Does Inrom Construction Industries (TLV:INRM) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Inrom Construction Industries Ltd (TLV:INRM) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Inrom Construction Industries

What Is Inrom Construction Industries's Net Debt?

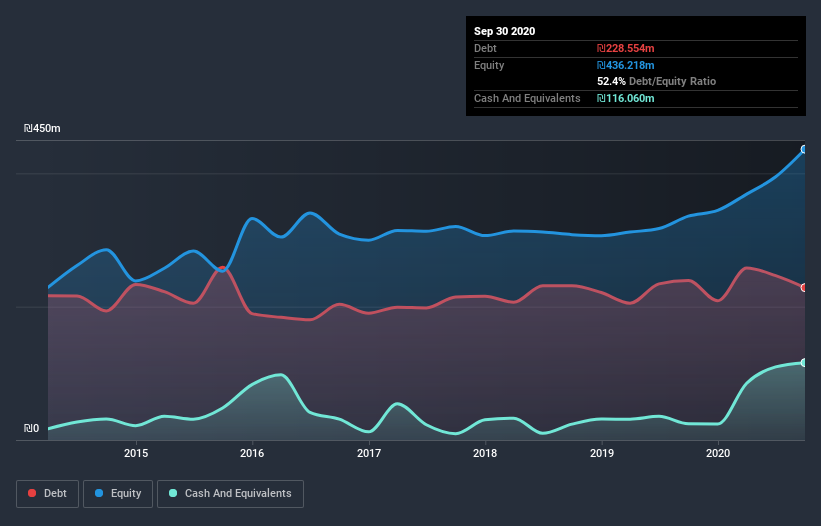

As you can see below, Inrom Construction Industries had ₪228.6m of debt at September 2020, down from ₪239.3m a year prior. However, it does have ₪116.1m in cash offsetting this, leading to net debt of about ₪112.5m.

How Healthy Is Inrom Construction Industries' Balance Sheet?

We can see from the most recent balance sheet that Inrom Construction Industries had liabilities of ₪343.7m falling due within a year, and liabilities of ₪235.5m due beyond that. Offsetting this, it had ₪116.1m in cash and ₪399.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪63.3m.

Given Inrom Construction Industries has a market capitalization of ₪1.61b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Inrom Construction Industries's net debt is only 0.58 times its EBITDA. And its EBIT easily covers its interest expense, being 24.6 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the other side of the story is that Inrom Construction Industries saw its EBIT decline by 7.2% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Inrom Construction Industries will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Inrom Construction Industries produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Inrom Construction Industries's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its EBIT growth rate does undermine this impression a bit. Taking all this data into account, it seems to us that Inrom Construction Industries takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Inrom Construction Industries you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Inrom Construction Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:INRM

Inrom Construction Industries

Produces, markets, and sells various products and solutions for the construction, renovation, and infrastructure industries in Israel.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026