- Sweden

- /

- Commercial Services

- /

- OM:BONG

European Penny Stocks With Market Caps Under €2B To Keep An Eye On

Reviewed by Simply Wall St

Amid concerns about global growth and a stronger euro, the pan-European STOXX Europe 600 Index recently ended slightly lower, reflecting mixed performances across major stock indexes in the region. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—remain an intriguing segment of the market. Although the term "penny stock" might seem outdated, these companies can offer unique opportunities for growth and value when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.26 | €1.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Maps (BIT:MAPS) | €3.37 | €44.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €247.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.14 | €66.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.20 | €10.15M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.475 | €395.52M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.69 | €72.54M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.11 | €291.65M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.93 | €31.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 330 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, along with its subsidiaries, focuses on constructing and selling houses and apartments to private buyers, local authorities, and the private rental sector in Ireland, with a market cap of €1.05 billion.

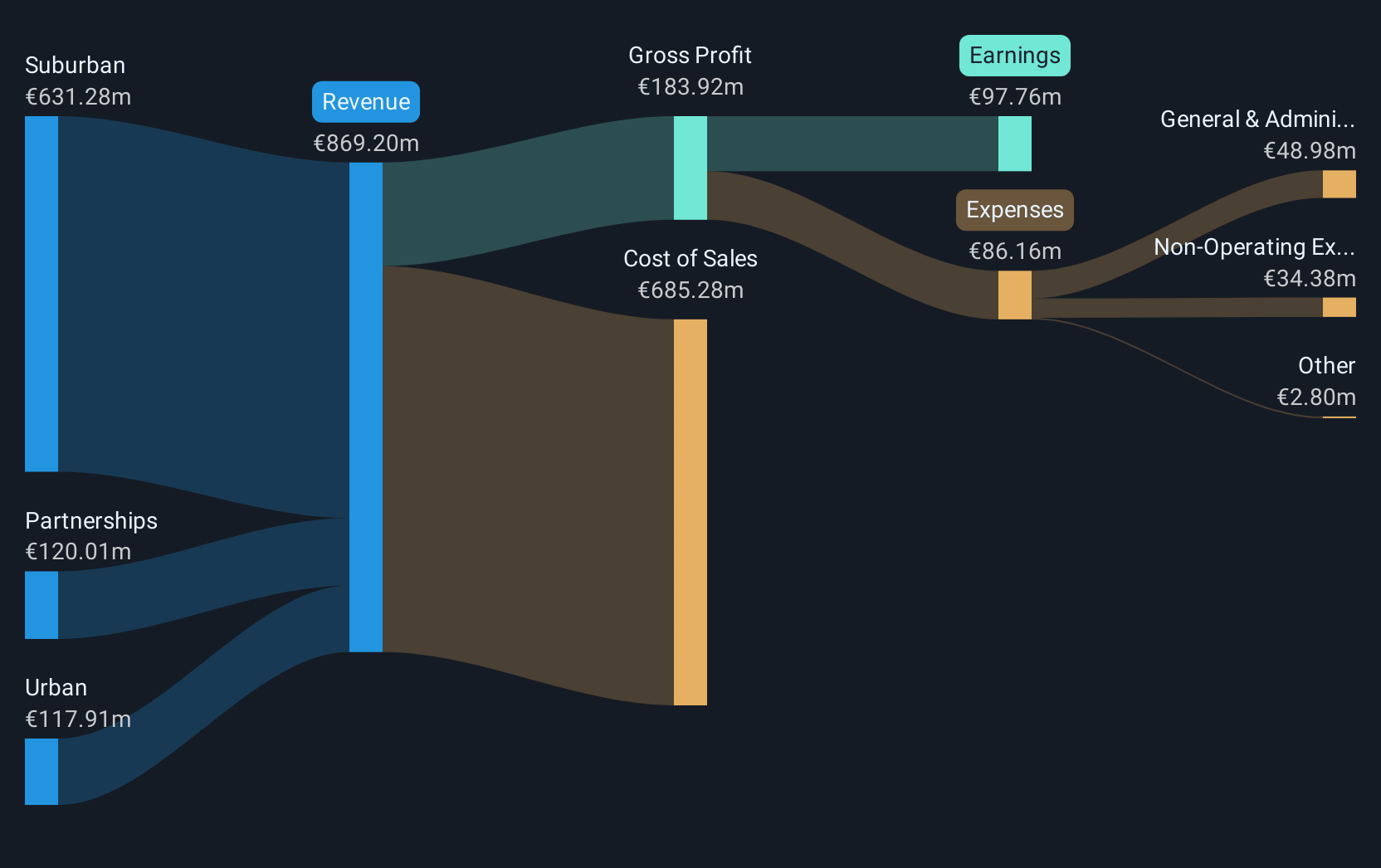

Operations: The company's revenue is derived from three segments: Suburban (€631.28 million), Partnerships (€120.01 million), and Urban (€117.91 million).

Market Cap: €1.05B

Glenveagh Properties exhibits a strong financial position with short-term assets of €1.1 billion covering both short- and long-term liabilities, while its net debt to equity ratio remains satisfactory at 23.5%. Despite negative operating cash flow indicating debt isn't well covered, the company has achieved significant earnings growth of 107.5% over the past year, surpassing its five-year average. However, the return on equity is relatively low at 13%, and there is a high level of non-cash earnings. Trading significantly below estimated fair value suggests potential for appreciation if fundamentals align positively in future assessments.

- Click here and access our complete financial health analysis report to understand the dynamics of Glenveagh Properties.

- Evaluate Glenveagh Properties' prospects by accessing our earnings growth report.

Bong (OM:BONG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bong AB (publ) is a company that offers light packaging and envelope products across Central Europe, South Europe, North Africa, the Nordics, and the United Kingdom with a market cap of SEK172.34 million.

Operations: The company's revenue is primarily derived from Central Europe (SEK844 million), the United Kingdom (SEK288.19 million), and the Nordics (SEK233.04 million).

Market Cap: SEK172.34M

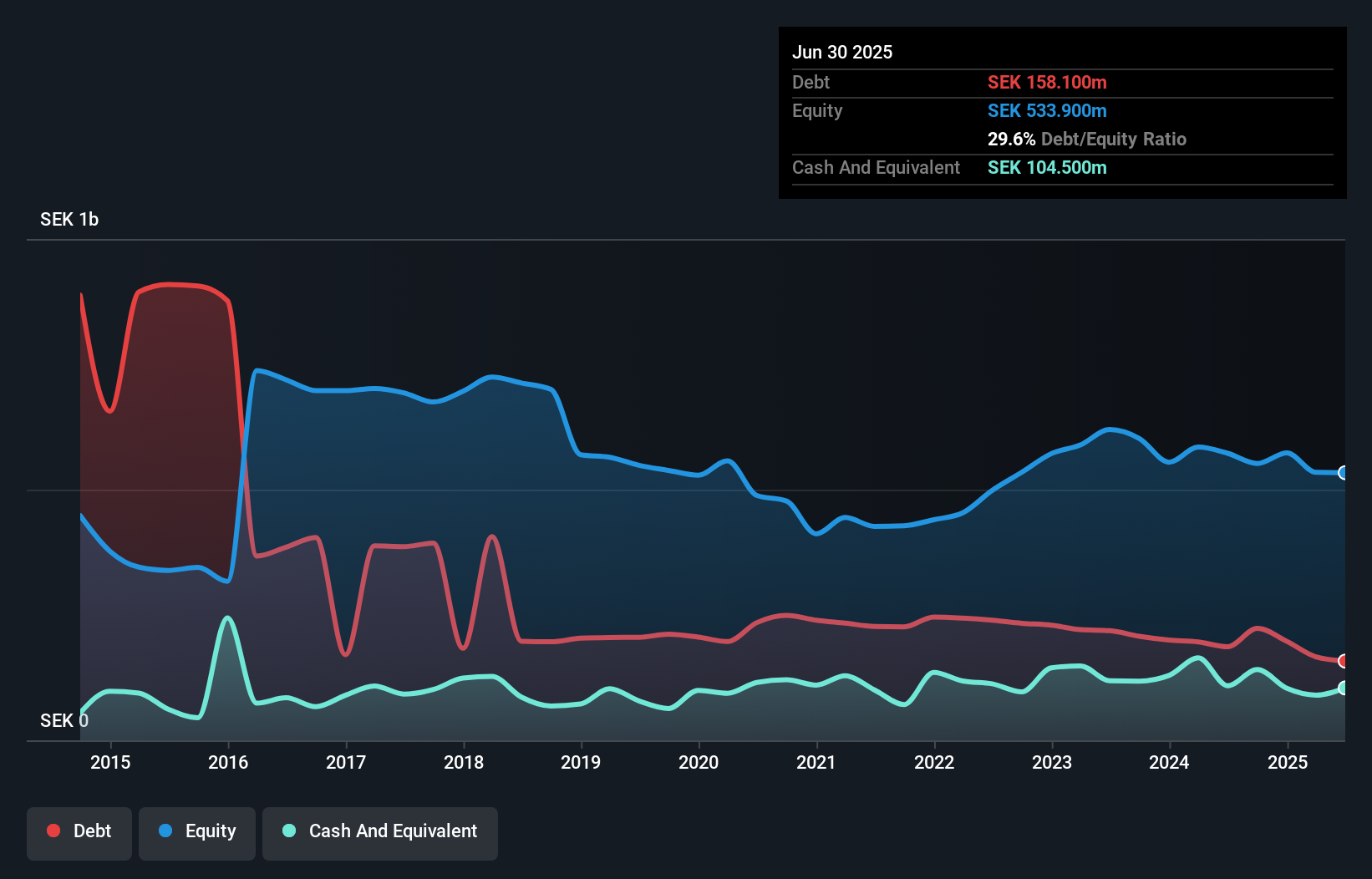

Bong AB, focused on light packaging and envelopes, shows a mixed financial picture. The company has reduced its debt to equity ratio from 48.1% to 29.6% over five years and maintains short-term assets of SEK586.9 million that cover both short- and long-term liabilities. Despite being unprofitable with a net loss of SEK17 million for the first half of 2025, Bong's cash runway exceeds three years due to positive free cash flow growth at 5.6% annually. Trading at a significant discount below estimated fair value suggests potential if profitability improves amidst stable volatility and no recent shareholder dilution.

- Dive into the specifics of Bong here with our thorough balance sheet health report.

- Learn about Bong's historical performance here.

Eniro Group (OM:ENRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eniro Group AB (publ) is a software-as-a-service company operating in Sweden, Norway, Denmark, and Finland with a market cap of SEK335.64 million.

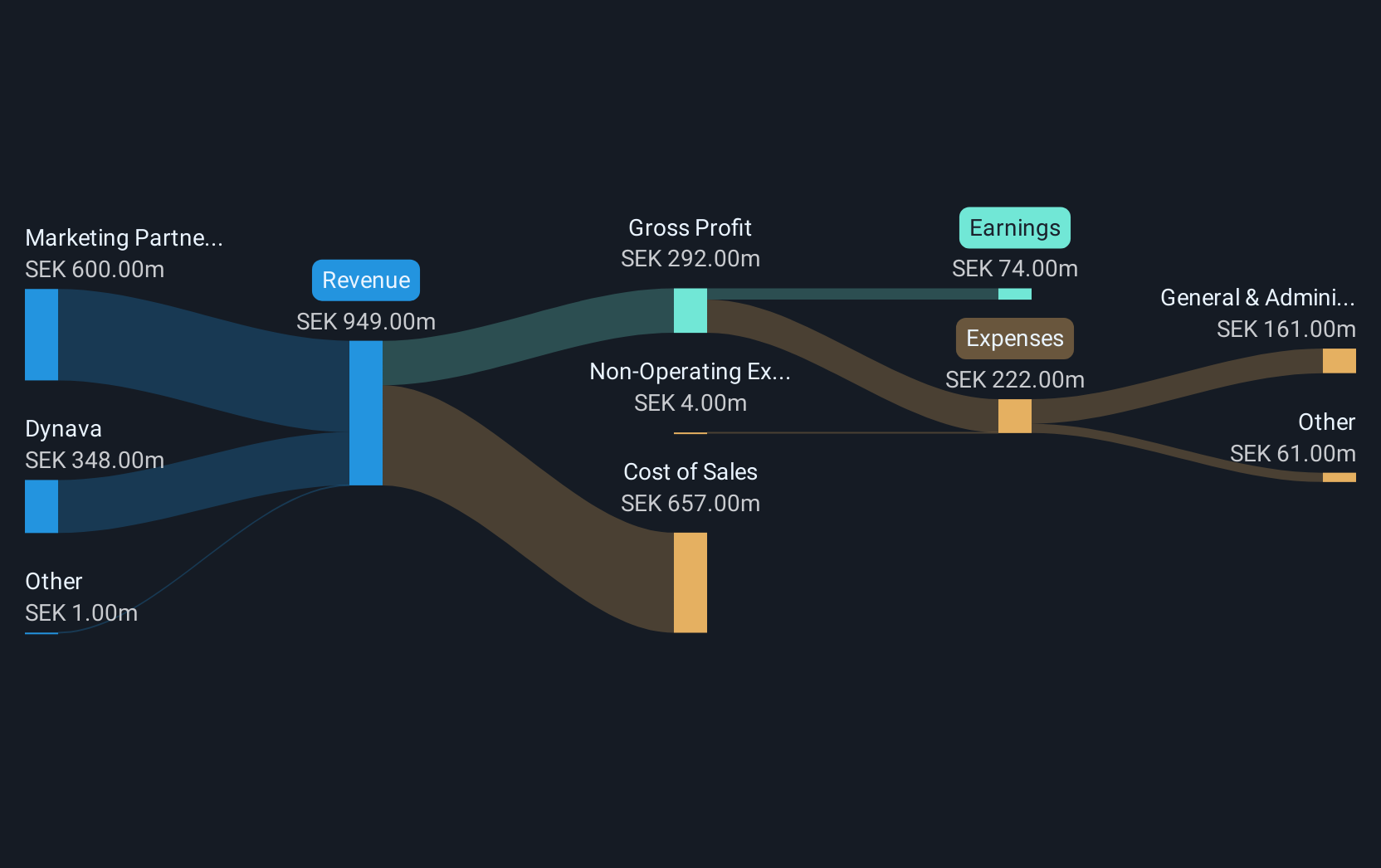

Operations: The company's revenue is derived from its Dynava segment, contributing SEK348 million, and the Marketing Partner segment, generating SEK600 million.

Market Cap: SEK335.64M

Eniro Group AB, a software-as-a-service company, presents an intriguing profile within the penny stock landscape. The company operates debt-free, with short-term assets of SEK320 million surpassing long-term liabilities of SEK305 million. Its profitability has improved significantly over the past year with net profit margins rising from 3.7% to 7.8%. Earnings growth stands out at 111.4%, far exceeding industry trends and reflecting high-quality earnings and a robust return on equity of 24.8%. Despite this progress, challenges remain as short-term liabilities exceed short-term assets by SEK41 million and recent sales have slightly declined year-over-year.

- Click here to discover the nuances of Eniro Group with our detailed analytical financial health report.

- Explore historical data to track Eniro Group's performance over time in our past results report.

Seize The Opportunity

- Gain an insight into the universe of 330 European Penny Stocks by clicking here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 23 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONG

Bong

Provides light packaging and envelope products in Central Europe, South Europe, North Africa, Nordics, and the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Community Narratives