- Indonesia

- /

- Metals and Mining

- /

- IDX:MDKA

Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As global markets celebrate the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, reflecting optimism among investors. In this climate of renewed market enthusiasm, identifying growth companies with high insider ownership can be a strategic move for investors seeking robust opportunities. When evaluating potential stocks, high insider ownership is often seen as a positive indicator, suggesting that those who know the company best have significant confidence in its future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Merdeka Copper Gold (IDX:MDKA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PT Merdeka Copper Gold Tbk engages in the mining business in Indonesia and has a market cap of approximately IDR59.80 trillion.

Operations: PT Merdeka Copper Gold Tbk generates revenue primarily through its mining operations in Indonesia.

Insider Ownership: 11.1%

Earnings Growth Forecast: 101.9% p.a.

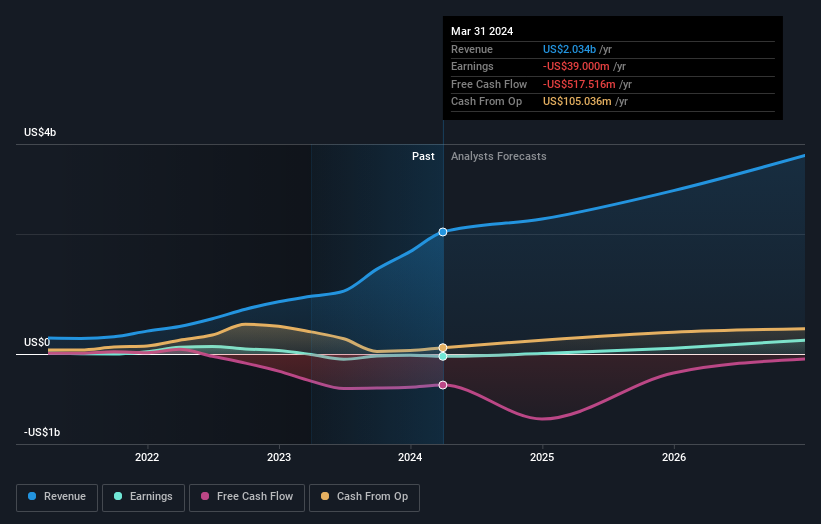

Merdeka Copper Gold's revenue is forecast to grow at 16.6% annually, outpacing the Indonesian market's 9.3%. Expected to become profitable within three years with earnings growth of 101.85% per year, it shows strong potential despite a low future Return on Equity (9.2%). Recent fixed-income offerings totaling IDR 1.97 trillion reflect strategic financial maneuvers aimed at bolstering growth and operational capacity without significant insider trading activity in the past three months.

- Get an in-depth perspective on Merdeka Copper Gold's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Merdeka Copper Gold's share price might be on the expensive side.

Lepu Medical Technology (Beijing) (SZSE:300003)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lepu Medical Technology (Beijing) Co., Ltd. operates in the medical devices and healthcare solutions industry, with a market cap of CN¥17.99 billion.

Operations: Lepu Medical Technology (Beijing) Co., Ltd. generates revenue from its operations in the medical devices and healthcare solutions industry, with a market cap of CN¥17.99 billion.

Insider Ownership: 13.8%

Earnings Growth Forecast: 31.1% p.a.

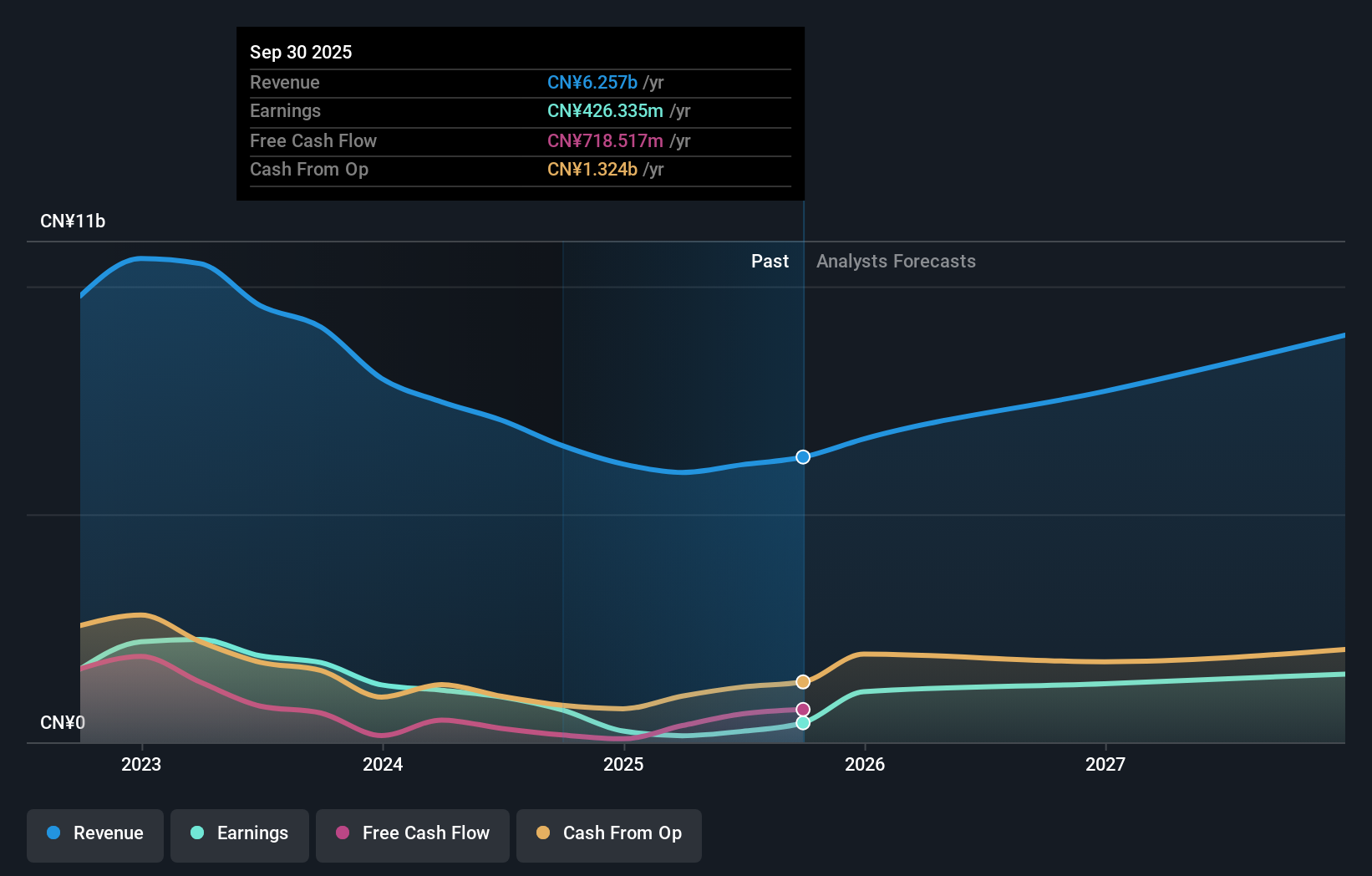

Lepu Medical Technology (Beijing) is forecast to achieve annual revenue growth of 17.1%, surpassing the broader CN market's 13.1%. Despite a recent decline in half-year sales and net income, earnings are expected to grow significantly at 31.07% annually over the next three years, outpacing market averages. Trading at a price-to-earnings ratio of 18.1x, it presents good value compared to peers and industry standards, although its dividend sustainability remains questionable due to limited free cash flow coverage.

- Dive into the specifics of Lepu Medical Technology (Beijing) here with our thorough growth forecast report.

- According our valuation report, there's an indication that Lepu Medical Technology (Beijing)'s share price might be on the cheaper side.

Shenyang Xingqi PharmaceuticalLtd (SZSE:300573)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic medications in China and has a market cap of CN¥13.23 billion.

Operations: The company's revenue segments include the research, development, production, and sale of ophthalmic medications in China.

Insider Ownership: 30.9%

Earnings Growth Forecast: 32.6% p.a.

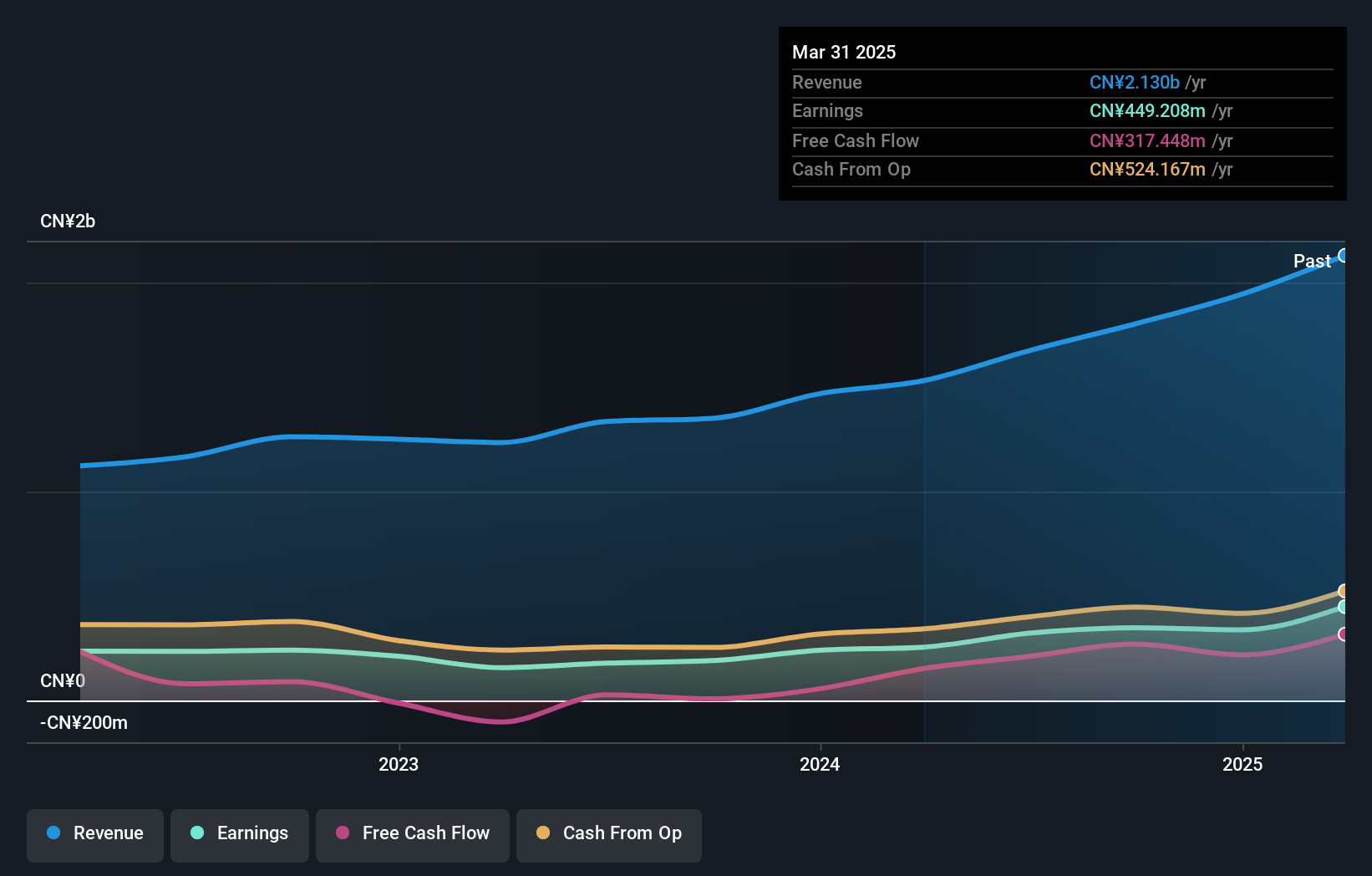

Shenyang Xingqi Pharmaceutical Ltd. is forecast to achieve annual revenue growth of 23.1%, significantly outpacing the broader CN market's 13.1%. Despite a volatile share price and recent dividend decreases, earnings are expected to grow at 32.6% per year, reflecting strong future performance potential. Recent additions to the FTSE All-World Index and substantial earnings growth over the past year bolster its profile as a high-growth company with significant insider ownership.

- Click to explore a detailed breakdown of our findings in Shenyang Xingqi PharmaceuticalLtd's earnings growth report.

- The valuation report we've compiled suggests that Shenyang Xingqi PharmaceuticalLtd's current price could be inflated.

Where To Now?

- Delve into our full catalog of 1523 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Merdeka Copper Gold, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:MDKA

Reasonable growth potential and fair value.

Market Insights

Community Narratives