- Israel

- /

- Construction

- /

- TASE:ELTR

Is Now the Right Time to Consider Electra After 11% Weekly Surge?

Reviewed by Bailey Pemberton

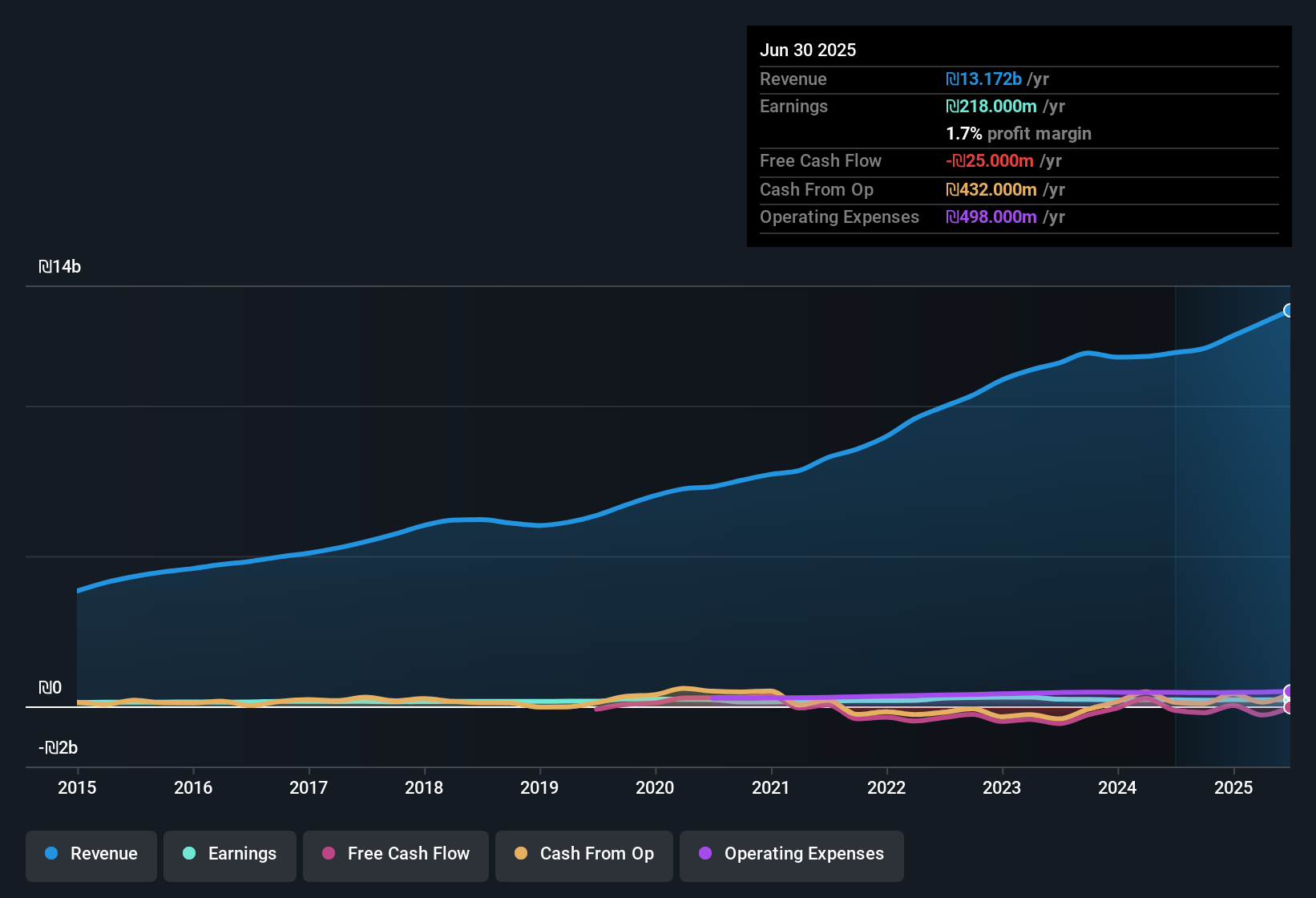

If you’re looking at Electra stock and wondering whether now is the right time to make a move, you’re not alone. Over the past week, shares have surged 11.2%, with a 41.3% gain over the past year. This performance should catch any investor’s eye. However, it’s also worth noting that year-to-date, Electra is down 3.3%, which suggests that risk sentiment around the stock can shift quickly as the broader market reacts to ongoing industry changes and economic shifts.

Recently, discussions around electric infrastructure investments and supply chain strategies have caught the attention of traders and may be fueling renewed optimism in Electra’s growth story. Even with impressive gains over several periods, the company’s valuation score sits at a modest 2 out of 6. This is a quick signal that Electra only meets a couple of the standard undervaluation criteria.

So, how do we make sense of these surges and setbacks? Let’s break down how Electra stacks up across different valuation methods. And keep reading, because after we dive into the numbers, we’ll reveal an even smarter way to size up Electra’s real worth.

Electra scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Electra Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic worth by forecasting its future cash flows and discounting them back to their present value. For Electra, this process involves predicting how much cash the business can generate in the years ahead and determining what that is worth today in ₪.

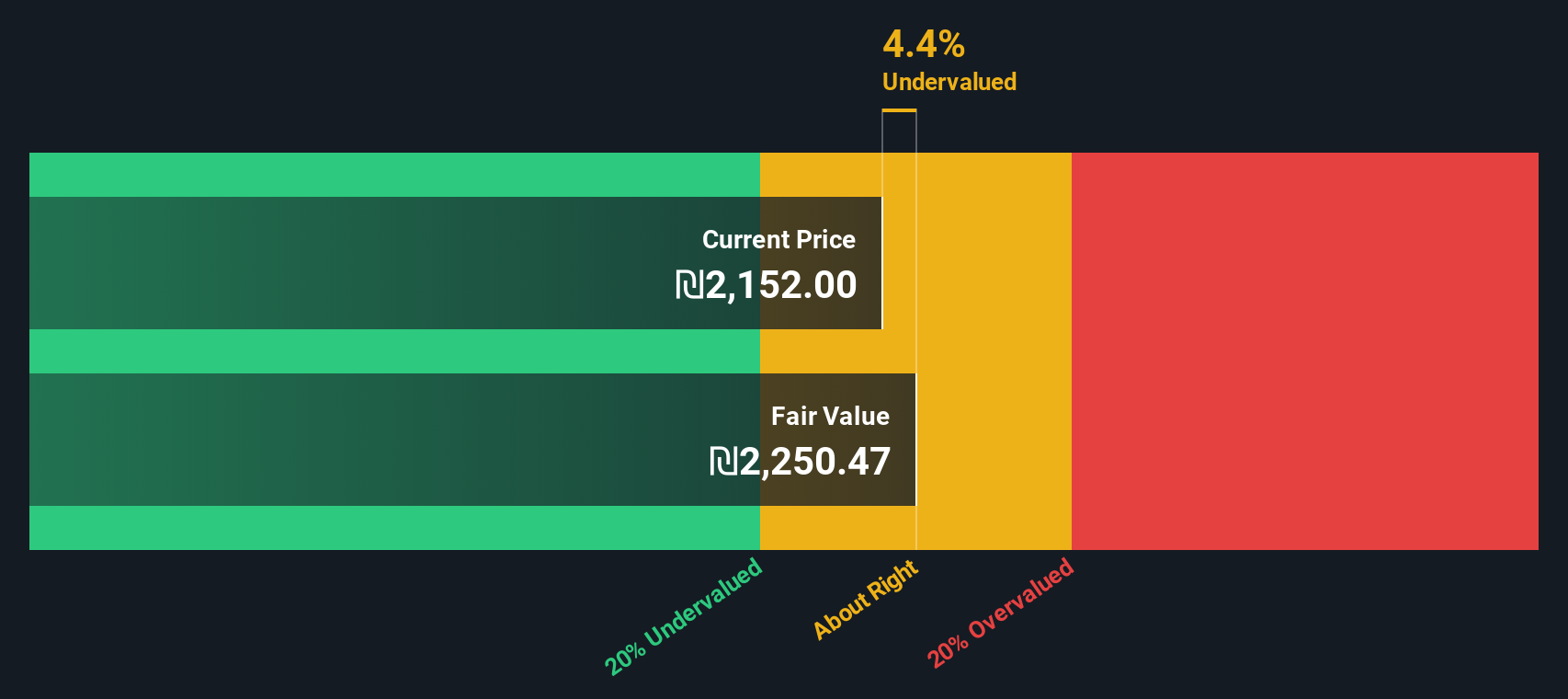

Currently, Electra’s last twelve months free cash flow stands at ₪111.3 million. Analysts expect this figure to rise dramatically, with projections for the company’s free cash flow reaching ₪1.38 billion by 2035. Over the near term, estimates cover approximately five years. Projections beyond that time frame are extrapolated using Simply Wall St’s methodology.

Using these cash flow estimates and discounting them by 8.5%, the model calculates an intrinsic value for Electra stock of ₪2,186.69 per share. Compared to the current share price, this suggests the stock is trading about 8.5% below calculated fair value.

While an 8.5% discount technically means the stock is undervalued, it is close enough to fair value that investors may want to be cautious. Minor shifts in assumptions could tip the scales either way.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Electra's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Electra Price vs Earnings (PE Ratio)

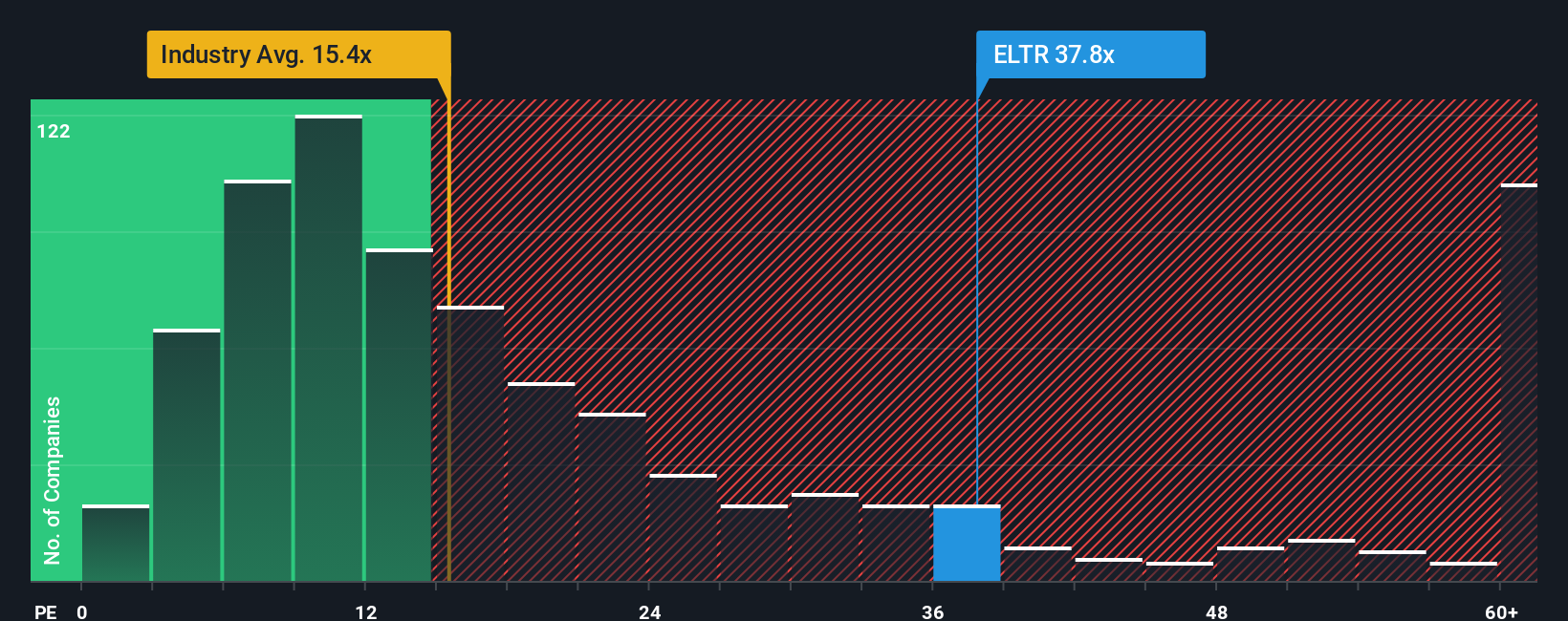

For profitable companies like Electra, the Price-to-Earnings (PE) ratio is a widely used metric to estimate value because it tells us how much investors are paying for each unit of net profit. In essence, a lower PE means you're paying less for each shekel of earnings, while a higher PE indicates the market expects stronger future growth, lower risk, or both.

Naturally, the “right” PE ratio is shaped by growth expectations and risk. Fast-growing companies often command higher PEs, as investors are willing to pay today for the promise of substantially higher earnings down the track. Conversely, companies facing larger risks or slow growth typically trade at lower PEs. With Electra, the current PE stands at 35.1x. This is noticeably higher than the Construction industry average of 16.0x, but is more in line with the average PE of its peer group, which clocks in at around 48.5x.

This is where Simply Wall St's Fair Ratio comes in. Instead of simply comparing Electra to its industry or peers, which can overlook critical differences in growth, risk profile, margins or market cap, the Fair Ratio layers in all these factors to arrive at a more tailored and equitable benchmark. By accounting for the company’s unique earnings growth outlook, risk, profit margins and size, this metric helps investors judge value more intelligently.

Because the difference between Electra’s actual PE and the Fair Ratio is less than 0.10, the stock looks fairly valued on this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Electra Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful way to see your own story about a company reflected in the numbers. It lets you ground your perspective about Electra in a forecast of future revenue, earnings, and margins, and then see what that means for fair value.

Narratives seamlessly connect a company’s unique story with a financial outlook and a tailored fair value, offering a dynamic approach beyond the traditional models. Available right on Simply Wall St’s Community page, Narratives are designed for everyone, with millions of investors using them to guide buy or sell decisions by continuously comparing fair value with the actual share price.

Because Narratives automatically update whenever fresh news or company results arrive, your view of Electra stays relevant as new insights come in. For example, some investors may calculate a fair value for Electra as high as ₪2,850, while others, taking a more cautious outlook, estimate it closer to ₪1,700.

With Narratives, you can easily put your personal spin on Electra’s story, see how it stacks up to others’ views, and confidently decide when the price is right for you.

Do you think there's more to the story for Electra? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELTR

Electra

Through its subsidiaries, engages in the contracting, construction, infrastructure, and electromechanical system businesses in Israel and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives