- Israel

- /

- Aerospace & Defense

- /

- TASE:ARYT

Aryt Industries (TASE:ARYT): Examining Valuation After S&P Global BMI Index Inclusion

Reviewed by Kshitija Bhandaru

Aryt Industries (TASE:ARYT) just landed a spot on the S&P Global BMI Index, and that kind of move hardly flies under the radar. This inclusion tends to put a company directly in front of a new group of investors, as index funds recalibrate their holdings and sector watchers revisit their assumptions. While it might sound technical on the surface, this development can quickly change how the market values Aryt. Both seasoned shareholders and fence-sitters may rethink their next move as a result.

The timing is interesting given Aryt’s recent track record. Shares have posted an 8.5% gain over the past year, with momentum accelerating sharply this past quarter and rising over 100% in three months. While the last week saw a pause, the month marked double-digit growth, and the three-year return is substantial. Other recent stories have not matched the impact of this index addition, so attention is on whether this is a turning point or just another step in the climb.

With Aryt now in the global spotlight, is the market underestimating its growth potential, or has this inclusion already been priced in?

Price-to-Earnings of 28.9x: Is it justified?

Aryt Industries trades at a Price-to-Earnings (P/E) ratio of 28.9x, which is significantly below both its peer average of 41.8x and the Asian Aerospace & Defense industry average of 55.6x. This suggests the market may be undervaluing Aryt relative to comparable companies.

The P/E ratio measures a company's current share price relative to its per-share earnings, providing a quick view of how investors value future earnings. In the capital goods sector, especially for high-growth firms, this multiple often reflects growth expectations and operational quality.

Given Aryt’s rapid earnings expansion and high-quality results, some investors might see this lower multiple as an opportunity, while others could interpret it as the market remaining cautious about future prospects. Whether this valuation is warranted depends on your outlook for continued earnings growth.

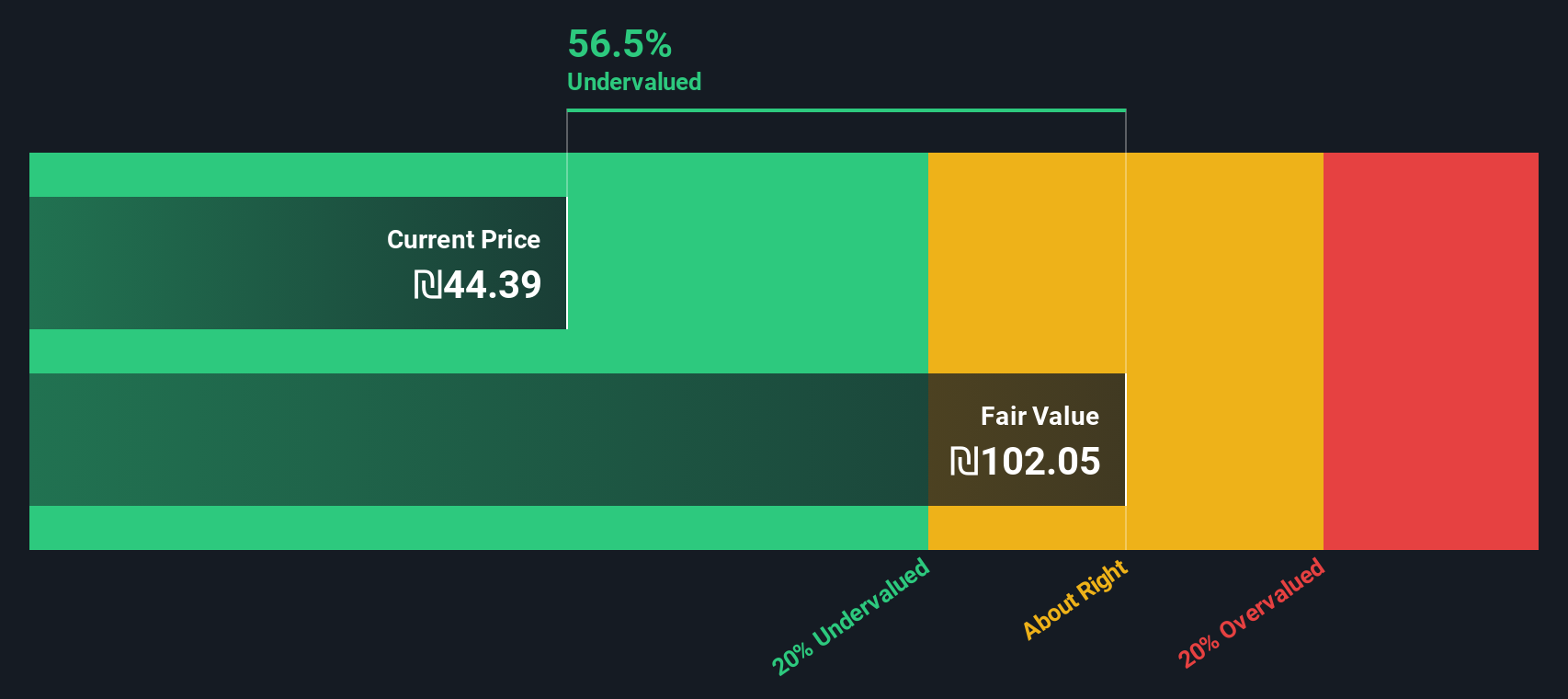

Result: Fair Value of ₪103.20 (UNDERVALUED)

See our latest analysis for Aryt Industries.However, potential risks include uncertain future earnings and the broader sector’s volatility, both of which could affect Aryt’s valuation going forward.

Find out about the key risks to this Aryt Industries narrative.Another View: What Does Our DCF Model Say?

Looking beyond earnings multiples, our DCF model also signals Aryt Industries appears undervalued. This approach factors in projected cash flows and long-term fundamentals and offers a different lens on the company’s prospects. Can both be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aryt Industries Narrative

If you have a different perspective or want to see for yourself, you can assemble your own take in just a few minutes. Do it your way.

A great starting point for your Aryt Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t stop at a single stock. Give yourself a real advantage by tapping into other promising opportunities that you might be missing right now.

- Unlock income potential by checking out dividend stocks with yields > 3%. Here you’ll find companies offering yields that can strengthen your portfolio’s cash flow.

- Catalyze your watchlist with exciting innovation by exploring AI penny stocks. See which trailblazers are shaping the future with artificial intelligence.

- Step ahead of the curve and spot value before the crowd by using undervalued stocks based on cash flows. This tool is designed to reveal businesses currently underappreciated by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ARYT

Aryt Industries

Through its subsidiaries, develops, produces, and markets electronic thunderbolt for the defense market in Israel.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives