- Croatia

- /

- Hospitality

- /

- ZGSE:ILRA

A Piece Of The Puzzle Missing From Ilirija d.d.'s (ZGSE:ILRA) 28% Share Price Climb

Ilirija d.d. (ZGSE:ILRA) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 30%.

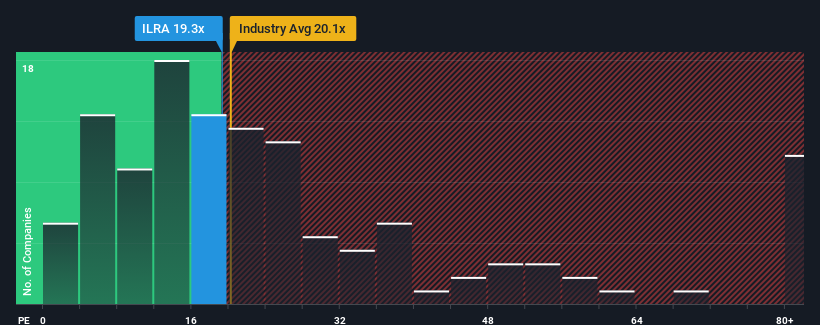

Although its price has surged higher, you could still be forgiven for feeling indifferent about Ilirija d.d's P/E ratio of 19.3x, since the median price-to-earnings (or "P/E") ratio in Croatia is also close to 18x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Ilirija d.d has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Ilirija d.d

Is There Some Growth For Ilirija d.d?

Ilirija d.d's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 36% gain to the company's bottom line. The latest three year period has also seen an excellent 390% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 10% shows it's a great look while it lasts.

With this information, we find it odd that Ilirija d.d is trading at a fairly similar P/E to the market. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader market.

What We Can Learn From Ilirija d.d's P/E?

Ilirija d.d appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ilirija d.d revealed its growing earnings over the medium-term aren't contributing to its P/E as much as we would have predicted, given the market is set to shrink. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears some are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Ilirija d.d (1 doesn't sit too well with us!) that we have uncovered.

Of course, you might also be able to find a better stock than Ilirija d.d. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:ILRA

Ilirija d.d

Operates as a tourism company in Croatia and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives