- France

- /

- Diversified Financial

- /

- ENXTPA:MF

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate mixed signals with U.S. stocks closing another strong year despite recent underperformance, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts to gauge future market directions. Amid these conditions, dividend stocks continue to attract attention for their potential to provide steady income streams, offering a degree of stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

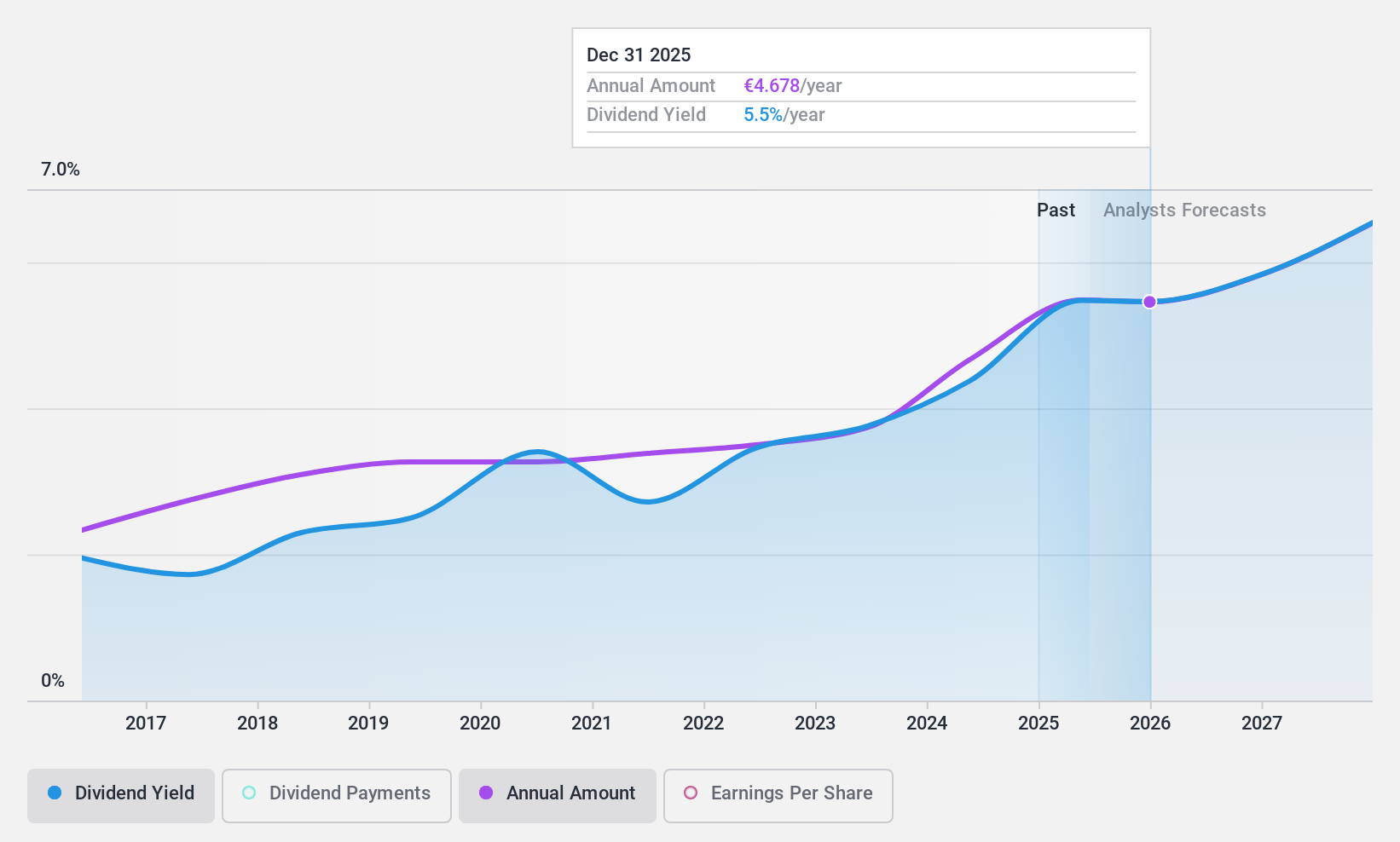

Wendel (ENXTPA:MF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm focusing on equity financing in middle markets and later stages through leveraged buy-outs, transactions, and acquisitions, with a market cap of €3.95 billion.

Operations: Wendel's revenue is primarily derived from Bureau Veritas (€5.99 billion), followed by Stahl (€935.20 million), CPI (€136 million), and ACAMS (€93.60 million).

Dividend Yield: 4.2%

Wendel's dividend payments have been reliable and stable over the past decade, with growth despite some concerns about sustainability. The dividend yield of 4.25% is lower than the top quartile in France but remains covered by cash flows due to a low payout ratio of 14.2%. However, earnings do not cover these dividends, indicating potential risks if profitability does not improve. Recent sales growth to €5.92 billion year-to-date suggests positive revenue momentum.

- Click here and access our complete dividend analysis report to understand the dynamics of Wendel.

- In light of our recent valuation report, it seems possible that Wendel is trading behind its estimated value.

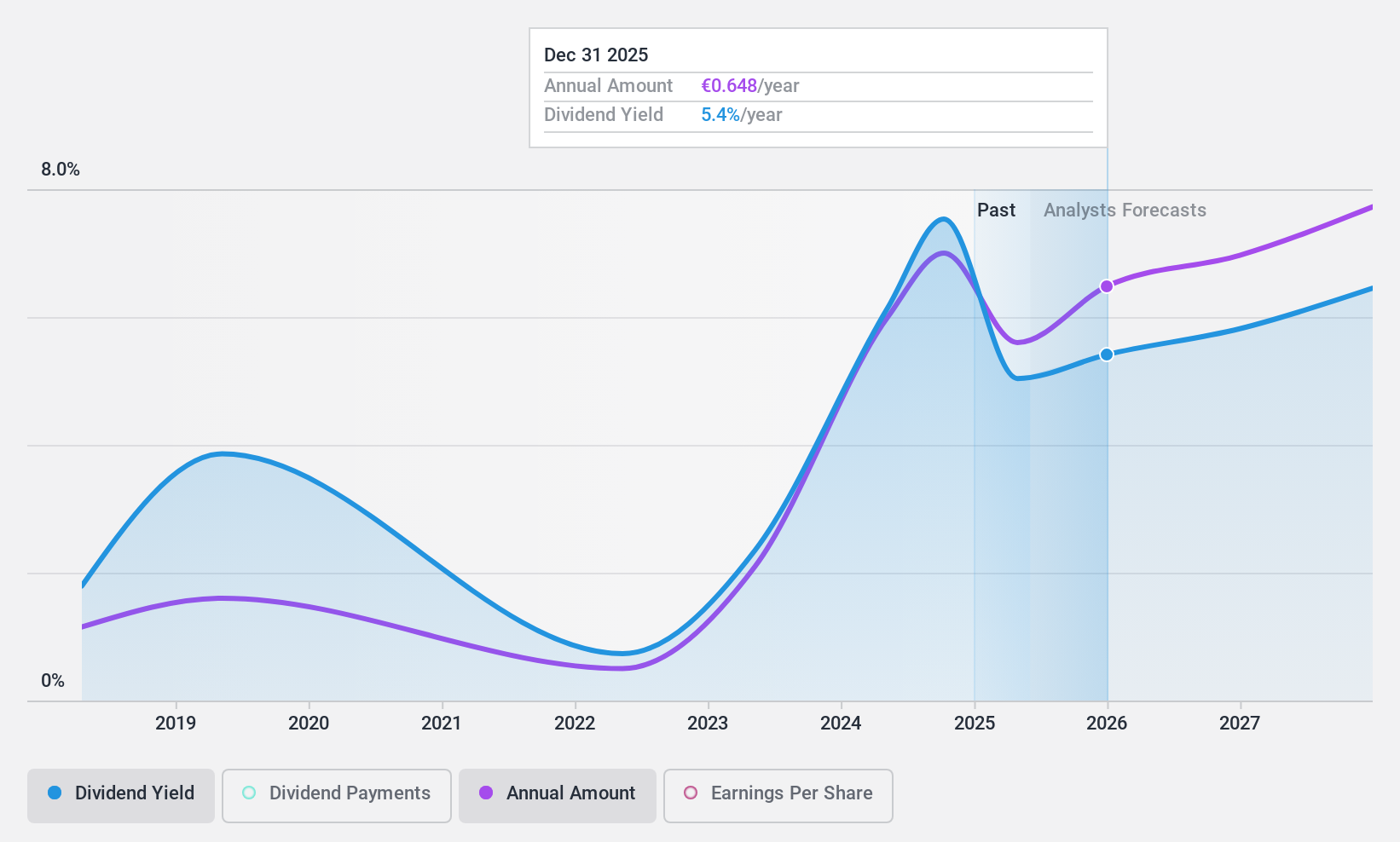

Bank of Ireland Group (ISE:BIRG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Ireland Group plc offers a range of banking and financial products and services, with a market cap of approximately €8.68 billion.

Operations: Bank of Ireland Group plc's revenue is primarily derived from its Retail Ireland segment (€1.59 billion), Corporate and Commercial segment (€1.64 billion), Retail UK segment (€577 million), and Wealth and Insurance segment (€341 million).

Dividend Yield: 7.9%

Bank of Ireland Group's dividend history is marked by volatility, with payments increasing but only over a 7-year period. The payout ratio stands at 64.8%, indicating dividends are currently covered by earnings, and forecasts suggest improved coverage in three years. However, the company's high level of bad loans (2.9%) and low allowance for these loans (52%) may pose risks to financial stability. Despite these challenges, the stock trades at good value relative to peers and industry benchmarks.

- Click here to discover the nuances of Bank of Ireland Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bank of Ireland Group shares in the market.

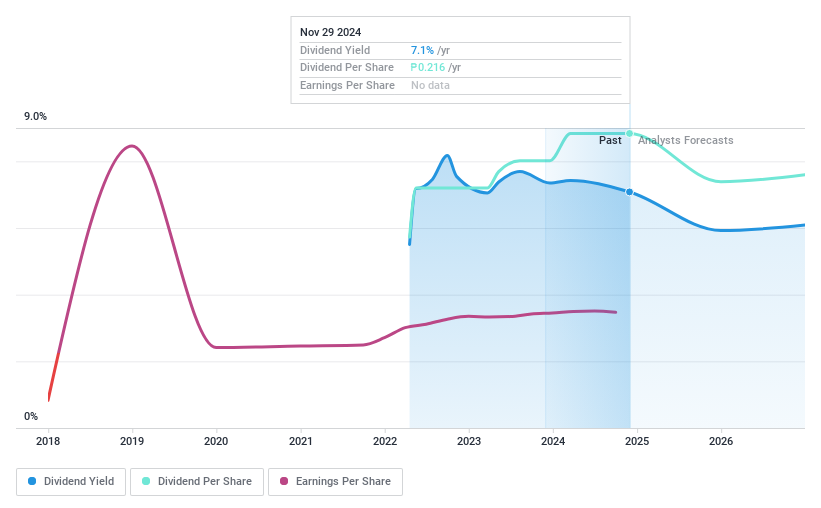

Citicore Energy REIT (PSE:CREIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Citicore Energy REIT (PSE:CREIT) is the Philippines' first renewable energy real estate investment trust and largest renewable energy landlord, with a market cap of ₱20.23 billion, supported by its sponsor, Citicore Renewable Energy Corporation.

Operations: CREIT generates its revenue primarily from leasing, with earnings of ₱1.87 billion.

Dividend Yield: 7.0%

Citicore Energy REIT's dividends, covered by earnings (79.5%) and cash flows (87.6%), have grown steadily over three years, placing its yield in the top 25% of the PH market. Despite stable payouts, limited history underpins long-term reliability concerns. Recent executive changes include appointing Michelle A. Magdato as CFO and Treasurer following resignations. Q3 2024 saw reduced sales and net income compared to last year, yet nine-month figures showed growth in both metrics.

- Click to explore a detailed breakdown of our findings in Citicore Energy REIT's dividend report.

- Upon reviewing our latest valuation report, Citicore Energy REIT's share price might be too pessimistic.

Key Takeaways

- Embark on your investment journey to our 1979 Top Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wendel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MF

Wendel

A private equity firm specializing in equity financing in middle markets and later stages through leveraged buy-out and transactions and acquisitions.

Undervalued with adequate balance sheet and pays a dividend.