- Israel

- /

- Aerospace & Defense

- /

- TASE:BSEN

Will Weakness in Bet Shemesh Engines Holdings (1997) Ltd's (TLV:BSEN) Stock Prove Temporary Given Strong Fundamentals?

With its stock down 6.9% over the past week, it is easy to disregard Bet Shemesh Engines Holdings (1997) (TLV:BSEN). However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Particularly, we will be paying attention to Bet Shemesh Engines Holdings (1997)'s ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bet Shemesh Engines Holdings (1997) is:

19% = US$36m ÷ US$193m (Based on the trailing twelve months to December 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each ₪1 of shareholders' capital it has, the company made ₪0.19 in profit.

See our latest analysis for Bet Shemesh Engines Holdings (1997)

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Bet Shemesh Engines Holdings (1997)'s Earnings Growth And 19% ROE

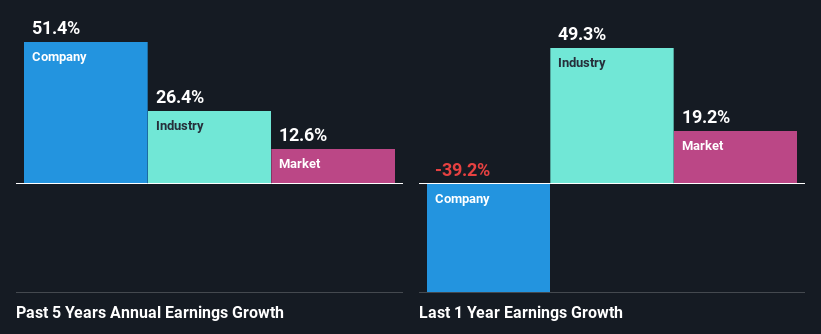

To start with, Bet Shemesh Engines Holdings (1997)'s ROE looks acceptable. Further, the company's ROE is similar to the industry average of 19%. This probably goes some way in explaining Bet Shemesh Engines Holdings (1997)'s significant 51% net income growth over the past five years amongst other factors. However, there could also be other drivers behind this growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Bet Shemesh Engines Holdings (1997)'s net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 26%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Bet Shemesh Engines Holdings (1997)'s's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Bet Shemesh Engines Holdings (1997) Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 76% (implying that it keeps only 24% of profits) for Bet Shemesh Engines Holdings (1997) suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Besides, Bet Shemesh Engines Holdings (1997) has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Summary

In total, we are pretty happy with Bet Shemesh Engines Holdings (1997)'s performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Bet Shemesh Engines Holdings (1997) and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

Valuation is complex, but we're here to simplify it.

Discover if Bet Shemesh Engines Holdings (1997) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BSEN

Bet Shemesh Engines Holdings (1997)

Manufactures and sells jet engine parts in Israel.

Flawless balance sheet and good value.

Market Insights

Community Narratives