- Taiwan

- /

- Semiconductors

- /

- TWSE:3661

3 Stocks Estimated To Be Up To 49.2% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets celebrated the prospect of upcoming interest rate cuts, with major indices like the Dow Jones Industrial Average and S&P 500 Index nearing record highs, investors are increasingly looking for opportunities to capitalize on undervalued stocks. In this favorable environment, identifying stocks that are trading below their intrinsic value can offer significant potential for growth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kaspi.kz (NasdaqGS:KSPI) | US$125.27 | US$249.46 | 49.8% |

| IMAGICA GROUP (TSE:6879) | ¥505.00 | ¥1005.28 | 49.8% |

| Singapore Technologies Engineering (SGX:S63) | SGD4.48 | SGD8.96 | 50% |

| Heartland Financial USA (NasdaqGS:HTLF) | US$54.97 | US$109.68 | 49.9% |

| Stille (OM:STIL) | SEK222.00 | SEK442.89 | 49.9% |

| Tencent Holdings (SEHK:700) | HK$381.80 | HK$761.31 | 49.8% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.08 | SGD2.16 | 49.9% |

| Bilibili (NasdaqGS:BILI) | US$14.26 | US$28.47 | 49.9% |

| Kempower Oyj (HLSE:KEMPOWR) | €12.73 | €25.41 | 49.9% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.013 | €0.026 | 49.9% |

Here's a peek at a few of the choices from the screener.

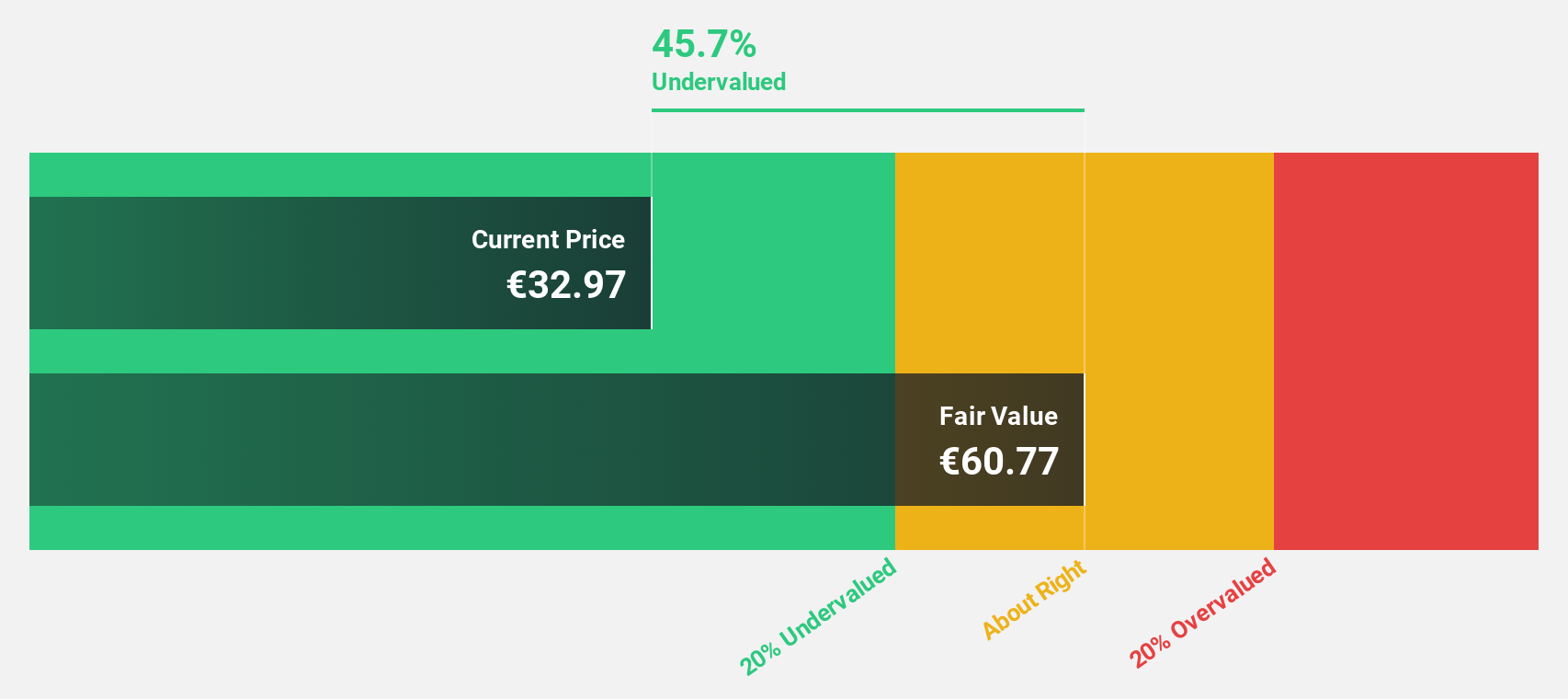

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates wireless telecommunication infrastructure across multiple European countries and has a market cap of €24.89 billion.

Operations: Cellnex generates revenue primarily from its wireless telecommunication infrastructure operations across Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Estimated Discount To Fair Value: 49.2%

Cellnex Telecom (CLNX) is trading at €35.28, significantly below its estimated fair value of €69.52, suggesting it may be undervalued based on discounted cash flows. Despite reporting a net loss of €418.09 million for H1 2024, the company is in advanced negotiations to divest its Austrian operations and has raised €625 million through a private placement. Revenue growth is expected to outpace the Spanish market at 5.9% annually, with profitability anticipated within three years.

- The growth report we've compiled suggests that Cellnex Telecom's future prospects could be on the up.

- Navigate through the intricacies of Cellnex Telecom with our comprehensive financial health report here.

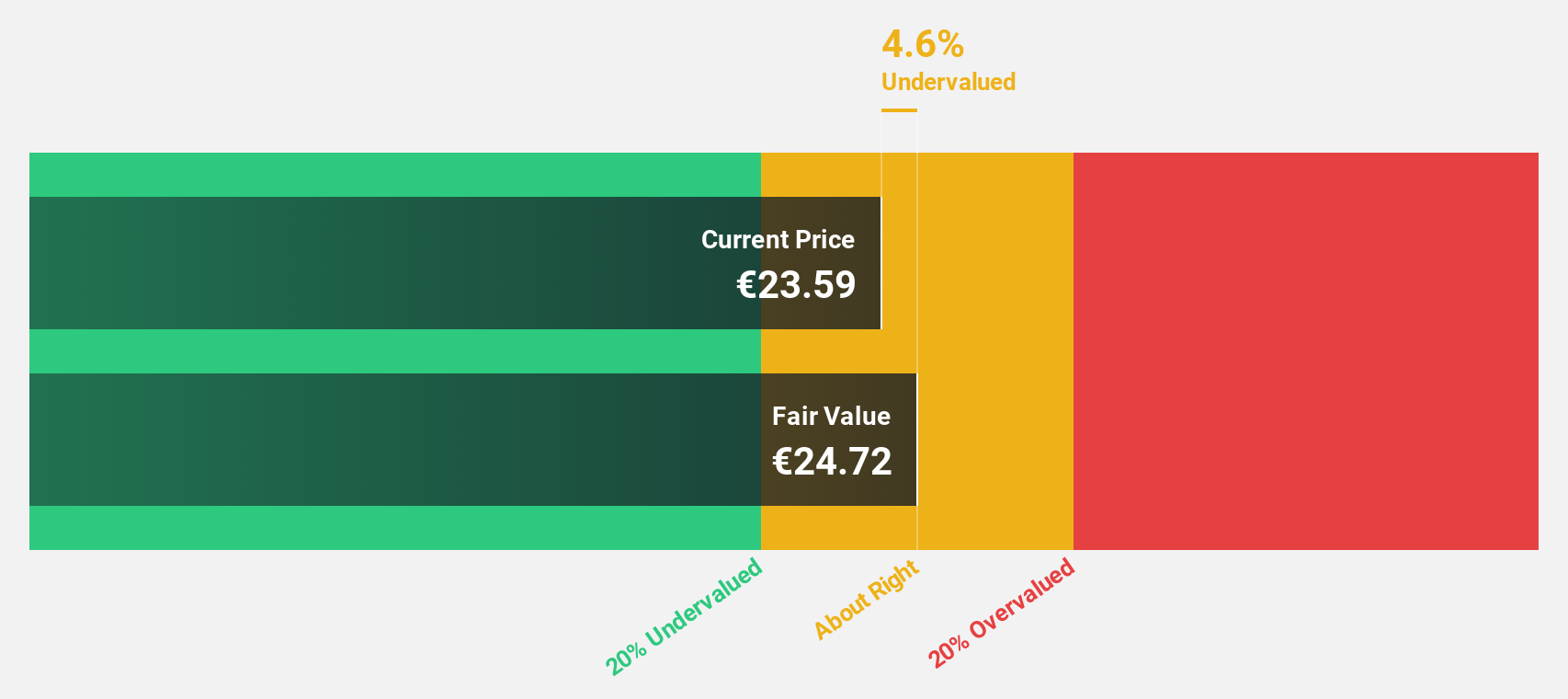

Ryanair Holdings (ISE:RYA)

Overview: Ryanair Holdings plc, with a market cap of €16.75 billion, operates scheduled-passenger airline services in Ireland, the United Kingdom, Spain, Italy, and internationally.

Operations: Ryanair Holdings generates revenue primarily from Ryanair DAC (€14.06 billion) and Other Airlines (€1.51 billion).

Estimated Discount To Fair Value: 32.1%

Ryanair Holdings is trading at €15.12, well below its estimated fair value of €22.25, indicating it is undervalued based on discounted cash flows. Despite a volatile share price and an unstable dividend track record, the company forecasts annual revenue growth of 6.3% and earnings growth of 10.1%, both outpacing the Irish market averages. Recent legal victories and consistent passenger traffic increases further bolster its financial outlook despite mixed recent earnings results.

- In light of our recent growth report, it seems possible that Ryanair Holdings' financial performance will exceed current levels.

- Get an in-depth perspective on Ryanair Holdings' balance sheet by reading our health report here.

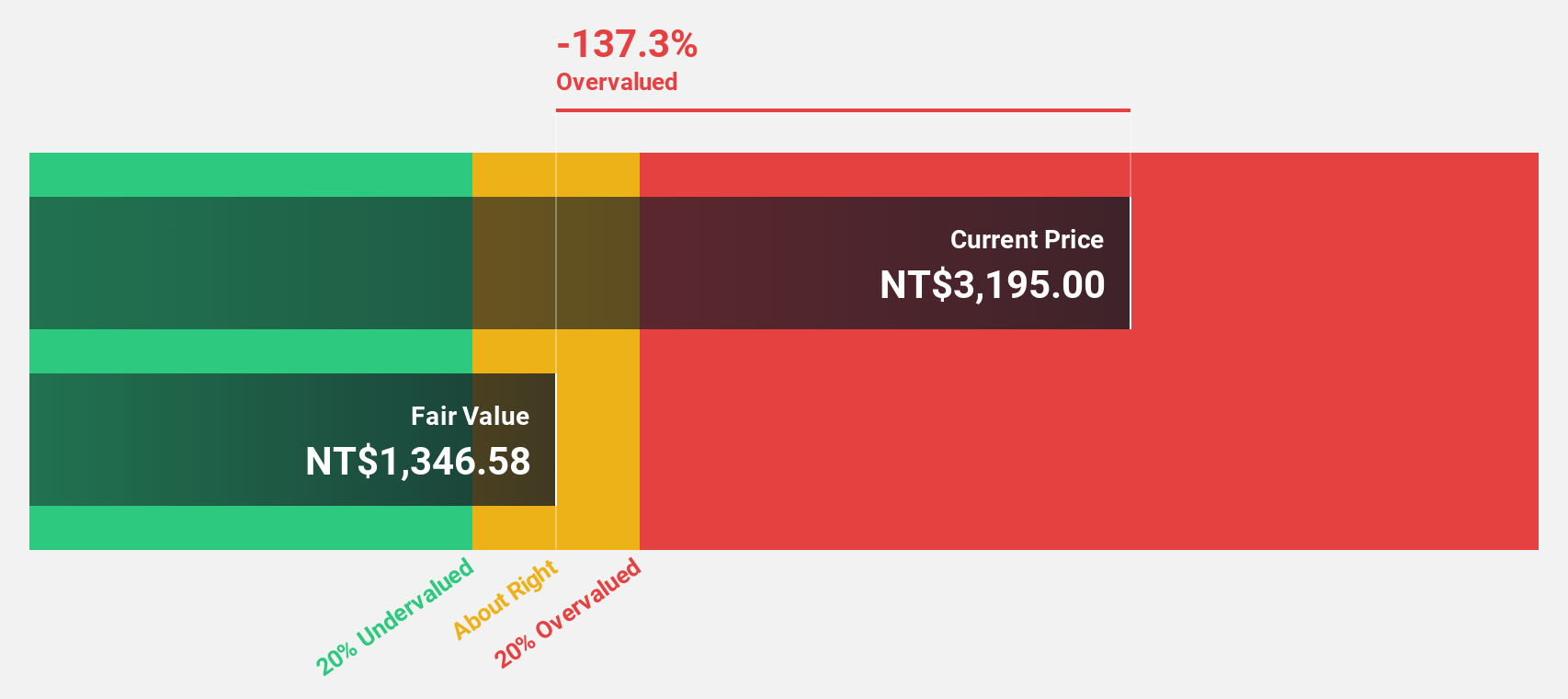

Alchip Technologies (TWSE:3661)

Overview: Alchip Technologies, Limited, with a market cap of NT$200.33 billion, engages in the research and development, design, and manufacture of fabless application-specific integrated circuits (ASIC) and system on a chip (SOC) in Japan, Taiwan, and China.

Operations: The company generates revenue of NT$35.26 billion from its semiconductor segment.

Estimated Discount To Fair Value: 47.7%

Alchip Technologies is trading at NT$2665, significantly below its estimated fair value of NT$5099.43, making it highly undervalued based on discounted cash flows. The company has shown robust earnings growth of 101.8% over the past year and forecasts annual profit growth of 32.34%, outpacing the Taiwan market average. Despite recent share price volatility, Alchip's revenue is expected to grow at 25.2% per year, well above market rates.

- Our earnings growth report unveils the potential for significant increases in Alchip Technologies' future results.

- Dive into the specifics of Alchip Technologies here with our thorough financial health report.

Key Takeaways

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 949 more companies for you to explore.Click here to unveil our expertly curated list of 952 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3661

Alchip Technologies

Research, designs, and manufactures fabless application specific integrated circuits (ASIC) and system on a chip (SOC)in Japan, Taiwan, and China.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives