In the midst of global market fluctuations driven by tariff uncertainties and mixed economic signals, investors are increasingly looking for stable income sources to navigate through these turbulent times. Dividend stocks, with yields ranging from 3.9% to 7.2%, can offer a reliable income stream, making them an attractive option for those seeking stability amidst the current volatility in the markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

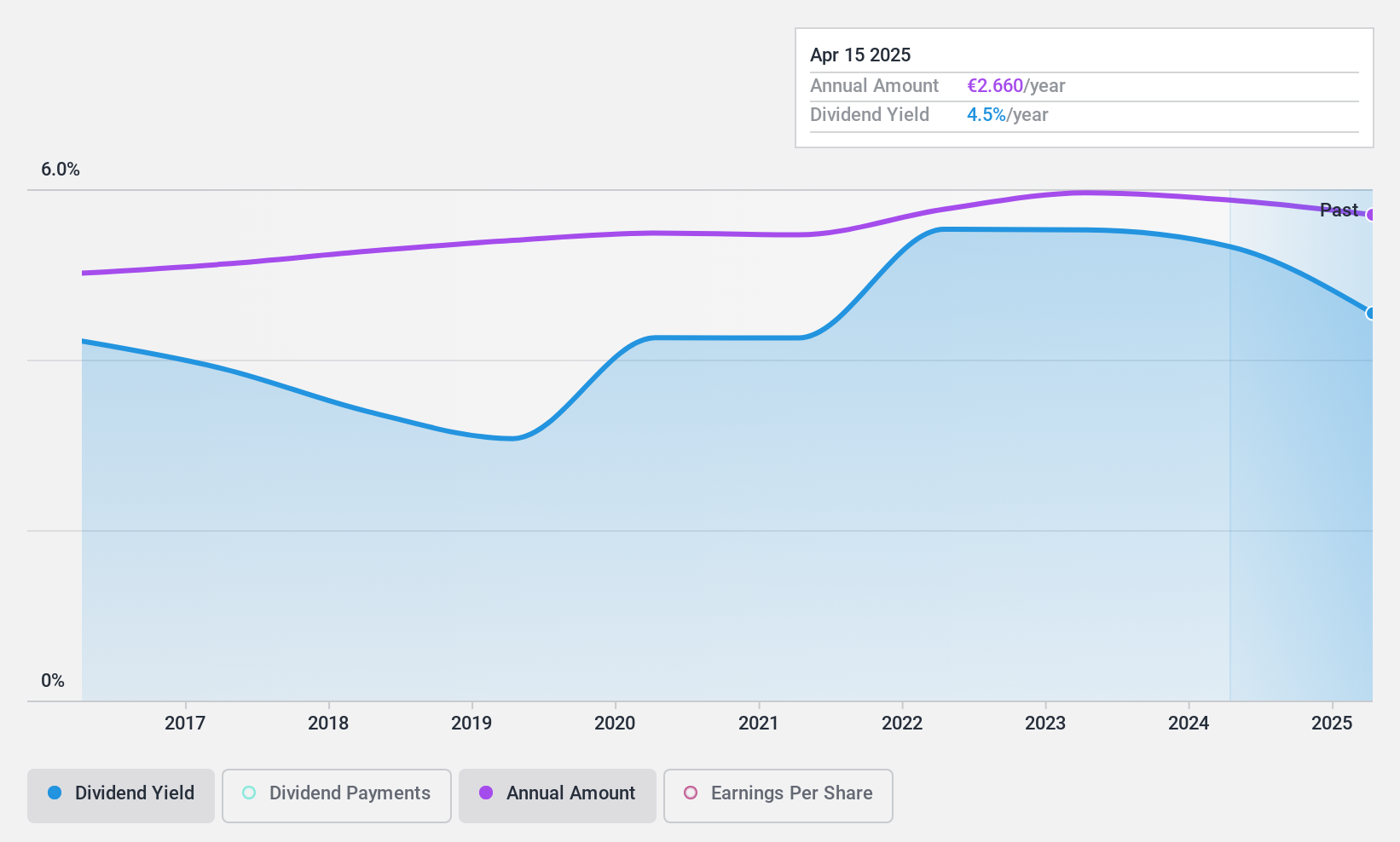

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse clients in France, including individuals, professionals, farmers, and businesses, with a market cap of €1.14 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue through its provision of banking products and services to a wide array of clients, including private individuals, professionals, farmers, businesses, and public sector entities in France.

Dividend Yield: 4.8%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc offers a reliable dividend yield of 4.77%, though it falls short of the top tier in the French market. With a payout ratio of 29.8%, its dividends are well covered by earnings, ensuring stability and reliability over the past decade. The stock trades at 58.4% below its estimated fair value, presenting potential value for investors seeking stable dividend income amidst moderate earnings growth of 4.2% annually over five years.

- Navigate through the intricacies of Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative is trading behind its estimated value.

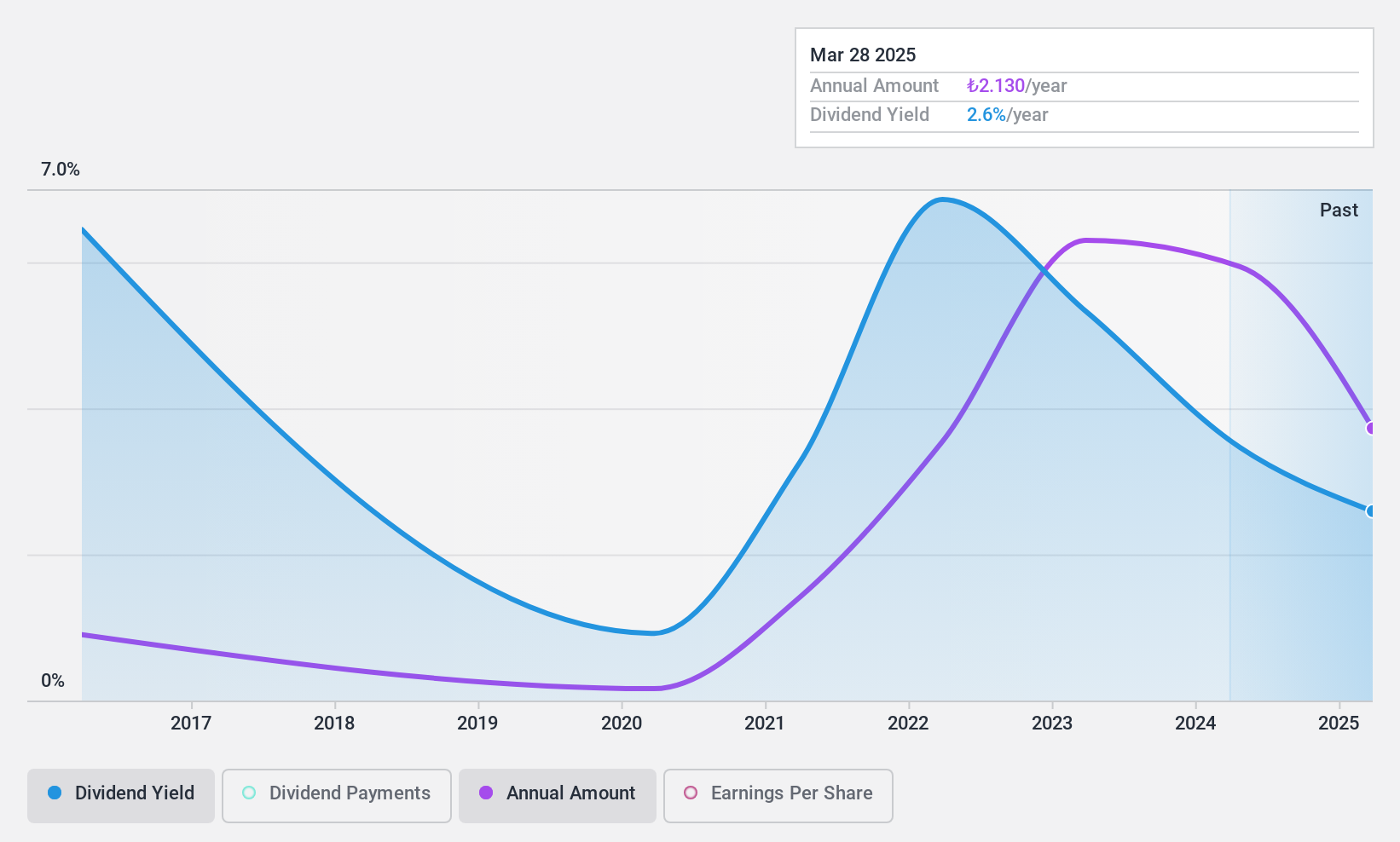

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret (IBSE:BRISA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. is a Turkish company engaged in the manufacturing and sale of tires, with a market cap of TRY26.10 billion.

Operations: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. generates revenue primarily from its Vehicle Tires segment, amounting to TRY24.87 billion.

Dividend Yield: 4%

BRISA provides a dividend yield of 3.97%, ranking in the top 25% of Turkish dividend payers. Despite this, its dividends have been volatile over the past decade, with periods of unreliability. The payout ratio is low at 32.6%, indicating dividends are well covered by earnings, though cash flow coverage is tighter at 83.8%. Trading below market P/E ratios suggests potential value, supported by strong historical and forecasted earnings growth rates.

- Unlock comprehensive insights into our analysis of Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret stock in this dividend report.

- Our expertly prepared valuation report Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret implies its share price may be lower than expected.

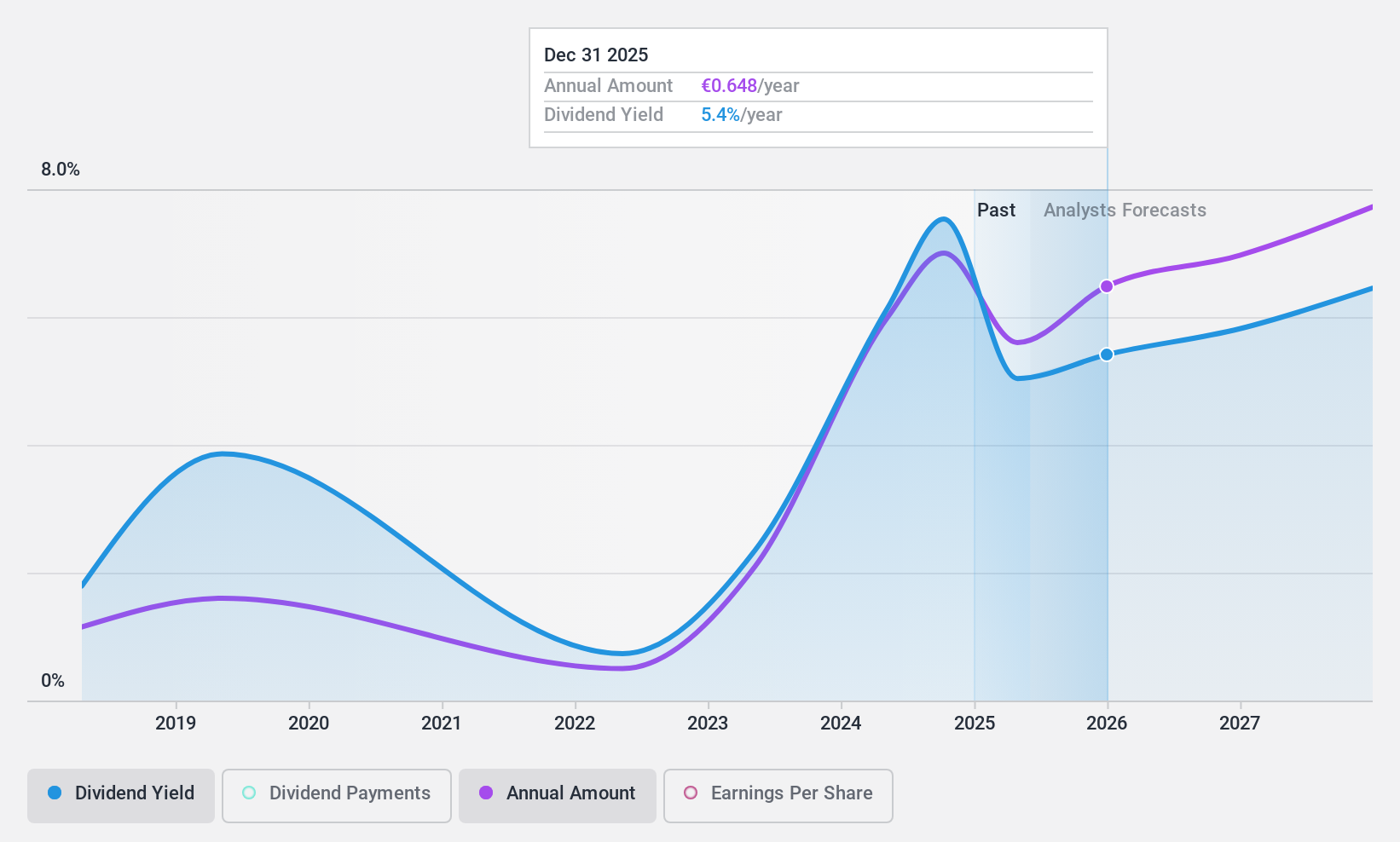

Bank of Ireland Group (ISE:BIRG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Ireland Group plc offers a range of banking and financial products and services, with a market cap of €9.72 billion.

Operations: Bank of Ireland Group plc generates revenue through several segments: Retail UK (€577 million), Retail Ireland (€1.59 billion), Wealth and Insurance (€341 million), and Corporate and Commercial (€1.64 billion).

Dividend Yield: 7.2%

Bank of Ireland Group offers a high dividend yield, ranking in the top 25% of Irish dividend payers. However, its dividends have been volatile over the past seven years and are not consistently reliable. The payout ratio is reasonable at 64.8%, indicating current earnings coverage, but the bank's high level of bad loans (2.9%) and low allowance for these loans (52%) could pose risks to future stability. Recent leadership changes may also impact strategic direction.

- Click here to discover the nuances of Bank of Ireland Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Bank of Ireland Group is priced lower than what may be justified by its financials.

Taking Advantage

- Unlock our comprehensive list of 1965 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRLA

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Provides various banking products and services to individuals, professionals and associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives