If EPS Growth Is Important To You, Bank Hapoalim B.M (TLV:POLI) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Bank Hapoalim B.M (TLV:POLI), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Bank Hapoalim B.M

Bank Hapoalim B.M's Improving Profits

In the last three years Bank Hapoalim B.M's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Bank Hapoalim B.M's EPS soared from ₪3.84 to ₪5.58, over the last year. That's a commendable gain of 45%.

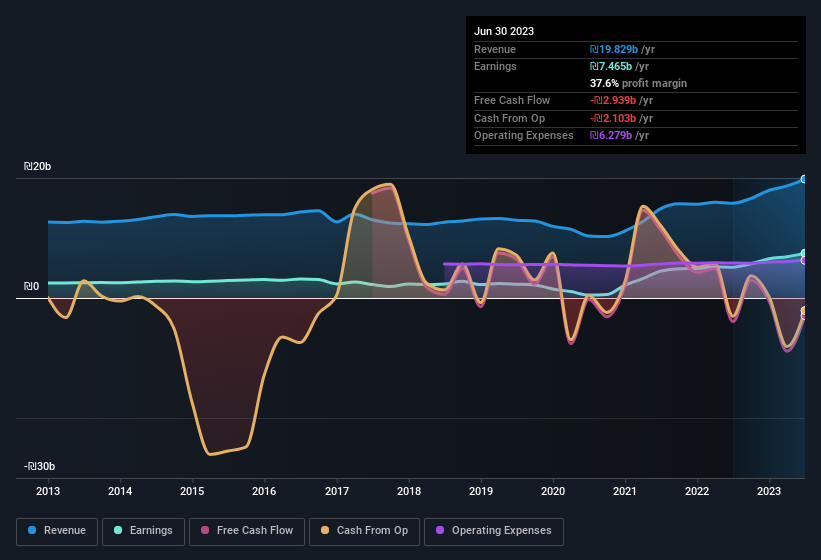

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Bank Hapoalim B.M's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Bank Hapoalim B.M achieved similar EBIT margins to last year, revenue grew by a solid 26% to ₪20b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Bank Hapoalim B.M's forecast profits?

Are Bank Hapoalim B.M Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Bank Hapoalim B.M, with market caps over ₪32b, is about ₪4.4m.

Bank Hapoalim B.M offered total compensation worth ₪3.3m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Bank Hapoalim B.M To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Bank Hapoalim B.M's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. You should always think about risks though. Case in point, we've spotted 2 warning signs for Bank Hapoalim B.M you should be aware of, and 1 of them is concerning.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bank Hapoalim B.M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:POLI

Bank Hapoalim B.M

Provides various banking and financial services in Israel and internationally.

Flawless balance sheet average dividend payer.