If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Speaking of which, we noticed some great changes in Uniphar's (ISE:UPR) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Uniphar, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = €43m ÷ (€733m - €326m) (Based on the trailing twelve months to June 2020).

Therefore, Uniphar has an ROCE of 11%. In absolute terms, that's a satisfactory return, but compared to the Healthcare industry average of 7.2% it's much better.

See our latest analysis for Uniphar

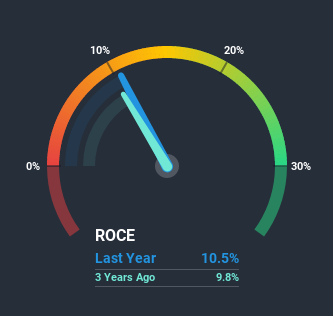

Above you can see how the current ROCE for Uniphar compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From Uniphar's ROCE Trend?

Uniphar is displaying some positive trends. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 11%. The amount of capital employed has increased too, by 879%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 45%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. So shareholders would be pleased that the growth in returns has mostly come from underlying business performance. However, current liabilities are still at a pretty high level, so just be aware that this can bring with it some risks.

What We Can Learn From Uniphar's ROCE

All in all, it's terrific to see that Uniphar is reaping the rewards from prior investments and is growing its capital base. And with the stock having performed exceptionally well over the last year, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing, we've spotted 2 warning signs facing Uniphar that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Uniphar, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally.

Adequate balance sheet and fair value.