Should You Be Adding Ryanair Holdings (ISE:RYA) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Ryanair Holdings (ISE:RYA), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Ryanair Holdings

Ryanair Holdings' Improving Profits

Ryanair Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Ryanair Holdings' EPS catapulted from €0.94 to €1.96, over the last year. Year on year growth of 107% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Ryanair Holdings is growing revenues, and EBIT margins improved by 5.2 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

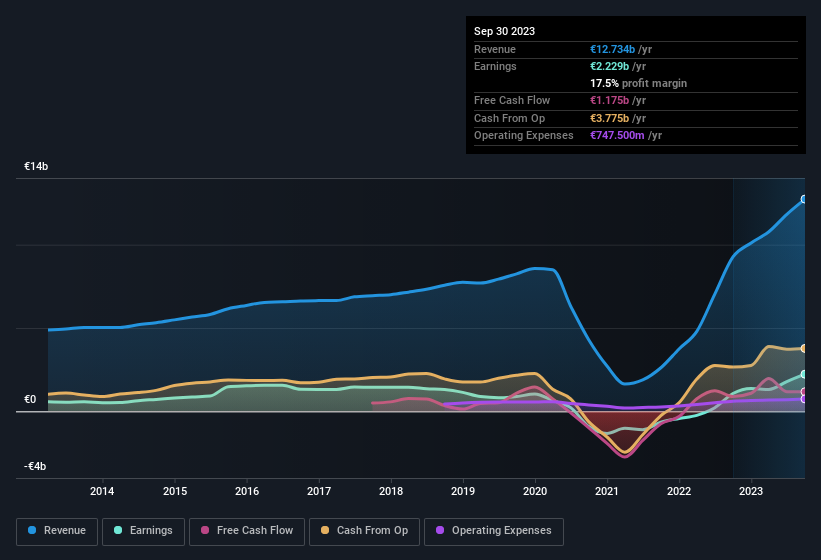

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Ryanair Holdings.

Are Ryanair Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Ryanair Holdings insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Independent Non-Executive Director, Anne Nolan, paid €118k to buy shares at an average price of €15.59. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Along with the insider buying, another encouraging sign for Ryanair Holdings is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth €818m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Ryanair Holdings To Your Watchlist?

Ryanair Holdings' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Ryanair Holdings deserves timely attention. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Ryanair Holdings. You might benefit from giving it a glance today.

The good news is that Ryanair Holdings is not the only growth stock with insider buying. Here's a list of growth-focused companies in IE with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, the United Kingdom, Spain, Italy, and internationally.

Excellent balance sheet with moderate growth potential.