- Israel

- /

- Construction

- /

- TASE:ELTR

Electra (TASE:ELTR): Assessing Valuation as Evolito Partnership Powers EL9 Aircraft Momentum

Reviewed by Kshitija Bhandaru

Electra (TASE:ELTR) has chosen Evolito to supply the electric propulsion units for its EL9 hybrid-electric aircraft, marking a key advance in its development of next-generation short takeoff and landing technology. This supplier partnership comes as the EL9 program draws market interest.

See our latest analysis for Electra.

Electra’s latest partnership news comes alongside a period of steady positive momentum for the shares, with a 1-month share price return of nearly 15% and an impressive 54% total shareholder return over the past year. Recent gains suggest the market is warming up to Electra’s growth ambitions, particularly given mounting interest around the EL9 program and the sizable pre-orders already on the books.

If you’re interested in uncovering other companies making waves in aerospace and defense, why not explore See the full list for free.

With shares surging and excitement building around Electra's EL9 program, a key question remains: are investors overlooking hidden value, or is the stock already reflecting all the future growth in its price?

Price-to-Earnings of 38.4x: Is it justified?

Electra is currently trading at a price-to-earnings (P/E) ratio of 38.4x, which presents an intriguing comparison to both its peers and the broader market. At this level, the stock appears attractively valued compared to similar companies but expensive relative to its wider industry group.

The price-to-earnings ratio measures how much investors are willing to pay today for each shekel of company earnings. In construction and industrial sectors, the P/E can reflect expectations for future earnings growth or the perceived quality and stability of current profits.

Electra's P/E ratio is substantially lower than the peer average of 54.4x. This means investors are paying less for comparable earnings than they would for similar companies in its immediate competitive set. However, the stock is significantly more expensive than the broader Asian Construction industry, where the average P/E stands at just 15.8x. This could indicate that the market is assigning a growth premium to Electra due to its project pipeline like the EL9 program, but it also raises expectations that these growth ambitions must deliver to justify the high multiple over the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 38.4x (ABOUT RIGHT)

However, if project ramp-up is slower than expected or net income growth is weaker, the case for Electra’s current valuation premium could quickly be challenged.

Find out about the key risks to this Electra narrative.

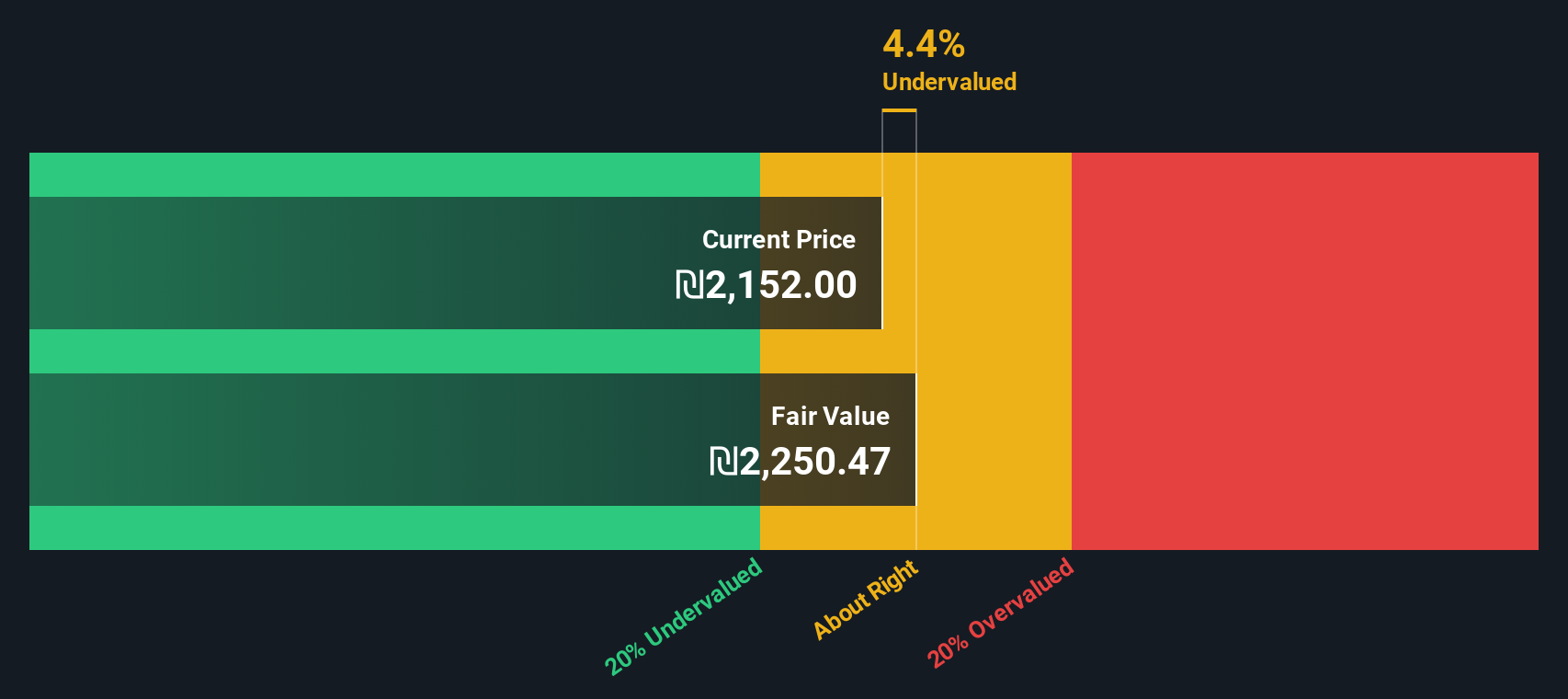

Another View: Our DCF Model Weighs In

Taking a different approach, our SWS DCF model suggests Electra is trading 3.2% below its intrinsic value. The fair value estimate is ₪2257.97, compared to the current price of ₪2186.1. This points to a small undervaluation and adds a new angle to the valuation debate.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electra Narrative

If our view doesn’t align with your perspective or you want to dig deeper, you can construct your own take on Electra’s story in just a few minutes using our tools, and Do it your way.

A great starting point for your Electra research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass by. Set yourself up for smarter moves with these targeted stock ideas from the Simply Wall Street Screener:

- Tap into reliable income streams by starting with these 19 dividend stocks with yields > 3%, where you’ll uncover stocks offering attractive yields above 3%.

- Seize early potential by seeking out these 3580 penny stocks with strong financials with robust financials primed for dynamic growth.

- Benefit from the AI revolution and select market leaders using these 24 AI penny stocks designed to showcase cutting-edge technology investments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELTR

Electra

Through its subsidiaries, engages in the contracting, construction, infrastructure, and electromechanical system businesses in Israel and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives