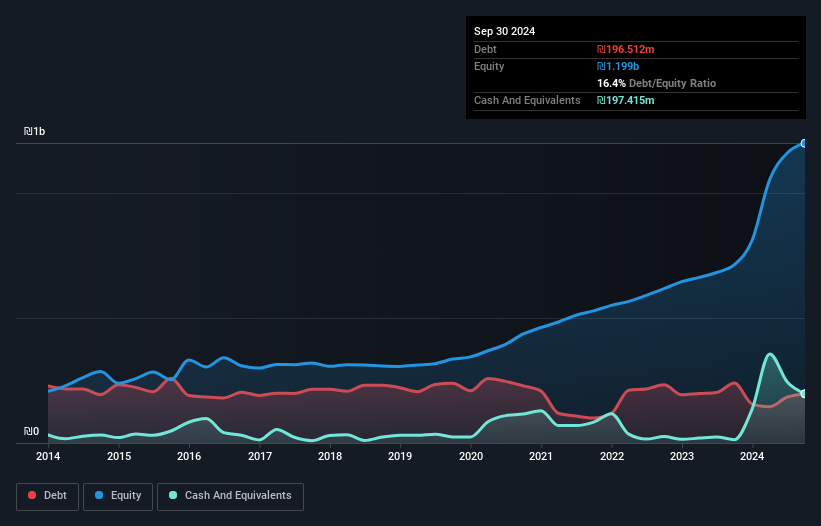

Inrom Construction Industries, a small player in the construction sector, has shown resilience with its earnings growing by 29% over the past year, outpacing the industry. The company is trading at an attractive 92.4% below its estimated fair value and boasts a strong debt position with more cash than total liabilities. Notably, Inrom's interest payments are well covered by EBIT at 22.7x coverage. However, recent financials reveal mixed results; third-quarter sales were ₪341.89 million compared to ₪345.43 million last year while net income rose to ₪39.05 million from ₪35.79 million previously reported.

Turning Ideas Into Actions

- Embark on your investment journey to our 4509 Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:INRM

Inrom Construction Industries

Produces, markets, and sells various products and solutions for the construction, renovation, and infrastructure industries in Israel.

Flawless balance sheet and good value.