Here's Why Bank of Ireland Group (ISE:BIRG) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Bank of Ireland Group (ISE:BIRG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Bank of Ireland Group

How Quickly Is Bank of Ireland Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Bank of Ireland Group has grown EPS by 26% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

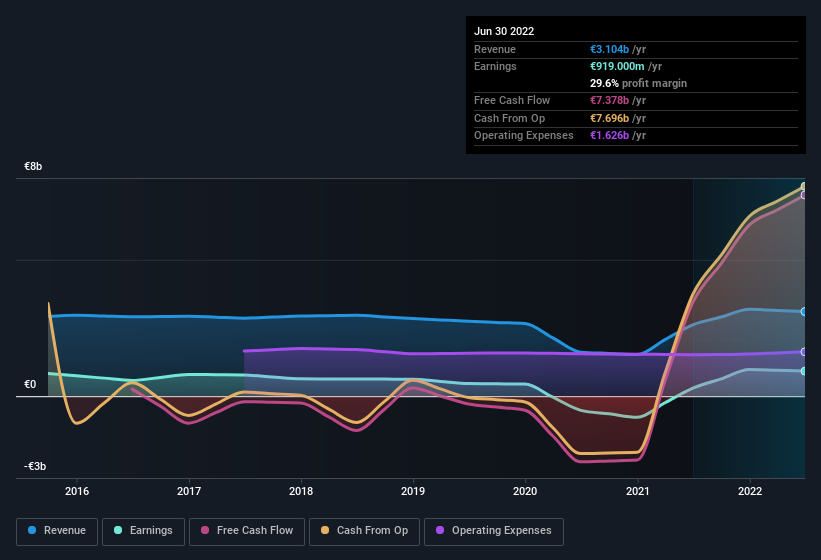

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Bank of Ireland Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Bank of Ireland Group maintained stable EBIT margins over the last year, all while growing revenue 19% to €3.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Bank of Ireland Group.

Are Bank of Ireland Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Bank of Ireland Group insiders refrain from selling stock during the year, but they also spent €100k buying it. This is a good look for the company as it paints an optimistic picture for the future.

It's commendable to see that insiders have been buying shares in Bank of Ireland Group, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. Our analysis has discovered that the median total compensation for the CEOs of companies like Bank of Ireland Group with market caps between €4.0b and €12b is about €2.4m.

Bank of Ireland Group's CEO took home a total compensation package of €960k in the year prior to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Bank of Ireland Group Worth Keeping An Eye On?

For growth investors, Bank of Ireland Group's raw rate of earnings growth is a beacon in the night. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. The overriding message from this quick rundown is yes, this stock is worth investigating further. Of course, just because Bank of Ireland Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Bank of Ireland Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Ireland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:BIRG

Bank of Ireland Group

Provides various banking and financial products and services.

Undervalued with proven track record and pays a dividend.