- Israel

- /

- Aerospace & Defense

- /

- TASE:BSEN

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent start to 2025, marked by inflation concerns and political uncertainties, investors are closely watching economic indicators and central bank policies. Amidst this backdrop of fluctuating indices and resilient labor markets, dividend stocks continue to attract attention for their potential to provide steady income streams. In such volatile times, a strong dividend stock is often characterized by its ability to maintain consistent payouts while demonstrating financial stability and resilience against market headwinds.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.52% | ★★★★★★ |

| MISC Berhad (KLSE:MISC) | 5.10% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.08% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 2004 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited specializes in the research, development, manufacture, and sale of agricultural and power machinery globally with a market cap of HK$13.21 billion.

Operations: First Tractor Company Limited generates revenue through its global operations in agricultural and power machinery, including the development, manufacturing, and sales of related products.

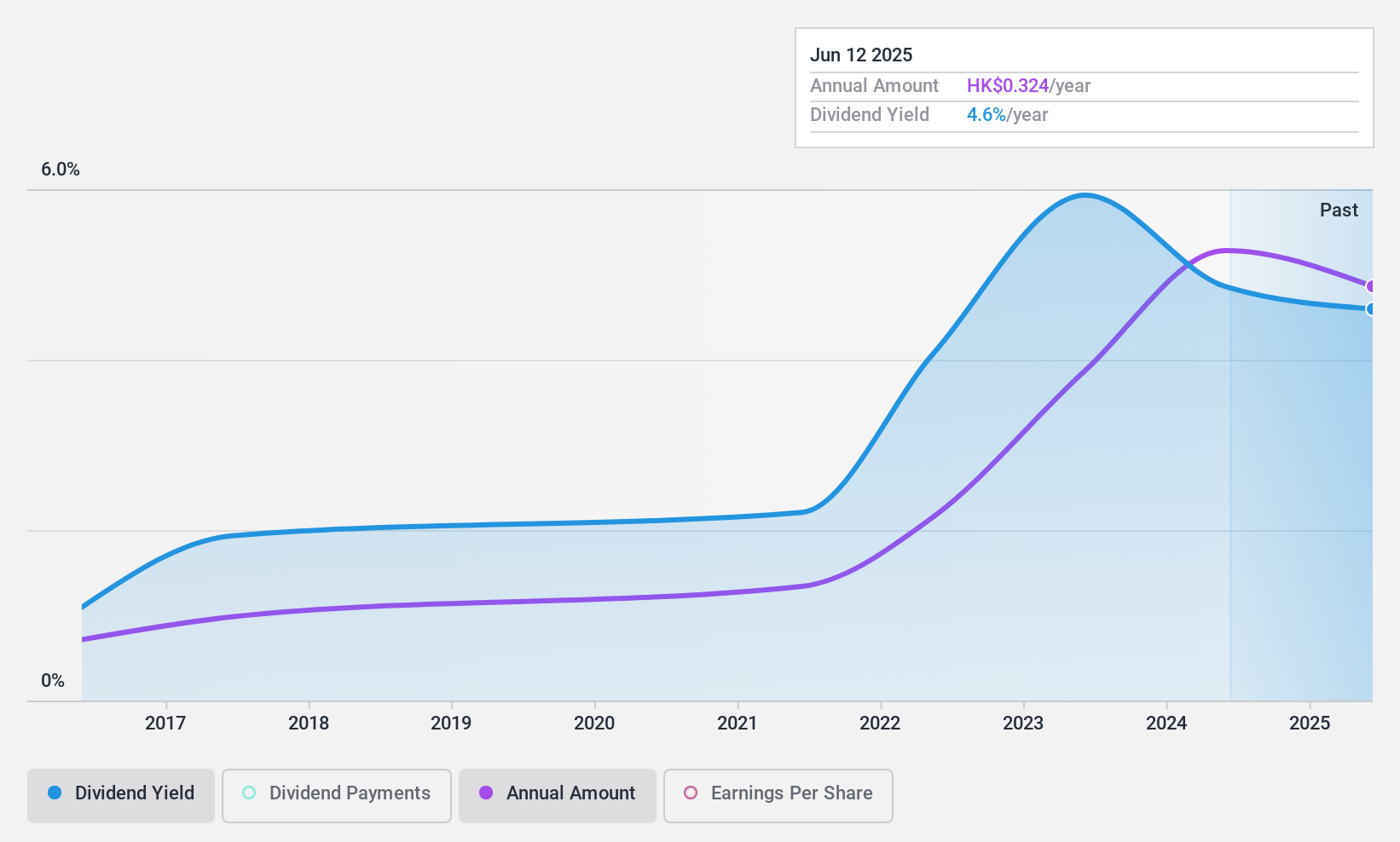

Dividend Yield: 4.8%

First Tractor's dividend payments have been volatile over the past decade, yet they are well-covered by both earnings and cash flows with payout ratios of 35.4% and 30%, respectively. Despite trading at a significant discount to estimated fair value, its dividend yield of 4.82% is below top-tier levels in Hong Kong. Recent executive changes, including a new CFO appointment, may influence future strategic directions but do not currently impact daily operations or dividend stability.

- Navigate through the intricacies of First Tractor with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, First Tractor's share price might be too pessimistic.

Qingdao East Steel Tower StockLtd (SZSE:002545)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Qingdao East Steel Tower Stock Co. Ltd, with a market cap of CN¥8.68 billion, manufactures and markets steel structure products in the People’s Republic of China.

Operations: Qingdao East Steel Tower Stock Co. Ltd's revenue is primarily derived from its steel structure products in the People’s Republic of China.

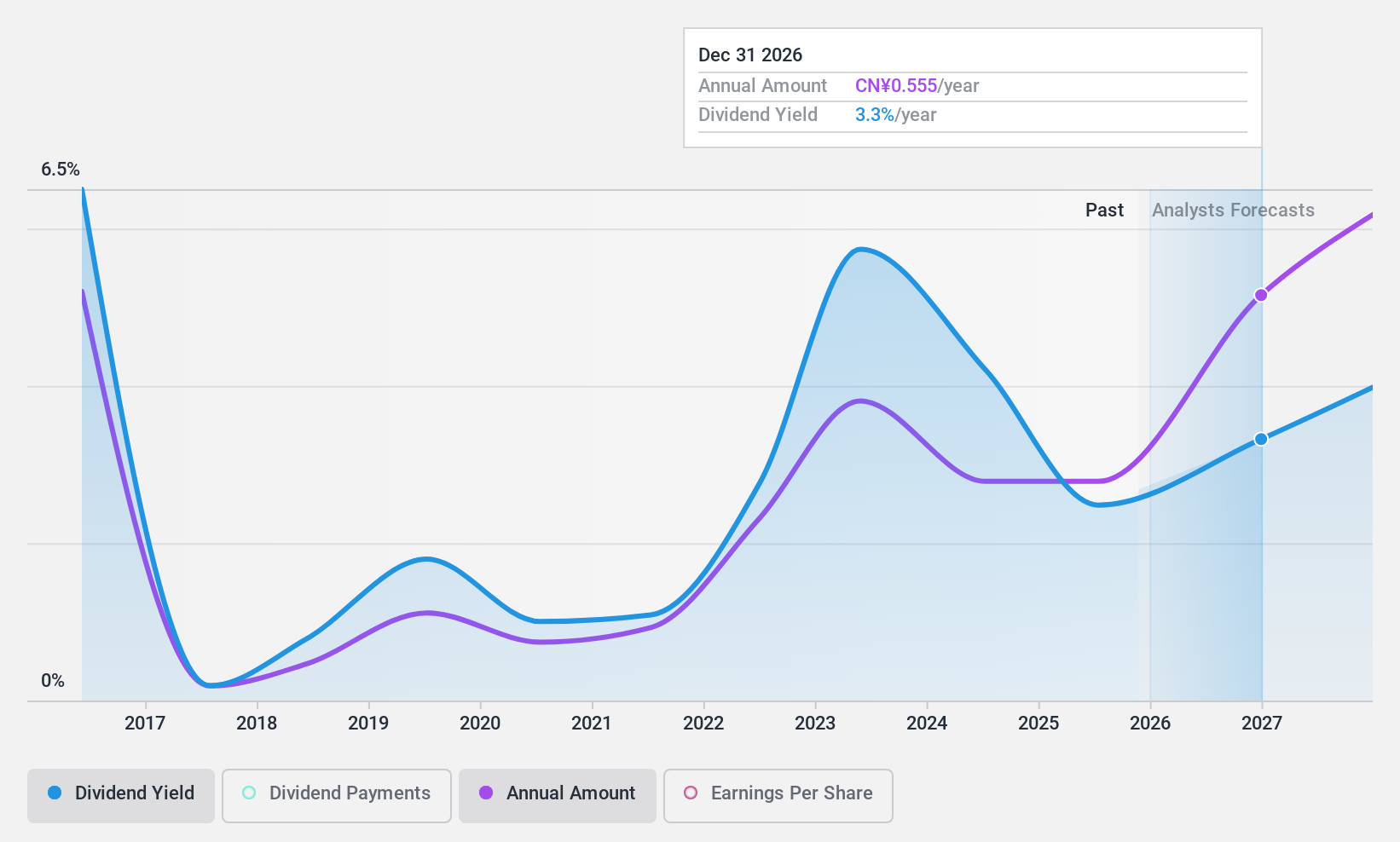

Dividend Yield: 4.3%

Qingdao East Steel Tower's dividend yield of 4.3% ranks in the top 25% of Chinese dividend payers, supported by a cash payout ratio of 40%. However, its dividends have been unstable and volatile over the past decade. Despite this, they are adequately covered by earnings with a payout ratio of 63.1%. Trading at a favorable price-to-earnings ratio of 14.7x compared to the market average, it presents good relative value.

- Unlock comprehensive insights into our analysis of Qingdao East Steel Tower StockLtd stock in this dividend report.

- The analysis detailed in our Qingdao East Steel Tower StockLtd valuation report hints at an deflated share price compared to its estimated value.

Bet Shemesh Engines Holdings (1997) (TASE:BSEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bet Shemesh Engines Holdings (1997) Ltd, with a market cap of ₪3.38 billion, manufactures and sells jet engine parts in Israel.

Operations: The company's revenue is derived from two primary segments: Engines, contributing $90.63 million, and Manufacturing of Parts, generating $169.29 million.

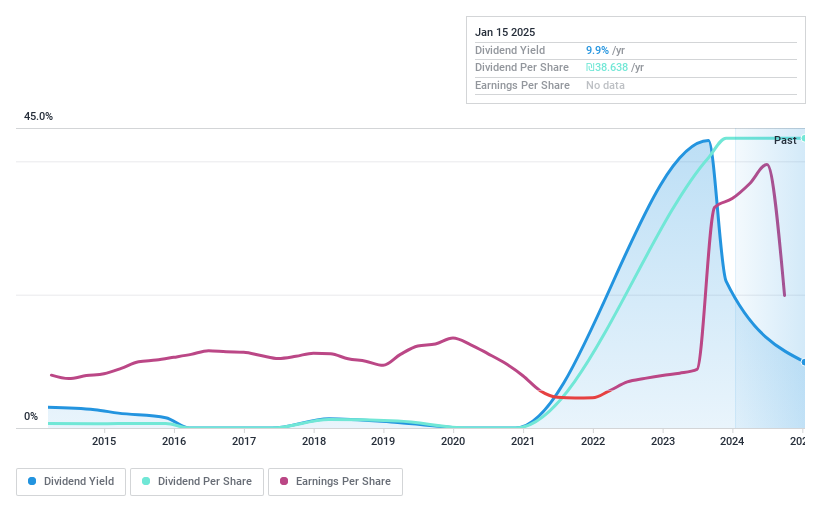

Dividend Yield: 9.9%

Bet Shemesh Engines Holdings offers a high dividend yield of 9.88%, placing it in the top 25% of Israeli dividend payers, but its sustainability is questionable due to a high cash payout ratio of 325.1%. Despite an increase in dividends over the past decade, payments have been volatile and unreliable. Recent earnings show net income has significantly decreased despite increased sales. The stock trades at 71.8% below its estimated fair value, suggesting potential undervaluation amidst financial challenges.

- Click here to discover the nuances of Bet Shemesh Engines Holdings (1997) with our detailed analytical dividend report.

- Our valuation report here indicates Bet Shemesh Engines Holdings (1997) may be undervalued.

Summing It All Up

- Navigate through the entire inventory of 2004 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bet Shemesh Engines Holdings (1997) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BSEN

Bet Shemesh Engines Holdings (1997)

Manufactures and sells jet engine parts in Israel.

Excellent balance sheet, good value and pays a dividend.