Birman Wood & Hardware Ltd (TLV:BIRM) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Birman Wood & Hardware Ltd (TLV:BIRM) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

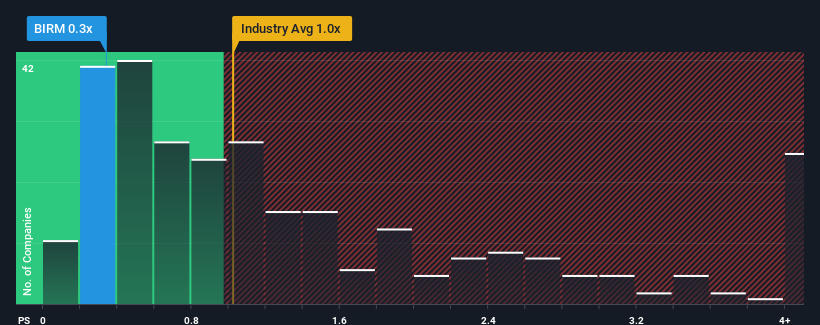

Even after such a large jump in price, there still wouldn't be many who think Birman Wood & Hardware's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Israel's Building industry is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Birman Wood & Hardware

What Does Birman Wood & Hardware's Recent Performance Look Like?

For instance, Birman Wood & Hardware's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Birman Wood & Hardware's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Birman Wood & Hardware's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why Birman Wood & Hardware is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does Birman Wood & Hardware's P/S Mean For Investors?

Birman Wood & Hardware's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, Birman Wood & Hardware's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Birman Wood & Hardware (of which 1 doesn't sit too well with us!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Birman Wood & Hardware might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BIRM

Birman Wood & Hardware

Imports, produces, and markets wood panels, hardware products, kitchen electrical appliances, and laminate flooring parquets.

Moderate and good value.