- Turkey

- /

- Infrastructure

- /

- IBSE:EGGUB

Unveiling Middle East Stock Gems With Potential In October 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China escalate, most Gulf markets have been in decline, with key indices like Saudi Arabia's benchmark index dropping 0.8% amid global economic uncertainties. Despite this challenging backdrop, the Middle East continues to present opportunities for investors seeking stocks that can weather market volatility and potentially capitalize on regional growth dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ege Gübre Sanayii (IBSE:EGGUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Gübre Sanayii A.S., along with its subsidiary TCE EGE Konteyner Terminal Isletmeleri A.S., operates in the port services sector in Turkey and has a market capitalization of TRY11.08 billion.

Operations: Ege Gübre Sanayii generates revenue primarily from port services, amounting to TRY2.49 billion. The company also records a segment adjustment of TRY23.22 million and incurs a negative revenue of TRY63.51 million from its chemical fertilizer segment.

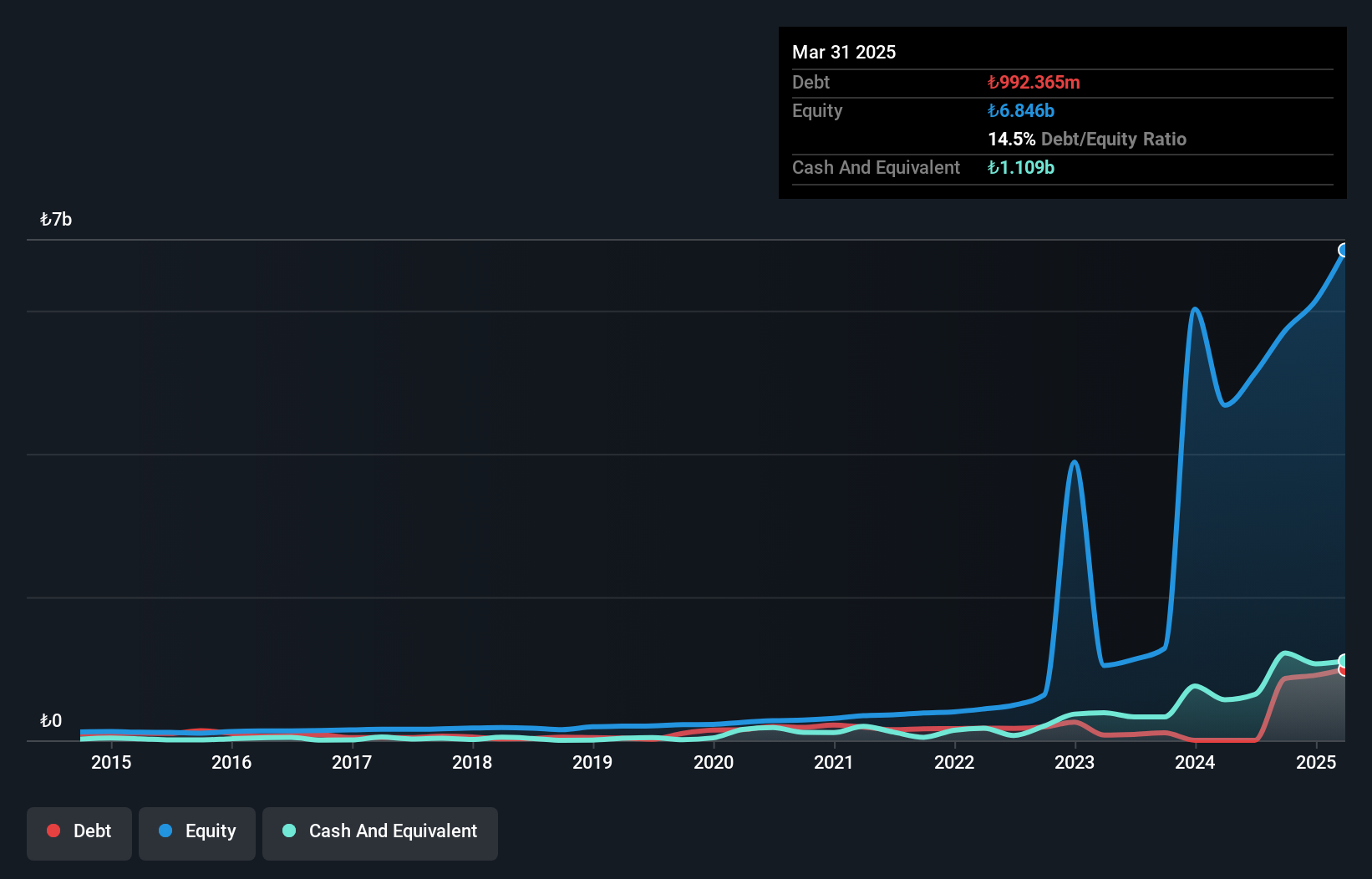

Ege Gübre Sanayii, a compact player in the industry, recently joined the S&P Global BMI Index, signaling increased recognition. Despite a dip in quarterly sales to TRY 738.1 million from TRY 816.99 million and net income falling to TRY 175.67 million from TRY 253.96 million year-over-year, its six-month performance shows promise with net income rising to TRY 256.67 million from just TRY 65.18 million previously. The company's debt management is commendable, having reduced its debt-to-equity ratio significantly over five years to a satisfactory level of 14.8%, indicating prudent financial strategies amidst fluctuating earnings growth rates.

- Take a closer look at Ege Gübre Sanayii's potential here in our health report.

Gain insights into Ege Gübre Sanayii's past trends and performance with our Past report.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is engaged in the production and sale of plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market capitalization of TRY15.21 billion.

Operations: EGPRO generates revenue primarily from building products, amounting to TRY9.12 billion. The company's financial performance is characterized by its focus on the production and sale of plastic goods, contributing significantly to its market presence in Turkey and internationally.

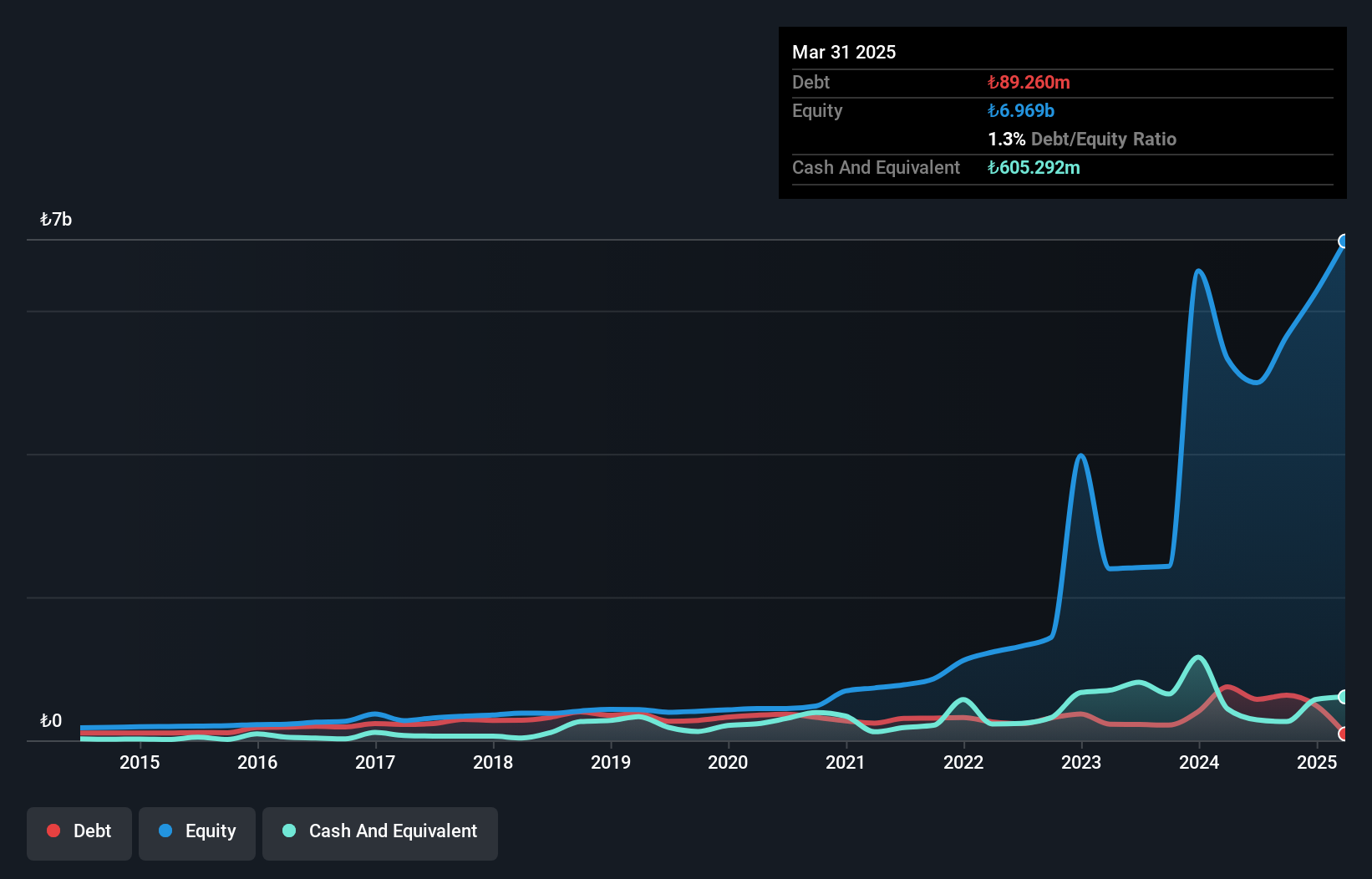

Ege Profil Ticaret ve Sanayi Anonim Sirketi, a player in the building industry, has demonstrated notable earnings growth of 7.8% over the past year, outpacing its industry peers who faced an -11.7%. The company showcases strong financial health with a debt-to-equity ratio dropping from 82.3% to 3.8% in five years and more cash than total debt on hand. However, recent earnings reports indicate some challenges; second-quarter sales were TRY 2,680 million and net income was TRY 189 million compared to higher figures last year. Despite these hurdles, Ege Profil continues delivering high-quality earnings with robust interest coverage.

Bank of Jerusalem (TASE:JBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank of Jerusalem Ltd. offers commercial banking services in Israel and has a market capitalization of ₪1.76 billion.

Operations: The bank's primary revenue streams include housing loans and household services, generating ₪212 million and ₪261.8 million, respectively. Private banking contributes ₪26.9 million, while institutional investors add ₪6.7 million to the revenue. Segment adjustments account for an additional ₪401.2 million in revenue.

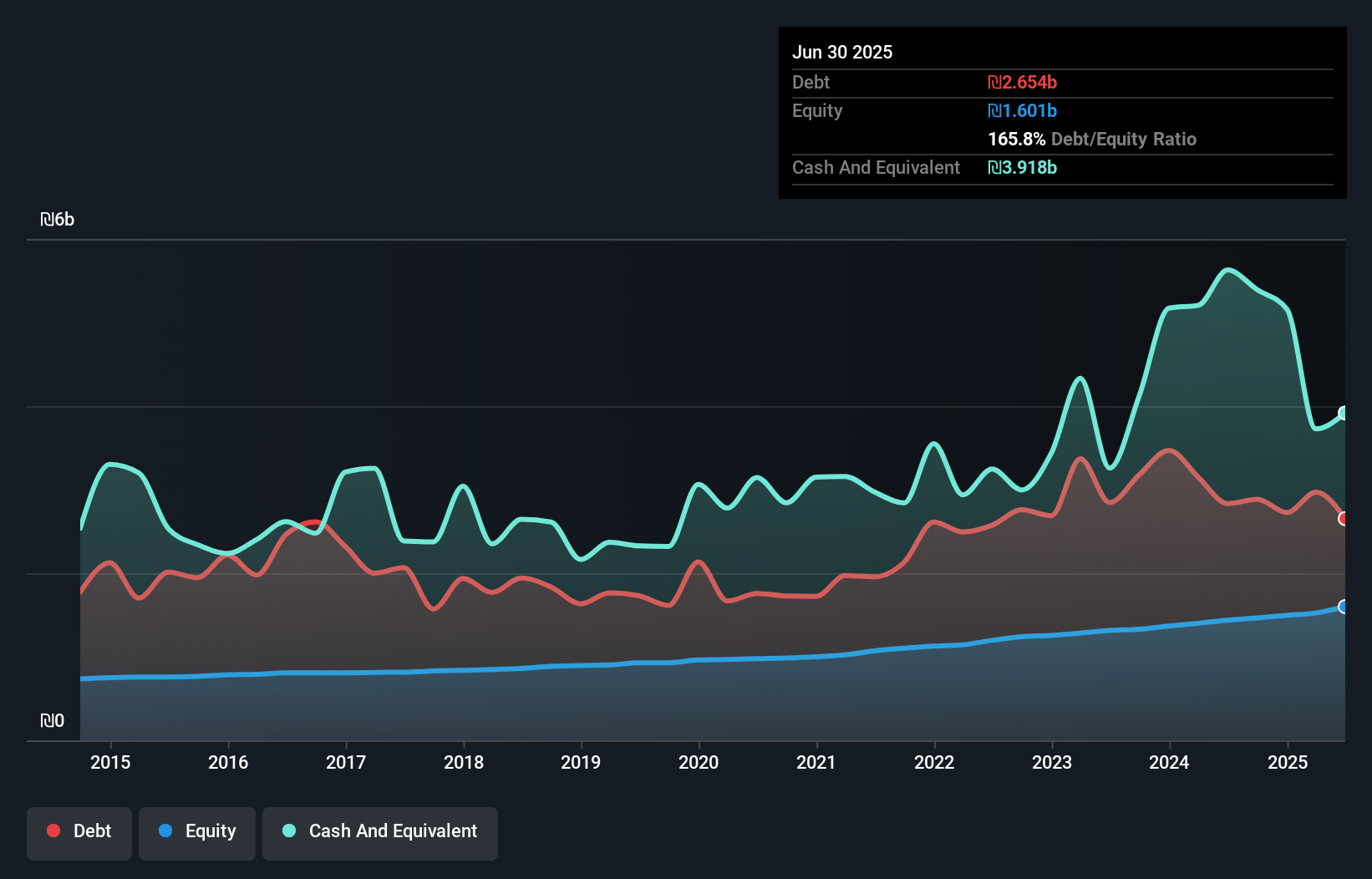

With total assets of ₪21.9 billion and equity of ₪1.6 billion, Bank of Jerusalem stands as a promising player in the region's financial landscape. Total deposits amount to ₪17.3 billion, while loans reach ₪15.8 billion, reflecting a solid loan-to-deposit ratio. The bank's earnings growth over the past year was 20.2%, outpacing the industry average of 12.6%. Its price-to-earnings ratio at 9.8x is notably lower than the IL market average of 15.8x, suggesting potential value for investors seeking opportunities in smaller financial entities with robust earnings performance and primarily low-risk funding sources.

Seize The Opportunity

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 201 more companies for you to explore.Click here to unveil our expertly curated list of 204 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Gübre Sanayii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGGUB

Ege Gübre Sanayii

Together with its subsidiary, TCE EGE Konteyner Terminal Isletmeleri A.S., provides port services in Turkey.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives