Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt (BUSE:RICHTER) Has A Pretty Healthy Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt. (BUSE:RICHTER) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt

What Is Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt's Net Debt?

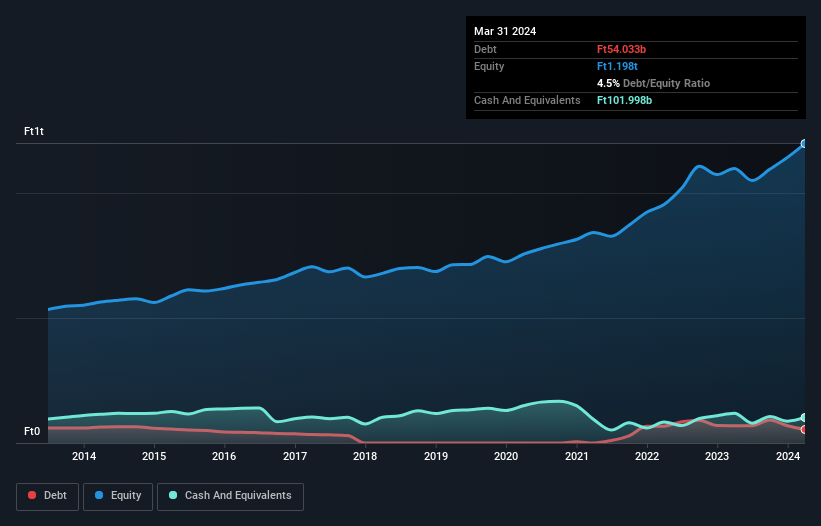

The image below, which you can click on for greater detail, shows that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt had debt of Ft54.0b at the end of March 2024, a reduction from Ft69.3b over a year. However, it does have Ft102.0b in cash offsetting this, leading to net cash of Ft48.0b.

How Healthy Is Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt had liabilities of Ft118.4b due within 12 months and liabilities of Ft106.0b due beyond that. On the other hand, it had cash of Ft102.0b and Ft220.3b worth of receivables due within a year. So it can boast Ft97.9b more liquid assets than total liabilities.

This surplus suggests that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt has more cash than debt is arguably a good indication that it can manage its debt safely.

The good news is that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt has increased its EBIT by 9.3% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt's free cash flow amounted to 37% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt has net cash of Ft48.0b, as well as more liquid assets than liabilities. On top of that, it increased its EBIT by 9.3% in the last twelve months. So we don't have any problem with Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:RICHTER

Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt

Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt.

Solid track record with excellent balance sheet and pays a dividend.