Do Mizrahi Tefahot Bank's (TLV:MZTF) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Mizrahi Tefahot Bank (TLV:MZTF), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Mizrahi Tefahot Bank

Mizrahi Tefahot Bank's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Mizrahi Tefahot Bank's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 42%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

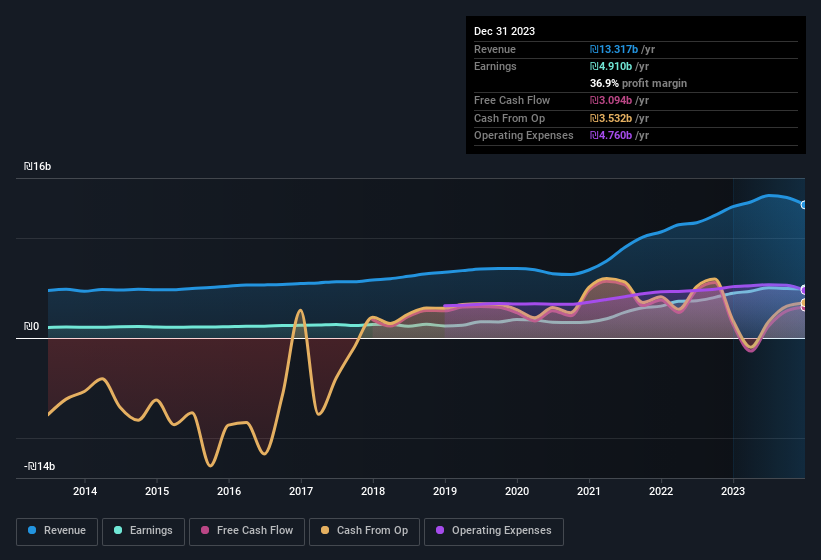

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Mizrahi Tefahot Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. It was a year of stability for Mizrahi Tefahot Bank as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Mizrahi Tefahot Bank's balance sheet strength, before getting too excited.

Are Mizrahi Tefahot Bank Insiders Aligned With All Shareholders?

Does Mizrahi Tefahot Bank Deserve A Spot On Your Watchlist?

Mizrahi Tefahot Bank's earnings per share have been soaring, with growth rates sky high. We should say that we've discovered 1 warning sign for Mizrahi Tefahot Bank that you should be aware of before investing here.

Although Mizrahi Tefahot Bank certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Israeli companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MZTF

Mizrahi Tefahot Bank

Provides a range of international, commercial, domestic, and personal banking services to individuals and businesses in Israel, Switzerland, and internationally.

Flawless balance sheet with proven track record and pays a dividend.