- Israel

- /

- Aerospace & Defense

- /

- TASE:BSEN

Bet Shemesh Engines Holdings (1997) Ltd's (TLV:BSEN) 27% Share Price Surge Not Quite Adding Up

Despite an already strong run, Bet Shemesh Engines Holdings (1997) Ltd (TLV:BSEN) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 259% in the last year.

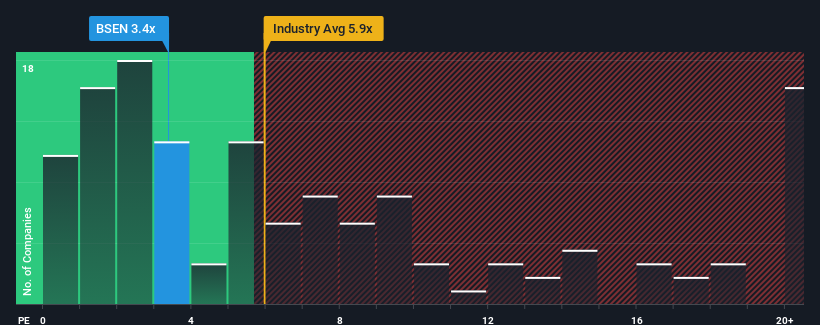

In spite of the firm bounce in price, there still wouldn't be many who think Bet Shemesh Engines Holdings (1997)'s price-to-sales (or "P/S") ratio of 3.4x is worth a mention when the median P/S in Israel's Aerospace & Defense industry is similar at about 2.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Bet Shemesh Engines Holdings (1997)

What Does Bet Shemesh Engines Holdings (1997)'s P/S Mean For Shareholders?

Recent times have been quite advantageous for Bet Shemesh Engines Holdings (1997) as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bet Shemesh Engines Holdings (1997) will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bet Shemesh Engines Holdings (1997)'s to be considered reasonable.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. The latest three year period has also seen an excellent 101% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 47% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that Bet Shemesh Engines Holdings (1997) is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Bet Shemesh Engines Holdings (1997)'s P/S?

Bet Shemesh Engines Holdings (1997) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bet Shemesh Engines Holdings (1997)'s average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Bet Shemesh Engines Holdings (1997) (1 is significant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Bet Shemesh Engines Holdings (1997), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bet Shemesh Engines Holdings (1997) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BSEN

Bet Shemesh Engines Holdings (1997)

Manufactures and sells jet engine parts in Israel.

Flawless balance sheet and good value.

Market Insights

Community Narratives