- Croatia

- /

- Oil and Gas

- /

- ZGSE:INA

A Piece Of The Puzzle Missing From INA-Industrija nafte, d.d.'s (ZGSE:INA) Share Price

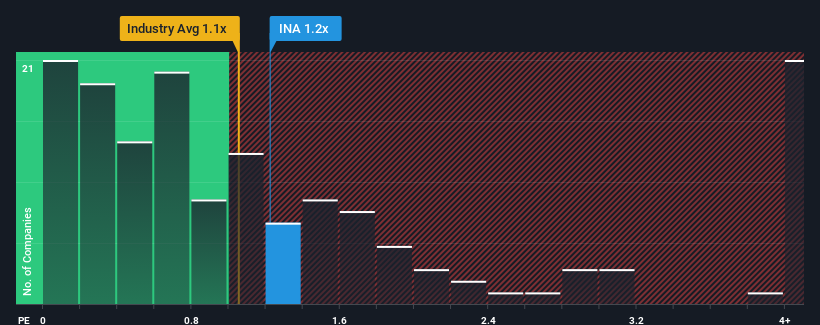

It's not a stretch to say that INA-Industrija nafte, d.d.'s (ZGSE:INA) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Oil and Gas industry in Croatia, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for INA-Industrija nafte d.d

What Does INA-Industrija nafte d.d's P/S Mean For Shareholders?

For instance, INA-Industrija nafte d.d's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on INA-Industrija nafte d.d will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like INA-Industrija nafte d.d's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. Even so, admirably revenue has lifted 73% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 1.6% shows it's noticeably more attractive.

With this information, we find it interesting that INA-Industrija nafte d.d is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that INA-Industrija nafte d.d currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware INA-Industrija nafte d.d is showing 4 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade INA-Industrija nafte d.d, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:INA

INA-Industrija nafte d.d

Explores for, produces, refines, and sells oil and gas.

Adequate balance sheet with questionable track record.