If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So, when we ran our eye over Ericsson Nikola Tesla d.d's (ZGSE:ERNT) trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Ericsson Nikola Tesla d.d, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.27 = Kn114m ÷ (Kn994m - Kn569m) (Based on the trailing twelve months to March 2021).

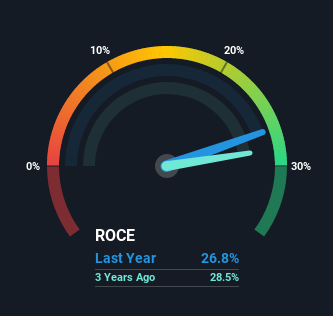

So, Ericsson Nikola Tesla d.d has an ROCE of 27%. In absolute terms that's a great return and it's even better than the Communications industry average of 10%.

See our latest analysis for Ericsson Nikola Tesla d.d

Above you can see how the current ROCE for Ericsson Nikola Tesla d.d compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Ericsson Nikola Tesla d.d.

So How Is Ericsson Nikola Tesla d.d's ROCE Trending?

We'd be pretty happy with returns on capital like Ericsson Nikola Tesla d.d. Over the past five years, ROCE has remained relatively flat at around 27% and the business has deployed 29% more capital into its operations. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. You'll see this when looking at well operated businesses or favorable business models.

Another thing to note, Ericsson Nikola Tesla d.d has a high ratio of current liabilities to total assets of 57%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

What We Can Learn From Ericsson Nikola Tesla d.d's ROCE

In summary, we're delighted to see that Ericsson Nikola Tesla d.d has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. And the stock has followed suit returning a meaningful 98% to shareholders over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

Ericsson Nikola Tesla d.d does have some risks though, and we've spotted 1 warning sign for Ericsson Nikola Tesla d.d that you might be interested in.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ericsson Nikola Tesla d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ZGSE:ERNT

Ericsson Nikola Tesla d.d

Provides communication products, and ICT solutions and related services in the Republic of Croatia, Bosnia and Herzegovina, and Central and Eastern Europe.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)