As global markets grapple with uncertainties surrounding the incoming Trump administration's policies and fluctuating interest rate expectations, investors are seeking stability in dividend stocks. Amidst this backdrop, selecting dividend stocks that offer reliable yields can provide a steady income stream and potentially cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.59% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.85% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Bank of Ireland Group (ISE:BIRG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Ireland Group plc offers a range of banking and financial products and services, with a market cap of approximately €8.77 billion.

Operations: Bank of Ireland Group plc's revenue segments include Retail UK (€577 million), Retail Ireland (€1.59 billion), Wealth and Insurance (€341 million), and Corporate and Commercial (€1.64 billion).

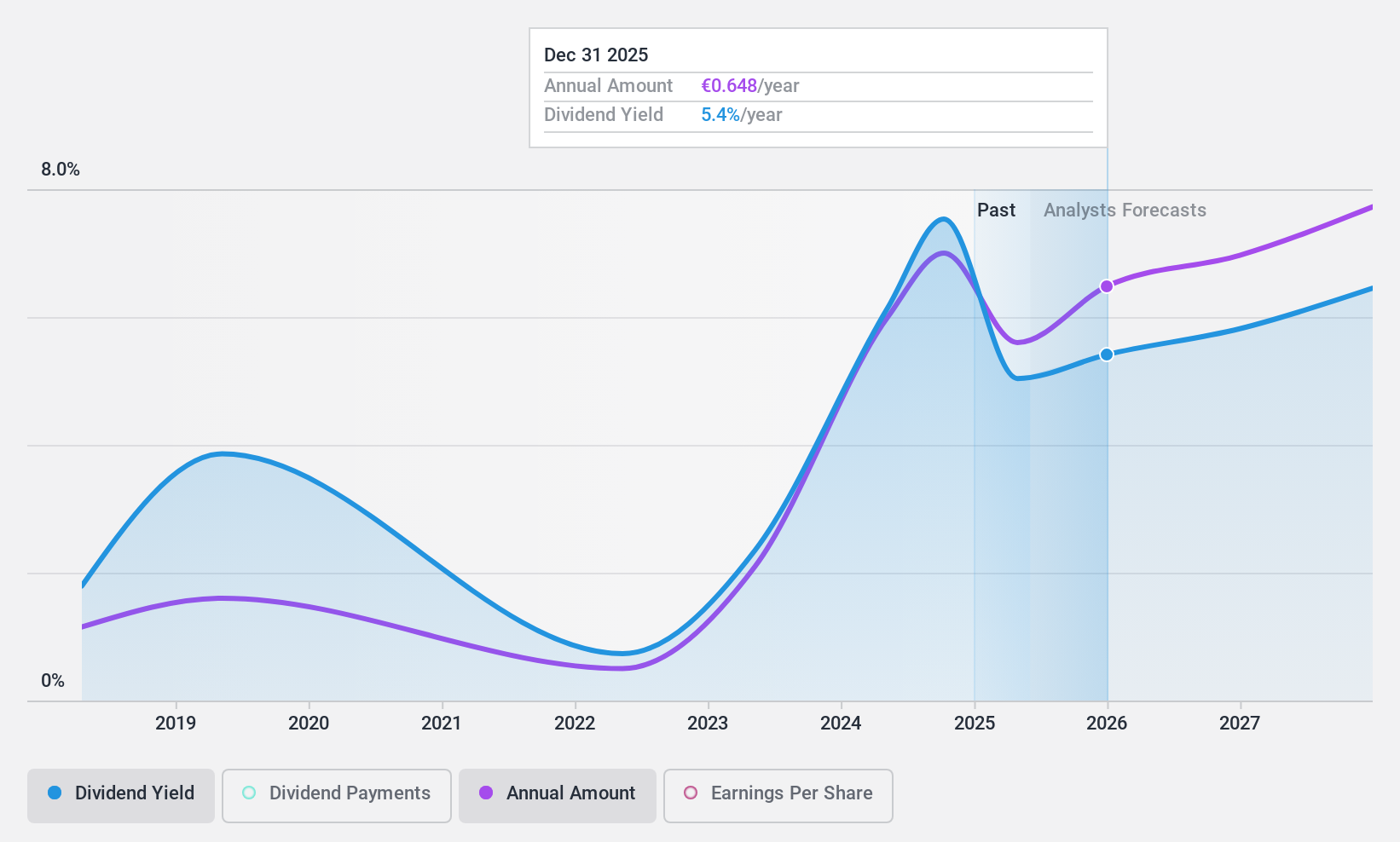

Dividend Yield: 7.9%

Bank of Ireland Group's dividend yield is notably high, ranking in the top 25% of Irish market payers. However, its dividend history is less stable, with payments being volatile over the past seven years. The payout ratio suggests dividends are currently covered by earnings and forecasted to remain so in three years. Despite recent earnings growth, the company faces challenges with a high level of bad loans and a volatile share price.

- Unlock comprehensive insights into our analysis of Bank of Ireland Group stock in this dividend report.

- According our valuation report, there's an indication that Bank of Ireland Group's share price might be on the cheaper side.

Bertrandt (XTRA:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bertrandt Aktiengesellschaft provides engineering services and has a market cap of €162.70 million.

Operations: Bertrandt Aktiengesellschaft generates revenue through three main segments: Digital Engineering (€640.06 million), Physical Engineering (€253.89 million), and Electrical Systems/Electronics (€409.76 million).

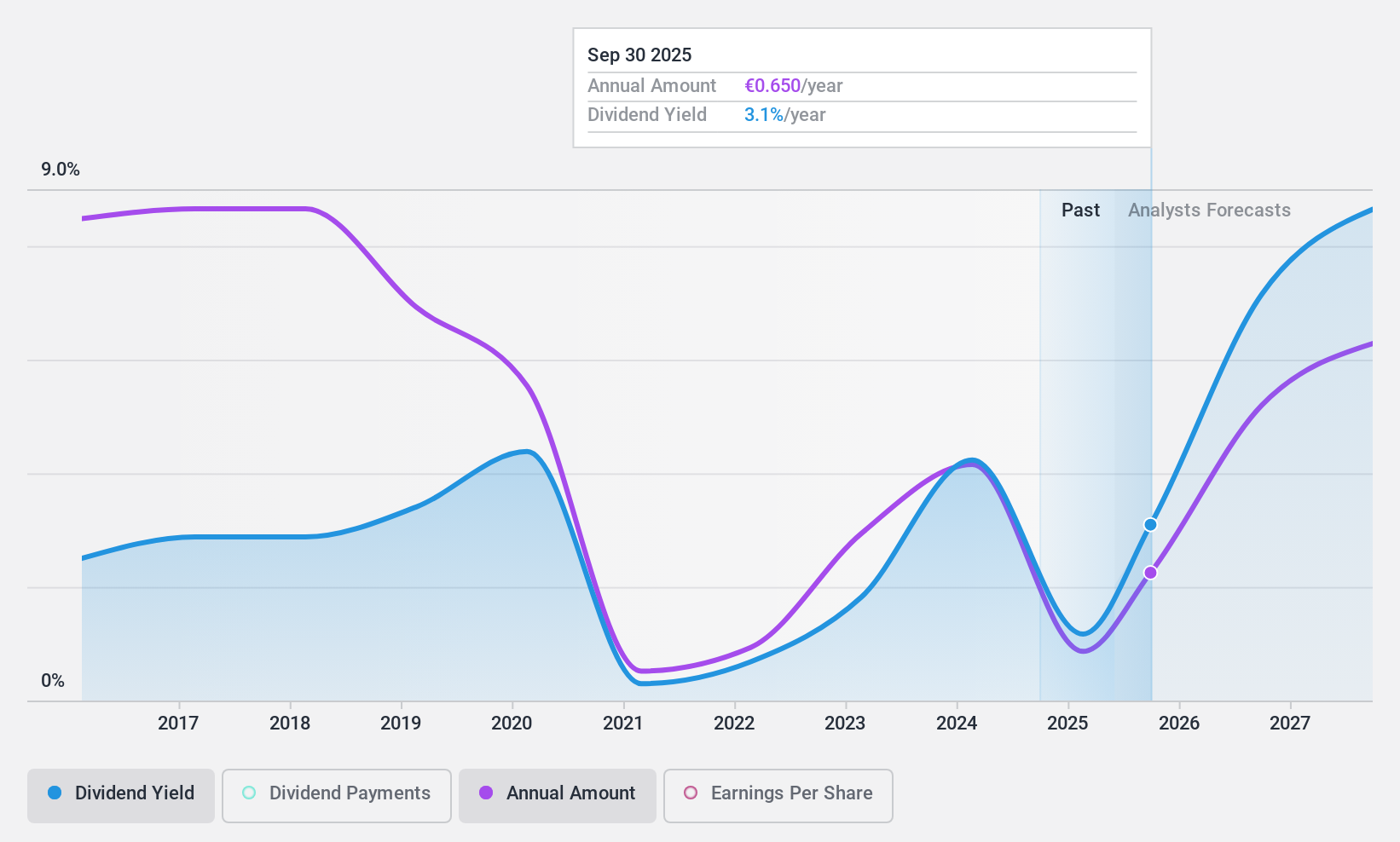

Dividend Yield: 7.1%

Bertrandt's dividend yield is among the top 25% in Germany, supported by a cash payout ratio of 26.8%, indicating strong coverage by cash flows. However, its dividend history is unstable and has declined over the past decade. Despite trading significantly below estimated fair value and being added to the S&P Global BMI Index, profit margins have decreased from last year. Earnings cover dividends with a reasonable payout ratio of 71.1%, but volatility remains a concern for investors seeking reliability.

- Dive into the specifics of Bertrandt here with our thorough dividend report.

- Our expertly prepared valuation report Bertrandt implies its share price may be lower than expected.

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles, motorcycles, and related spare parts and accessories globally, with a market cap of €43.10 billion.

Operations: Bayerische Motoren Werke's revenue segments include €128.15 billion from Automotive, €3.21 billion from Motorcycles, and €38.10 billion from Financial Services.

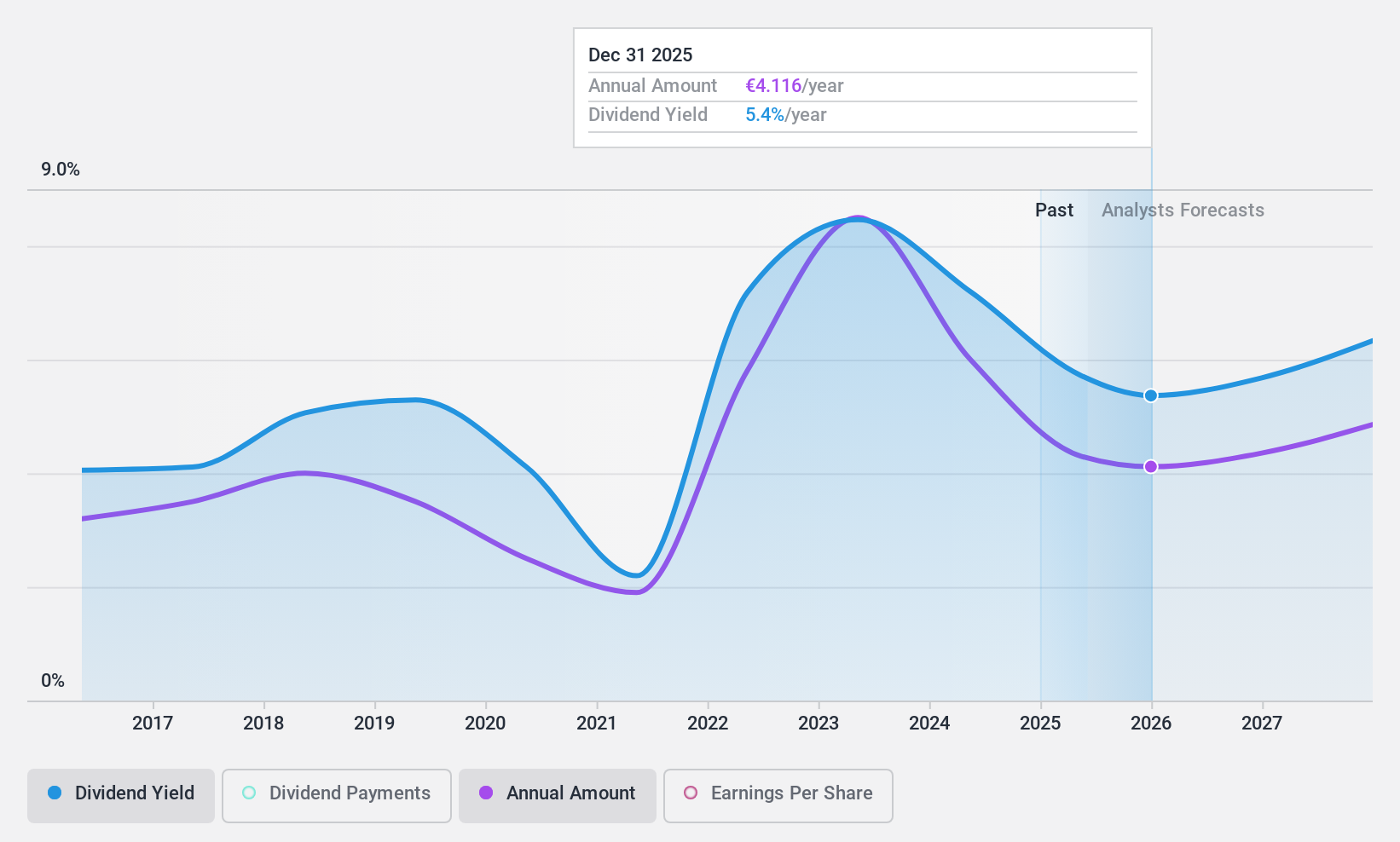

Dividend Yield: 8.8%

Bayerische Motoren Werke's dividend yield of 8.77% ranks in the top 25% of German dividend payers, yet it faces challenges with sustainability as dividends are not covered by free cash flows. Despite trading at a significant discount to its estimated fair value, BMW's dividend history is volatile and unreliable over the past decade. Recent earnings show a decline, with third-quarter net income dropping to €389 million from €2.68 billion last year, highlighting financial pressures impacting dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Bayerische Motoren Werke.

- Our comprehensive valuation report raises the possibility that Bayerische Motoren Werke is priced lower than what may be justified by its financials.

Where To Now?

- Embark on your investment journey to our 1976 Top Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Ireland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:BIRG

Bank of Ireland Group

Provides banking and other financial services in the Republic of Ireland, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives