- Ireland

- /

- Healthcare Services

- /

- ISE:UPR

December 2024's Top Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainty in the U.S., which has led to broad-based declines across major indices. Amid these challenges, investors are keenly observing opportunities that could emerge from smaller or newer companies often referred to as penny stocks. Although the term may seem outdated, it remains relevant for identifying companies with potential value. By focusing on those with strong financials and growth prospects, investors can uncover promising opportunities within this unique investment area.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,838 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Commercial Bank International P.S.C (ADX:CBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Commercial Bank International P.S.C., along with its subsidiaries, offers a range of banking products and services to individuals and businesses in the United Arab Emirates, with a market capitalization of AED1.37 billion.

Operations: The company's revenue is primarily derived from Wholesale Banking (AED392.60 million), Real Estate (AED148.07 million), Retail Banking (AED60.95 million), and Treasury operations (AED29.84 million).

Market Cap: AED1.37B

Commercial Bank International P.S.C. has demonstrated robust earnings growth, with a 49.3% increase over the past year, surpassing the industry average of 23.5%. The bank's price-to-earnings ratio of 5.3x suggests it is undervalued compared to the AE market average of 12.9x, and its net profit margin has improved to 39.6%. Despite having a high level of bad loans at 16.1%, its funding primarily comes from low-risk customer deposits (94%). The management team and board are experienced, though share price volatility remains high over recent months.

- Navigate through the intricacies of Commercial Bank International P.S.C with our comprehensive balance sheet health report here.

- Learn about Commercial Bank International P.S.C's historical performance here.

Uniphar (ISE:UPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

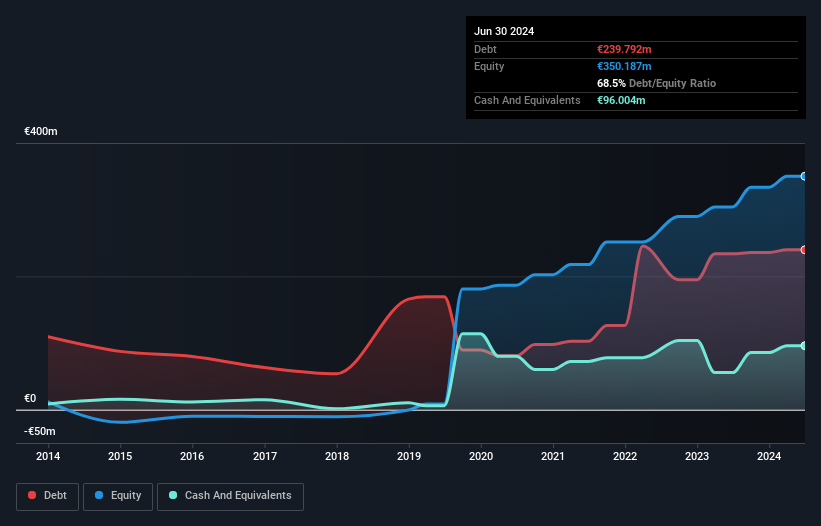

Overview: Uniphar plc is a diversified healthcare services company operating in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally, with a market cap of €573.33 million.

Operations: The company's revenue is generated from three main segments: Pharma (€657.34 million), Medtech (€252.93 million), and Supply Chain & Retail (€1.77 billion).

Market Cap: €573.33M

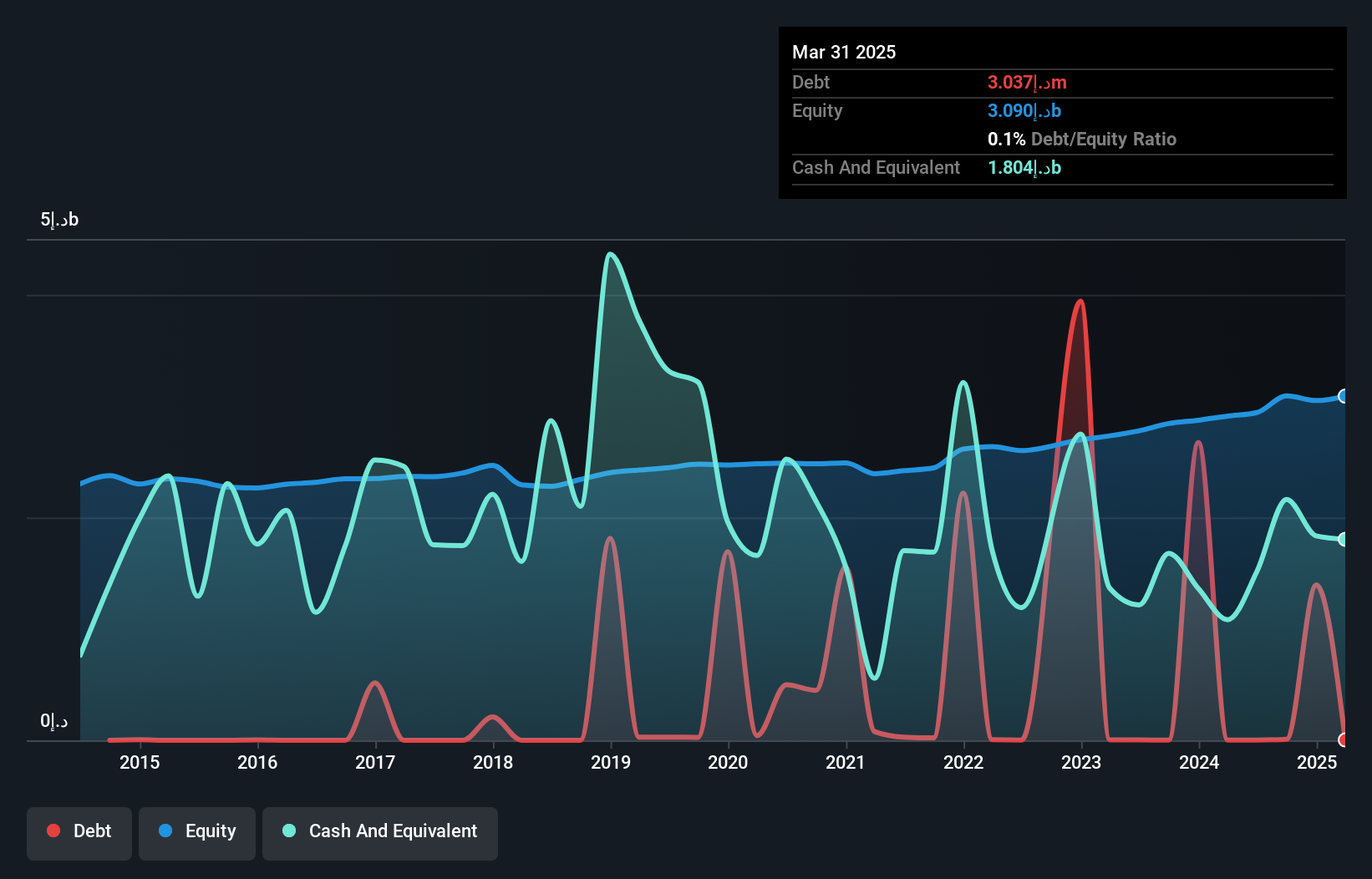

Uniphar plc, with a market cap of €573.33 million, operates in diverse healthcare sectors and generates substantial revenue from its Pharma (€657.34M), Medtech (€252.93M), and Supply Chain & Retail (€1.77B) segments. The company's financial position shows a high net debt to equity ratio of 41.1%, though debt is well covered by operating cash flow (54.2%). While earnings have grown by 17.2% annually over five years, recent growth slowed to 1.4%. Uniphar's price-to-earnings ratio of 12.7x suggests value compared to industry averages, and the company continues expanding its cell and gene therapy programs globally.

- Click to explore a detailed breakdown of our findings in Uniphar's financial health report.

- Understand Uniphar's earnings outlook by examining our growth report.

Ratchthani Leasing (SET:THANI)

Simply Wall St Financial Health Rating: ★★★★☆☆

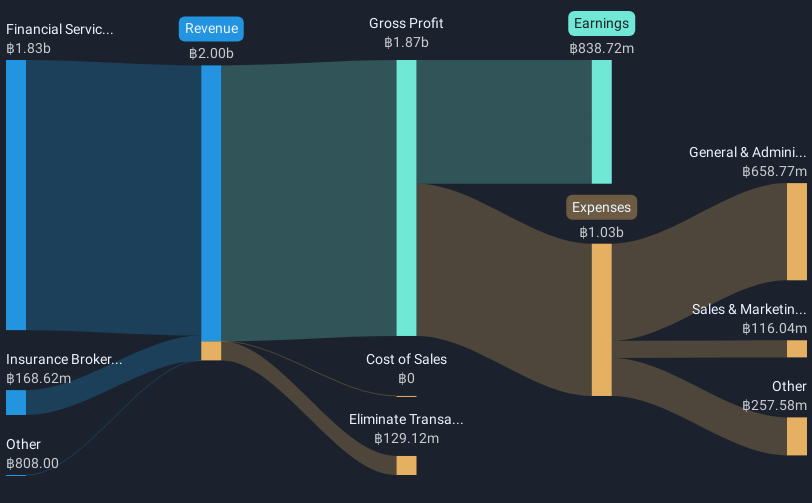

Overview: Ratchthani Leasing Public Company Limited, along with its subsidiary, offers hire-purchase and leasing services in Thailand and has a market cap of approximately THB9.97 billion.

Operations: The company's revenue is primarily derived from its financial service business, generating THB1.83 billion, and its insurance brokerage business, contributing THB168.62 million.

Market Cap: THB9.97B

Ratchthani Leasing, with a market cap of THB9.97 billion, faces challenges in its financial performance despite being considered good value compared to peers. The company reported declining revenues and net income for the third quarter and nine months ending September 2024, with earnings per share also decreasing from the previous year. While short-term assets exceed liabilities and debt is well covered by operating cash flow, Ratchthani's high net debt to equity ratio of 265.4% indicates significant leverage. The board and management are experienced; however, negative earnings growth over the past year highlights ongoing profitability concerns amidst stable weekly volatility.

- Click here to discover the nuances of Ratchthani Leasing with our detailed analytical financial health report.

- Learn about Ratchthani Leasing's future growth trajectory here.

Taking Advantage

- Discover the full array of 5,838 Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives