- Israel

- /

- Healthcare Services

- /

- TASE:MDTR

The 30% return delivered to Mediterranean Towers' (TLV:MDTR) shareholders actually lagged YoY earnings growth

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. Unfortunately for shareholders, while the Mediterranean Towers Ltd. (TLV:MDTR) share price is up 22% in the last year, that falls short of the market return. Longer term, the stock is up 21% in three years.

The past week has proven to be lucrative for Mediterranean Towers investors, so let's see if fundamentals drove the company's one-year performance.

See our latest analysis for Mediterranean Towers

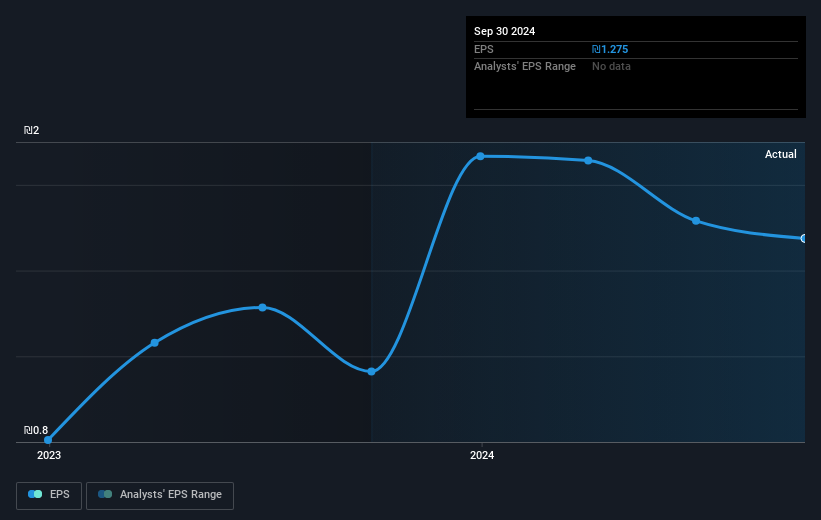

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Mediterranean Towers was able to grow EPS by 32% in the last twelve months. It's fair to say that the share price gain of 22% did not keep pace with the EPS growth. So it seems like the market has cooled on Mediterranean Towers, despite the growth. Interesting. The caution is also evident in the lowish P/E ratio of 9.24.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Mediterranean Towers' TSR for the last 1 year was 30%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Mediterranean Towers shareholders are up 30% for the year (even including dividends). Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 7% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Mediterranean Towers better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Mediterranean Towers (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

But note: Mediterranean Towers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MDTR

Mediterranean Towers

Owns and operates residential homes for the elderly population in Israel.

Proven track record second-rate dividend payer.