Assessing Inrom Construction Industries (TASE:INRM) Valuation After Strong Q3 and Nine-Month 2025 Earnings Growth

Reviewed by Simply Wall St

Inrom Construction Industries (TASE:INRM) just posted its third quarter and nine month 2025 results, with higher sales and net income that help explain why the stock has been catching investors attention lately.

See our latest analysis for Inrom Construction Industries.

Those stronger earnings land on top of a solid run, with the share price up 19.5% over the last three months and a 12 month total shareholder return of 46.6%, signaling momentum that investors are steadily rewarding.

If Inrom’s recent move has you reassessing your watchlist, it is worth exploring fast growing stocks with high insider ownership as a way to uncover other promising names riding improving sentiment.

But with earnings climbing alongside the share price and a modest intrinsic premium already implied, the key question now is whether Inrom still offers upside from here or if the market is fully pricing in future growth.

Price-to-Earnings of 25.4x: Is it justified?

Inrom Construction Industries trades on a price-to-earnings ratio of 25.4x at a last close of ₪23.8, which screens as expensive versus parts of its industry but cheaper than some peers.

The price-to-earnings multiple compares the company’s share price to its earnings per share, so a higher ratio typically reflects stronger growth expectations or perceived quality, especially in capital goods and building related names.

In Inrom’s case, the current 25.4x earnings multiple sits below the 33.9x average for its selected peer group, implying investors are not assigning it the richest growth premium available among comparable companies, even as its five year earnings track record shows moderate annual expansion.

However, that same 25.4x multiple looks demanding against the broader Asian Building industry average of 19.1x, underscoring that the market is still willing to pay a clear premium for Inrom’s earnings despite a weaker recent profit trend and lower net margins than a year ago.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 25.4x (OVERVALUED)

However, downside risks remain, including any slowdown in Israeli construction activity or margin pressure if input costs rise faster than Inrom can pass through.

Find out about the key risks to this Inrom Construction Industries narrative.

Another Take on Value

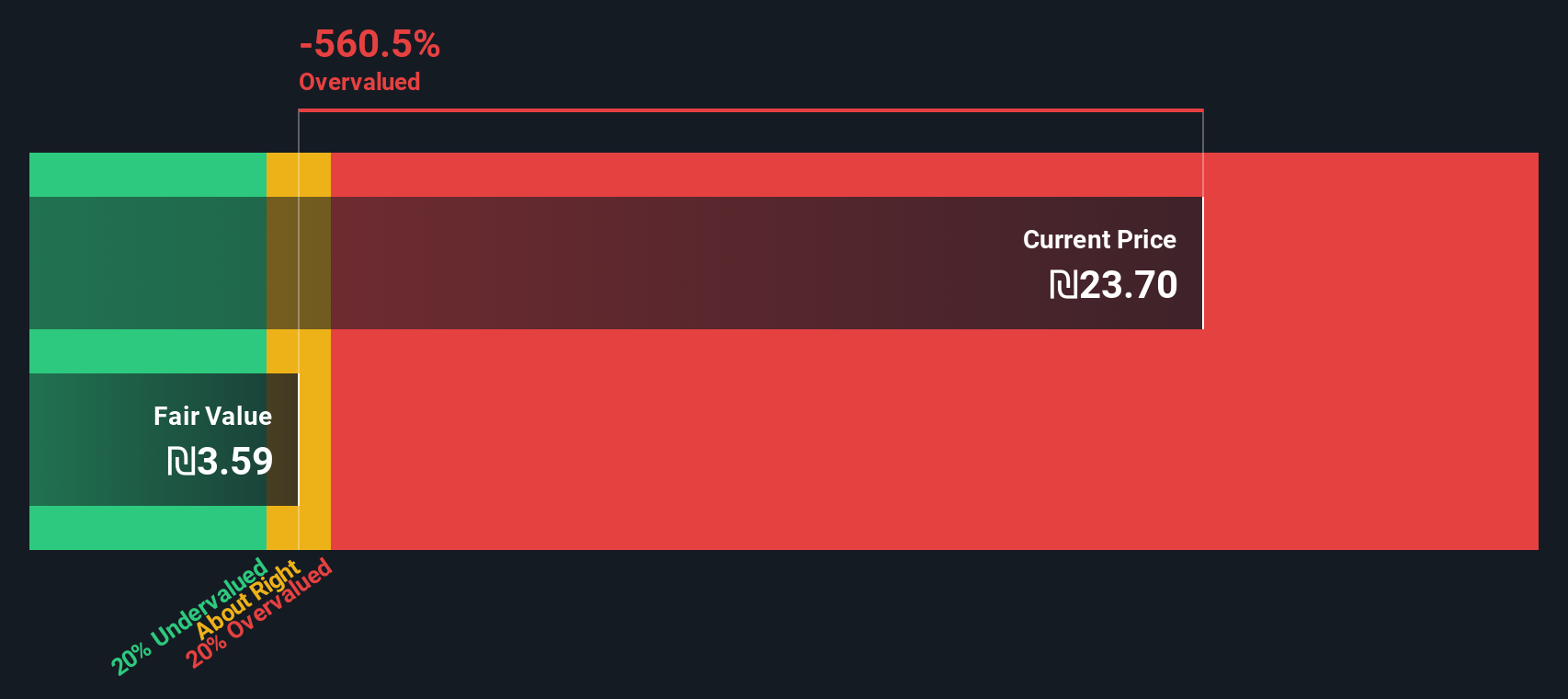

Our DCF model suggests a sharper downside than the earnings multiple indicates, with Inrom trading around ₪23.8 versus an estimated fair value near ₪3.59, implying it may be meaningfully overvalued. Is the market overestimating long term cash flows, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Inrom Construction Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Inrom Construction Industries Narrative

If you see things differently, or would rather dig into the numbers yourself, you can build a personalized view in just minutes using Do it your way.

A great starting point for your Inrom Construction Industries research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts elsewhere, put Simply Wall St’s screener to work and create a shortlist of opportunities aligned with your strategy, not market noise.

- Capitalize on mispriced quality by using these 915 undervalued stocks based on cash flows to surface companies where cash flow strength is not yet fully recognised in the share price.

- Stay ahead of the next technological wave by targeting innovation focused names through these 25 AI penny stocks with the potential to reshape entire industries.

- Strengthen your portfolio’s income stream by scanning these 14 dividend stocks with yields > 3% that combine attractive yields with the financials to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:INRM

Inrom Construction Industries

Produces, markets, and sells various products and solutions for the construction, renovation, and infrastructure industries in Israel.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026