- Ireland

- /

- Healthcare Services

- /

- ISE:UPR

Does Uniphar's (ISE:UPR) Share Price Gain of 83% Match Its Business Performance?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Uniphar plc (ISE:UPR) share price is 83% higher than it was a year ago, much better than the market return of around 11% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Uniphar hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Uniphar

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Uniphar actually saw its earnings per share drop 39%.

So we don't think that investors are paying too much attention to EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 0.3% dividend yield is doing much to support the share price. However the year on year revenue growth of 12% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

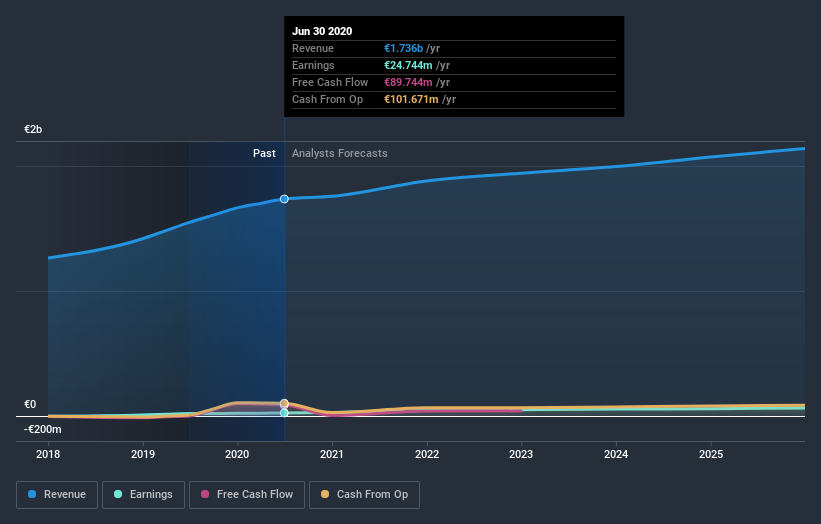

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Uniphar will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Uniphar shareholders have gained 84% over the last year, including dividends. The more recent returns haven't been as impressive as the longer term returns, coming in at just 9.9%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). It's always interesting to track share price performance over the longer term. But to understand Uniphar better, we need to consider many other factors. For example, we've discovered 2 warning signs for Uniphar that you should be aware of before investing here.

Uniphar is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IE exchanges.

If you decide to trade Uniphar, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally.

Adequate balance sheet and fair value.